The domain of stablecoins, intrinsic to the rapidly evolving cryptocurrency ecosystem, is witnessing remarkable expansion. By 2025, it’s anticipated that the global value of the stablecoin market will approach the whopping sum of $260 billion. Stablecoins, digital currencies pegged to stable assets like the U.S. dollar, are gaining traction for their minimal volatility, efficacy in facilitating international payments, and their potential to redefine the conventional financial frameworks.

Recent legislative advancements, notably the passing of the GENIUS Act by the U.S. Senate, have significantly elevated the status of stablecoins, heralding a new era of broad institutional acceptance.

This article delves into the roles and growth prospects of five publicly traded companies that are at the vanguard of the stablecoin surge, mapping out their invaluable contributions to this financial evolution.

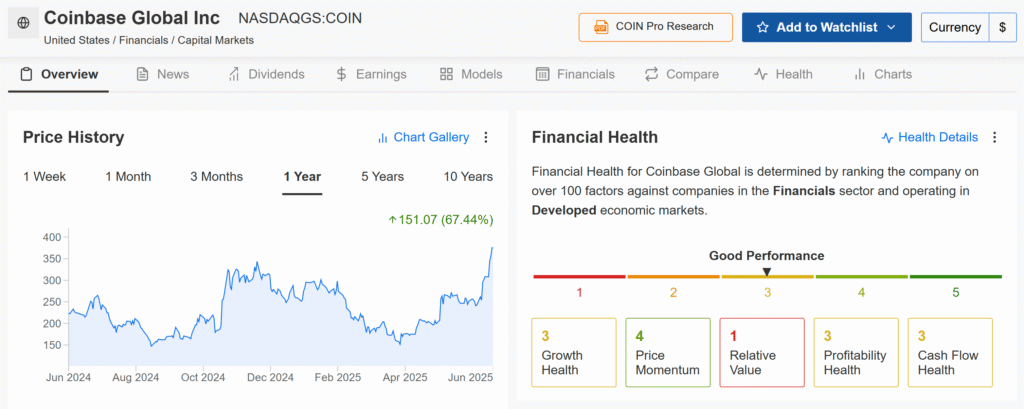

Coinbase Global (NASDAQ:)

At the forefront is Coinbase, a premier cryptocurrency exchange and a key player in the stablecoin arena. It shares ownership of the USDC, the market’s second-largest stablecoin, with Circle. The initiation of Base, a blockchain tailor-made for stablecoin transactions, epitomizes Coinbase’s ambition to become synonymous with compliant stablecoin exchanges.

The GENIUS Act’s ratification acts as a catalyst for Coinbase, fostering regulatory transparency and bolstering investor confidence. This has been reflected in the meteoric rise of Coinbase’s stock value post the Act’s approval, underscoring market optimism regarding its stablecoin-centric revenue avenues.

As a distinguished platform for both casual and professional investors, Coinbase stands to benefit from the surging stablecoin transactions, drawing income from trading fees and custodial services.

Coinbase’s CEO, Brian Armstrong, has mapped out ambitious plans for USDC to overtake Tether’s USDT as the world’s leading stablecoin, a vision supported by a 50% year-over-year increase in stablecoin-related revenue in Q1 2025. With Coinbase holding a significant chunk of USDC in circulation, its revenue prospects look robust.

Coinbase has also introduced Coinbase Payments, enabling merchants to accept stablecoin payments, which could challenge and possibly disrupt traditional payment systems.

Circle Internet Group (NYSE:)

Known primarily as the issuer of USDC, Circle has emerged from its IPO as a stablecoin behemoth. Since its inception in 2013, Circle has solidified its status in the stablecoin infrastructure space, with the Circle Payments Network facilitating international settlements.

The stock prices of CRCL have soared, demonstrating immense investor interest, which is further buoyed by the GENIUS Act, aligning with Circle’s regulatory-centric ethos.

Circle’s annual revenue is expected to grow by 25–30%, driven by USDC’s growing utilization across payments and finance. Its partnerships and technological innovations have positioned Circle for significant scalability and broad market penetration.

Fiserv

Fiserv stands out for its revolutionary approach to integrating stablecoins into traditional financial systems without necessitating an overhaul. The launch of its own stablecoin, FIUSD, in collaboration with Circle and Paxos, indicates Fiserv’s commitment to bridging the gap between conventional finance and digital assets.

The company’s foray into the stablecoin market could redefine the landscape of cross-border payments, offering a streamlined alternative to existing financial processes.

PayPal (NASDAQ:)

A pioneer in the digital payments sector, PayPal has ventured into the stablecoin space with PayPal USD (PYUSD), aiming to leverage its extensive user base for widespread PYUSD adoption across payments, remittances, and e-commerce.

With initiatives to ensure compatibility between PYUSD and other digital currencies like FIUSD, PayPal is strategically positioned to challenge legacy payment systems and pave the way for the mass adoption of stablecoins.

Robinhood Markets (NASDAQ:)

Robinhood is redefining access to digital currencies, including stablecoins, for retail investors. The platform’s growth is closely tied to the increasing popularity of stablecoins among its vast user base, which in turn, contributes to its revenues from crypto trading and custodial services.

Robinhood’s wallet and its plans for a prime brokerage service highlight its ambition to become a pivotal bridge between retail traders and the decentralized finance ecosystem powered by stablecoins.

In Conclusion

These five firms are uniquely positioned to thrive in the stablecoin era, each playing a critical role in the ecosystem—from pushing the boundaries of innovation and adoption to linking traditional finance with new digital rails, and democratizing access for a broader audience.

As regulatory landscapes become clearer and stablecoin usage continues to ascend into the mainstream, these entities are poised for significant gains, shaping the very foundation of the financial sector’s future.

Investors are encouraged to conduct meticulous due diligence and stay abreast of market trends when considering investments in this burgeoning field, bearing in mind that the stablecoin market isn’t merely speculative—it’s about who will lead the financial systems of tomorrow.

For those keeping an eye on market trends and seeking investment insights, tools like InvestingPro offer invaluable resources, from AI-driven stock picks to comprehensive stock screener tools, aiding investors in navigating the complex terrain of stablecoin and broader crypto market investments.

The evolution of stablecoins represents not just a shift in financial technology but a reimagining of global economic systems. Understanding these shifts, the players involved, and the regulatory frameworks shaping them is crucial for anyone looking to invest or participate in the next generation of finance.