On the 25th of June, an understated yet pivotal change was announced by the Federal Reserve concerning the Supplementary Leverage Ratio (SLR), a change largely overlooked by mainstream media. However, its reverberations throughout the U.S. Treasury market are profound and far-reaching.

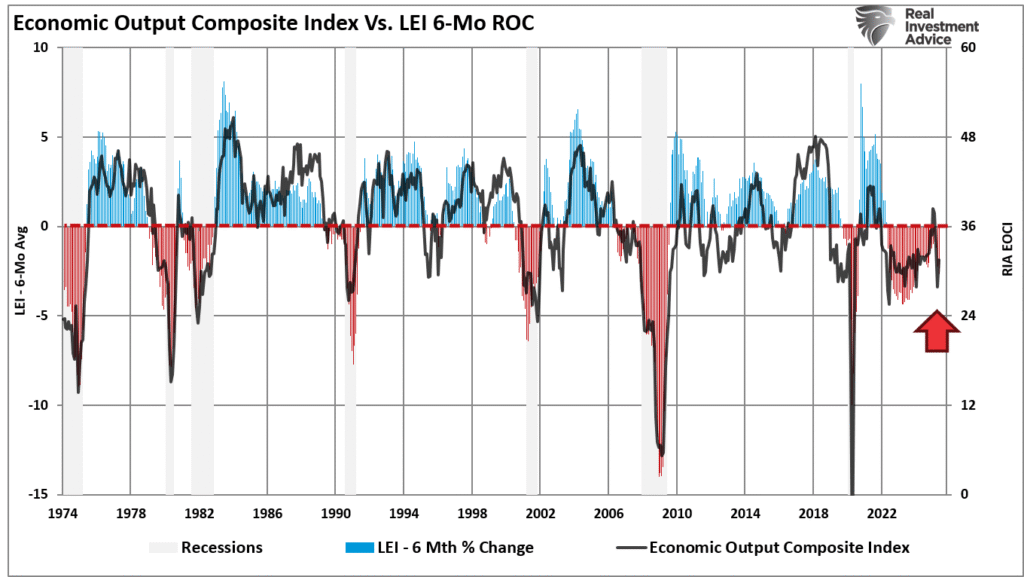

This recalibration represents not just a nuanced shift in economic stewardship but signals a potential boon for the Treasury landscape, possibly fostering greater demand, enhancing market fluidity, and even contributing to a reduction in yields amid a decelerating economy. Insights drawn from the Economic Output Composite Index, a sophisticated amalgam of approximately 100 data points, alongside the six-month rate of change in the Leading Economic Index, underscore this economic deceleration, suggesting a scenario more tepid than what surface-level headlines might suggest.

In stark relief to current times, the antecedent period since 2022 departs from predicted recessionary patterns. This anomaly can be attributed to the colossal monetary stimuli injected to sustain economic expansion, a lifeline that’s swiftly dwindling and potentially placing major financial institutions in jeopardy—a situation that casts the SLR into prominence.

Delving into the Essence of the SLR and Its Paramountcy

Post-Global Financial Crisis, the Supplementary Leverage Ratio was instituted as a bulwark against excessive leverage in banking systems, compelling banks to peg their borrowing against their capital reserves without weighting the asset risk. This regulation equated the risk of Treasury bonds and higher-yield, riskier loans in terms of leverage, inadvertently disincentivizing leading banks from incorporating low-risk assets like U.S. Treasuries into their portfolios during periods of financial strain.

In what is celebrated as a strategic reversal, the Federal Reserve, alongside the FDIC and the OCC, unveiled modifications to the SLR, ushering in a risk-sensitive approach that recalibrates the enhanced SLR (eSLR) add-on to 50% of the Method 1 Global Systemically Important Bank (G-SIB) surcharge. This realignment effectively eases the leverage constraints on America’s financial behemoths, engendering significant balance sheet flexibility.

Under this revised framework—an analysis by Goldman Sachs’ Richard Ramsden prophesies—a liberation of $5.5 to $7.2 trillion in banking balance sheet capacity is envisioned, an uplift tantamount to a quarter of the U.S. GDP. This reform is poised to primarily prop financial titans such as JP Morgan, Bank of America, Wells Fargo, and Citigroup, catalyzing an uptick in repo financing and direct Treasury acquisitions, particularly in times of market disarray.

Understanding the Impact on the Treasury Market

The SLR’s recalibration arrives amidst the backdrop of a persisting bear market in bonds following the COVID-19 pandemic, exacerbated by rising yields influenced by inflationary pressures and enhanced Fed fund rates, further compounded by a surge in Treasury debt issuance to finance expansive stimulus and spending initiatives under the Biden Administration. The reluctance of major banks to step in, thwarted by regulatory capital constraints, has sustained elevated yields, more so at the long end of the curve.

With the SLR reform, banks find themselves equipped to channel surplus capital into Treasuries, sidestepping leverage regulations and potentially absorbing a substantial slice of new issuance. This shift is predicted to exert a downward force on yields, especially during market volatility, thereby smoothing Treasury market operations and mitigating risks synonymous with incidents like the September 2019 repo tumult or the March 2020 liquidity crisis.

Moreover, a less apparent but equally consequential facet of the SLR revision pertains to its implications for the Total Loss Absorbing Capital (TLAC) and Long-Term Debt (LTD) prerequisites. These stipulations, designed for the orderly wind-down of large banks, will see a reduction under the new proposal, thereby releasing approximately $95 billion in wholesale debt across the top five U.S. banks—a boon in a climate of ascending interest rates, heralding lower funding expenses and enriched margins.

Strategic Portfolio Recommendations

This evolving regulatory and monetary landscape invites investors to recalibrate their portfolio strategies, bearing in mind that regulatory frameworks are as pivotal as monetary policy in shaping asset flows, risk appetites, and liquidity conditions. The inclination of banks towards bolstering their Treasury holdings presages downward pressure on long-term yields, particularly in “risk-off” conditions where the quest for safety intensifies.

Consequently, the pronounced short position against U.S. Treasury bonds harbors the potential to exacerbate this downward trajectory should a swift unwinding be necessitated. This scenario, while not guaranteeing a bond rally, decidedly shifts the risk-reward balance in favor of duration, especially within the realm of high-quality fixed income. For equity markets, this dynamic presents a nuanced picture: while typically bullish for growth stocks, plunging yields could signal economic malaise or recessionary fears.

Concluding Observations

Far from mere regulatory tidying, the Fed’s SLR amendments are a strategic maneuver aimed at bolstering the Treasury and repo market’s infrastructural underpinnings. By affording banks greater leeway in holding safer assets, these reforms not only promise enhanced liquidity and reduced yields but potentially herald a more stable financial ecosystem, provided unforeseen ramifications are kept at bay.

In sum, the recalibration of the SLR underscores the intricate dance between regulatory interventions and market dynamics, reminding investors and observers alike that the devil, as ever, is in the details. And in this instance, those details could very well redraw the contours of market engagement and financial stewardship.