The financial landscape observed a notable uptick on Friday, culminating in elevated closings that set new benchmarks for key indices, fueled by burgeoning optimism over potential trade agreements. This investor enthusiasm was further bolstered by promising economic indicators, which solidified the anticipation of forthcoming interest rate reductions by the Federal Reserve.

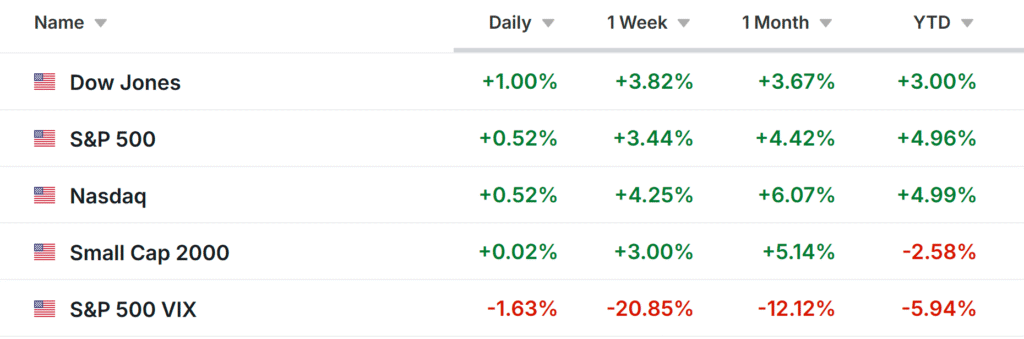

On Wall Street, the culmination of the week’s activities saw a bullish trend across the board, with impressive gains chalked up by the principal U.S. stock indexes. The S&P 500, known for its broad representation of the U.S. equity market, experienced a 3.4% upsurge. Meanwhile, the Nasdaq Composite, with its heavy technological stock composition, witnessed a 4.3% leap. The Dow Jones Industrial Average, comprising 30 significant stocks, also recorded a robust growth of 3.8%.

The approaching week, albeit truncated due to the upcoming Fourth of July celebrations, promises to be eventful. Investors are poised to navigate through the economic and corporate terrain, evaluating the implications of ongoing geopolitical tensions – notably President Trump’s trade confrontations – on inflation, interest rates, and earnings reports.

The impending closure of U.S. stock markets at 1:00 PM ET on Thursday and the subsequent day off on Friday for Independence Day anticipates a simmering of trading activities. Nonetheless, the highlight of the week is set to be Thursday’s U.S. employment report for June, anticipated to reveal the addition of 120,000 positions and hint at an unemployment rate uptick to 4.3%.

Amid these economic data releases, a raft of speeches from Federal Reserve officials, including Chairman Jerome Powell, is on the cards. Market participants have already baked in expectations, forecasting the Federal Reserve’s first rate cut of the year by September, with a smaller faction betting on an earlier move in July.

While the earnings season winds down, a few notable reports are scheduled for release, adding layers to the market narrative. Among those reporting include beverage and spirits giant Constellation Brands and software developer Progress Software.

In the investment spotlight, Tesla, the pioneering electric vehicle manufacturer, is poised to unveil its second-quarter vehicle delivery and production figures. The anticipation is leaning towards favorable outcomes, potentially uplifting its stock trajectory, which has recently seen consolidation. Analyst projections have varied, but the whisper numbers suggest Tesla might surpass expectations, particularly given the conservative estimates circulating among analysts. Tesla’s leadership in both the U.S. and Chinese electric vehicle markets, coupled with its diverse product line ranging from the Model 3 to the Cybertruck, positions it as a notable contender in the renewable energy narrative.

Conversely, Constellation Brands gears up for a challenging earnings disclosure, fraught with macroeconomic pressures and segment-specific headwinds. Analyst pessimism is palpable, with downward revisions in earnings per share (EPS) forecasts dominating the discourse. The looming earnings announcement has sparked anticipation of volatility, reflective of the broader challenges facing the wine and spirits sector, including shifting consumer preferences towards alternative beverages.

In the wider canvass of market activities, leveraging platforms like InvestingPro can offer investors an analytical edge, delivering insights and forecasts that shape strategic decision-making in volatile financial environments.

In sum, the preceding week highlighted the dynamism intrinsic to financial markets, framed by geopolitical developments, economic reports, and corporate disclosures. As investors look ahead, the blend of strategic foresight and analytical tools will be pivotal in navigating the anticipated stock movements and sectoral trends, reflecting the continuous interplay between macroeconomic indicators and market sentiments.