The strategy of patience and restraint that the Federal Reserve has maintained towards its monetary policy appears to be wavering, as interpreted by the reactions within the financial markets. Traditionally, the Federal Reserve’s decisions are keenly observed for indications of the country’s economic direction, making any shifts or hints towards policy changes subjects of intense scrutiny and speculation.

As of current standings, it seems probable that the Federal Reserve is likely to maintain its current interest rates at the forthcoming Federal Open Market Committee (FOMC) meeting in July. Nevertheless, recent fluctuations in market confidence suggest a declining assurance in this outcome. Significantly, there has been a discernible shift in anticipation towards a potential reduction in rates come September, with market dynamics pricing in an elevated likelihood exceeding 89%.

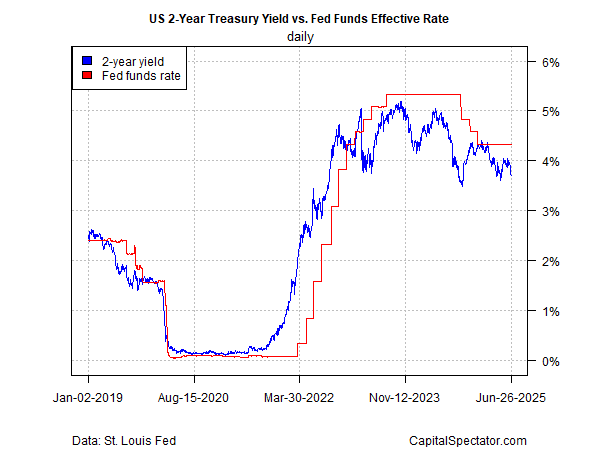

In recent times, a certain wariness has crept into the economic landscape, underscored by a continuous downtrend in the yield on 2-year U.S. Treasury notes across seven consecutive trading days, culminating on June 26. This decline, which brought yields to a trough not seen in close to two months, as per Treasury.gov data, reflects a growing expectation among traders for a forthcoming rate cut. Such expectations are particularly noteworthy, given the widening gap between the 2-year yield and the median Federal funds rate, hinting at a market sentiment that increasingly leans towards the likelihood of monetary easing.

An analytical model that juxtaposes inflation and unemployment metrics against the median effective Federal funds target rate still signals a relatively stringent policy environment. This suggests that arguments favoring a downward adjustment in rates possess a measure of financial credence.

Despite these market maneuverings, Federal Reserve Chairman Jerome Powell has recently reasserted the establishment’s intention to hold the line on current interest rates. During a testimony before Congress, Powell highlighted the prevailing uncertainties, particularly those related to inflation risks emanating from tariffs, as a basis for the Fed’s cautious stance. He stated, “For the time being, we are well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

An additional element stirring market conjectures is the state of the U.S. labor market, which may be showing early signs of stress. Despite a decrease in initial unemployment claims – a reversal after a peak not seen since October – the number of continuing claims has seen an uptick, reaching heights not observed in over three years. This has been interpreted by some experts as indicative of a softening labor market, particularly from the perspective of new hires.

Nancy Vanden Houten, lead economist at Oxford Economics, suggested, “The data are consistent with softening of labor market conditions, particularly on the hiring side of the labor market equation.” She, however, noted that current conditions might not yet be dire enough to prompt immediate action from the Fed, although she conceded the risk that once the Fed opts to lower rates, it may need to play catch-up.

The discourse around Federal Reserve policies is also being influenced by external pressures, notably from U.S. President Donald Trump, who has been vocally critical of the Fed’s decisions and has expressed a desire for lower rates. Recent reports suggest that Trump might be considering an early replacement for Powell in a bid to steer monetary policy more directly. Such a move would be unorthodox and raises questions about the implications for the independence of the Federal Reserve. The speculation around the nomination of an early successor to Powell introduces an element of uncertainty in the markets, with potential ramifications on the Fed’s credibility and its decisions going forward.

Critics and experts have voiced concerns over this development. Greg Valliere, chief U.S. policy strategist at AGF Investments, described the idea as “a terrible idea,” warning of the confusion and frustration it could sow within financial markets. Meanwhile, Kathryn Judge, a professor at Columbia Law School noted the unprecedented nature of such a scenario, underscoring the uncertainty surrounding the loyalty of any potential nominee to Trump and the potential consequences for U.S. monetary policy.

In conclusion, while the Federal Reserve maintains a cautious stance, underlying currents within the financial markets and broader economic indicators suggest a complex interplay of expectations, pressures, and potential policy adjustments on the horizon. How this scenario unfolds will undoubtedly be critical for the U.S economy’s trajectory in the coming months.