Rare Earth Elements and China’s Strategic Dominance: A Comprehensive Overview

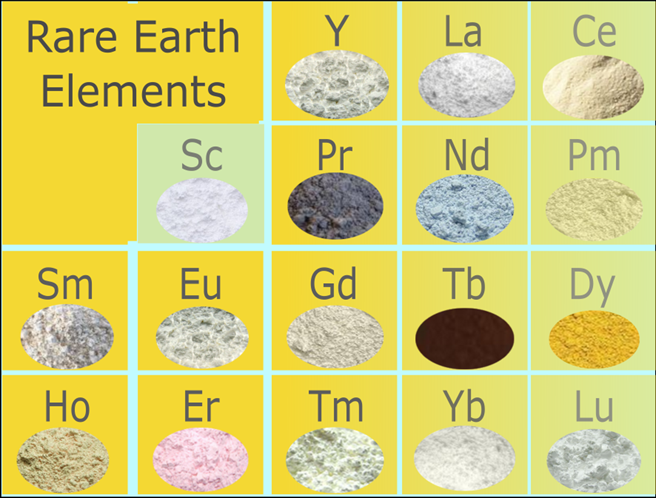

In the arena of global commerce, few resources have as significant a strategic value as rare earth elements (REEs). Comprising 17 metallic substances, REEs, while relatively abundant, present substantial extraction and refinement challenges. These elements are critical for a myriad of cutting-edge technologies, including but not limited to smartphones, electric vehicles, renewable energy solutions, artificial intelligence (AI) processors, and advanced defence mechanisms.

China’s methodical approach to securing dominion over the rare earth supply chain — commanding approximately 70% of the world’s production and possessing near-total control over the refining capacity — has positioned these materials as a formidable axis in its escalating economic competition, particularly with the United States.

Rare earths, pivotal for critical industries and central to national security concerns, underscore China’s stature as a key player in the ongoing battle for global influence, impacting global supply chains, financial markets, and investment strategies profoundly.

### The Intrinsic Strategic Value of Rare Earths

Rare earth elements are the linchpins of technological progress. Despite the global rare earth market’s seemingly modest valuation – estimated at $792.52 million in 2024 with projections suggesting growth to $1024.64 million by 2033 – their economic significance is disproportionate to their market size, owing to their crucial role in various high-value industries.

Elements such as neodymium and praseodymium are essential for creating the permanent magnets used in electric car motors and wind turbines. Dysprosium and terbium are used to enhance these magnets, ensuring their performance remains optimal under extreme temperatures, vital for military and aerospace applications.

The dependence of the defence sector on rare earths cannot be overstated. For instance, a single F-35 fighter jet and Virginia-class submarines are reliant on nearly 417 kilograms of rare earth materials. Similarly, missile defence systems and advanced satellites demand these specialised rare earth alloys for their operation and reliability.

The surge in renewable energy technologies and electric vehicles has significantly amplified the demand for high-performance rare earth magnets, necessitating the development of NdFeB magnets which are integral for high-efficiency motors critical for green energy transitions.

Projections by the International Energy Agency (IEA) suggest a potential quadrupling of demand for rare earth elements used in clean energy technologies by 2040, assuming ambitious global climate objectives are pursued.

Moreover, rare earths find extensive application in consumer electronics, emerging technologies such as artificial intelligence, 5G infrastructure, quantum computing, medical imaging equipment, lasers, and semiconductor manufacturing, illustrating the multiplier effect disruptions in rare earth supply chains could have across multiple industries.

Unlike common commodities like oil or wheat, rare earths lack viable substitutes. Developing alternative supply sources is not only expensive but requires extensive time, regulatory approvals, and sophisticated expertise.

### China’s Strategic Hold over Rare Earths

China’s ascendance as the commanding force in the rare earth market exemplifies an orchestrated industrial strategy, meticulously implemented over several decades. While Western nations moved towards high-value industries and outsourced heavy manufacturing, China adopted a contrary stance, recognizing the strategic importance of controlling the entire supply chain of such pivotal materials early on.

In the late 1970s and early 1980s, under the guidance of Xu Guangxian, often referred to as the father of China’s rare earth industry, and with the backing of the newly established Chinese Society of Rare Earth, China channelled significant state resources into the mining, refining, and separation of these elements. Despite the environmental toll, the Chinese government’s strategic objectives facilitated rapid sectoral growth, unencumbered by the regulatory challenges faced by counterparts in the West.

This approach enabled China to establish dominance in global rare earth production through state subsidies, cheap labour, and relaxed environmental standards, compelling Western countries to increasingly depend on Chinese refinement capacities, thus centralizing global supply chains under Chinese control.

Furthermore, China’s investment in mastering complex refining and separation processes allowed it to dominate the sector, making it challenging for new entrants to compete. Currently, over 85% of the world’s rare earth refining capacity is concentrated in China, underscoring the strategic leverage Beijing wields in global manufacturing, pricing, and diplomatic spheres.

### The Implications of China’s Rare Earth Strategy

As we navigate towards mid-2025, China’s rare earth policy has evolved into a more nuanced strategy, employing calculated export pressures and financial maneuvers, alongside demands for sensitive commercial data as contingencies for rare earth licenses. This approach not only disrupts global supply chains but also coerces Western firms into compromising strategic trade secrets, thereby extending China’s influence throughout the rare earth value chain.

Investment patterns also reflect China’s strategic ambitions, with sovereign wealth funds and state-backed enterprises acquiring stakes in foreign rare earth mining projects and processing facilities, further entrenching its control over global rare earth markets.

However, this aggressive stance could potentially backfire. The international community, led by actors like the US, EU, Australia, and Canada, may accelerate efforts towards establishing independent mining, refining, recycling, and substitution capabilities, potentially diminishing Beijing’s current dominance over the next decade.

In conclusion, the narrative surrounding rare earth elements epitomizes the intricacies of 21st-century geopolitics, where raw materials transform into pivotal economic and diplomatic instruments. China’s unmatched command over mining, refining, and processing has afforded it an extraordinary mechanism in its dealings with the US and the Western bloc. Through a judicious mix of export restrictions, asset acquisitions, regulatory pressures, and corporate espionage, Beijing has catapulted rare earths from niche commodities to cornerstone instruments of global economic statecraft, highlighting the strategic, yet fragile, nature of the global rare earth element supply chain.