In the ever-evolving world of cryptocurrencies, one name consistently grabs headlines for its remarkable market performance — Bitcoin. As we venture into the second quarter of 2025, Bitcoin’s trajectory looks promising, with projections indicating a near 30% return. This feat is particularly noteworthy considering the backdrop of global market uncertainties and geopolitical tensions that have cast shadows over the financial markets. Despite these challenges, Bitcoin has demonstrated resilience, bouncing back with vigour after achieving a record-breaking peak of $111,980 in May.

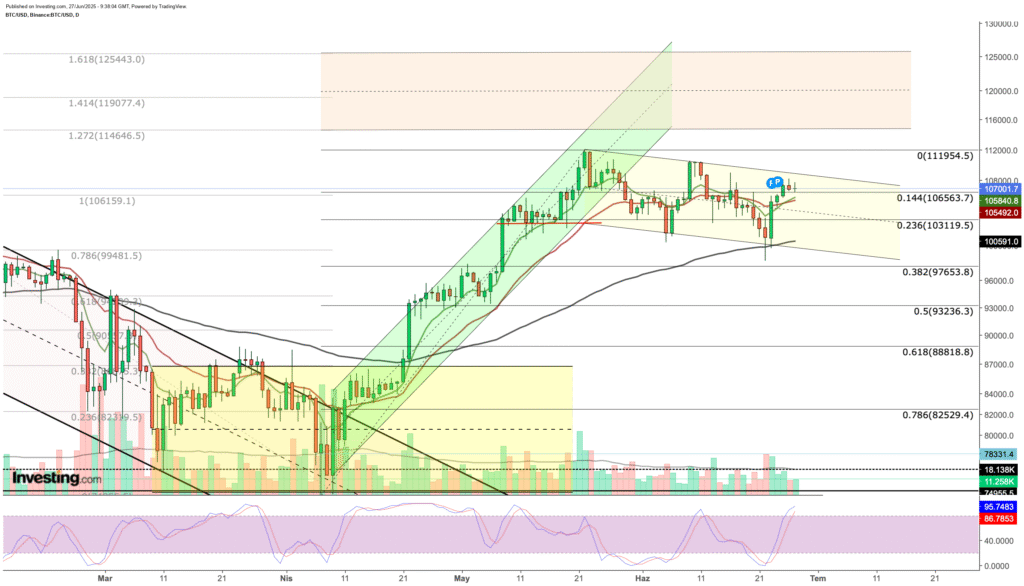

Over the recent months, Bitcoin’s trading pattern has found a comfortable bracket, oscillating between $100,000 and $110,000. Despite the lower trading volumes observed in both spot and futures markets, indicative of individual investors’ cautious approach, Bitcoin’s stability has been commendable. Early indicators since the beginning of the year point towards a 15% gain, inspiring confidence amongst investors about the cryptocurrency’s prospects.

The nuances of trading volumes provide an intriguing insight into the current state of the market. According to data from Glassnode, Bitcoin’s spot trading volume is presently at $7.7 billion — a stark contrast to the bustling activity during the 2021–2022 bull markets. This subdued trading activity suggests a tentative stance from retail investors, with many perhaps waiting on the sidelines for a clearer market trend to emerge. However, there’s a silver lining. The dominance of long-term holders, coupled with an illiquid supply constituting 75% of total supply, underscores a strategic accumulation phase, potentially setting the stage for future price ascensions.

Further bolstering confidence in Bitcoin’s long-term allure are the U.S.-listed spot Bitcoin ETFs, which have seen over $2.9 billion in net inflows in just 13 trading days, with the iShares Bitcoin Trust ETF leading the pack. While these inflows, primarily from institutional and over-the-counter (OTC) channels, may not have an immediate impact on the spot market, they certainly underscore the growing institutional interest and confidence in Bitcoin’s future.

Moreover, the Securities and Exchange Commission’s (SEC) open stance towards ETF applications for other cryptocurrencies signals a broader acceptance and potential for market expansion. This development could herald a new era of diversification and growth for the cryptocurrency sector.

The futures and options market for Bitcoin also reveals interesting trends, especially in light of the upcoming largest Bitcoin options expiry of the year, valued at $15 billion. The anticipated max pain point at $102,000 and the declining implied volatility suggest market participants do not foresee significant price shifts in the near term. This could lead to a stabilisation post-expiry, although a resurgence in market volatility cannot be entirely ruled out.

Looking ahead to the third quarter, historical patterns suggest a potential period of consolidation for Bitcoin. However, all eyes will be on the Federal Reserve’s policy decisions, with rate cuts potentially acting as a catalyst for market volatility and a boost in risk appetite. Despite the inherent uncertainties, factors like rising global liquidity, specifically from China, and a weakening dollar present supportive conditions for cryptocurrencies like Bitcoin, which thrive on limited supply.

Yet, the geopolitical landscape remains a wildcard. Recent easing of tensions notwithstanding, looming trade tensions and potential tariff hikes by the U.S. could introduce fresh volatility. The complex interplay between geopolitical events, economic policies, and market sentiment necessitates a cautious yet optimistic approach to Bitcoin investment in the coming quarters.

Technical analysis further delineates Bitcoin’s current market positioning. After a temporary dip below $100,000, the cryptocurrency has shown resilience, with prices stabilising above this critical threshold. The challenge now lies in overcoming resistance around the $106,000 mark to potentially usher in a new rally towards previously unreached highs. However, the journey is lined with potential hurdles, and a careful navigation of the market’s ebbs and flows remains paramount.

In conclusion, Bitcoin’s journey through 2025 encapsulates the volatile yet intriguing nature of the cryptocurrency market. With a blend of cautious optimism, strategic positioning, and an eye on the broader economic and geopolitical landscape, Bitcoin continues to offer a compelling narrative for investors worldwide. As we delve deeper into the year, the unfolding chapters of this saga will undoubtedly provide further insights into the evolving dynamics of the cryptocurrency market, highlighting both its challenges and opportunities.