In the contemporary world of investment and finance, the buzz around the notion of abandoning American investments for more globally diversified portfolios has amassed considerable attention. Critics label this trend as exaggerated, yet for those of us keen on securing robust income streams, the concept bears not just relevance but necessity. The United States, despite boasting an unrivaled dynamic and diverse economy, should not be the sole focus of investors aspiring for financial security and growth.

The essence of financial safety and the enhancement of portfolio value, as well as income streams, lies in strategic diversification. This means embracing not just the titan blue chips of the US markets but also casting our nets wider to encompass global stocks, real estate investment trusts (REITs), and corporate bonds. This approach, however, comes with its hazards; overzealous diversification could lead to diminishing returns, a predicament no investor desires.

It beckons a thoughtful consideration: might it be preferable to endure slight overexposure to specific markets or asset classes, the US, for instance, if it results in superior returns, as opposed to remaining entangled in the mediocrity of diversified investments that fail to impress over time? This question underlines the concept of ‘diversification done right,’ an approach bespeaking moderation and wisdom.

Delving into this strategy, let’s explore the world of closed-end funds (CEFs), particularly those yielding high returns, showcasing the dual faces of diversification. For example, consider two US-focused funds with starkly different investment portfolios – one primarily holding blue-chip stocks and the other in corporate bonds. These exemplify diversification that bears fruit, aligning with the goal of accruing a significant yearly income, say $100,000, from a calculated investment.

Consider the ease by which a selection of CEFs, offering a 7% yield, could facilitate this income goal with an investment substantially lower than what would be requisite in traditional S&P 500 stock investments. The underlying principle here is not to distribute assets so thinly across various classes that it hampers the potential returns.

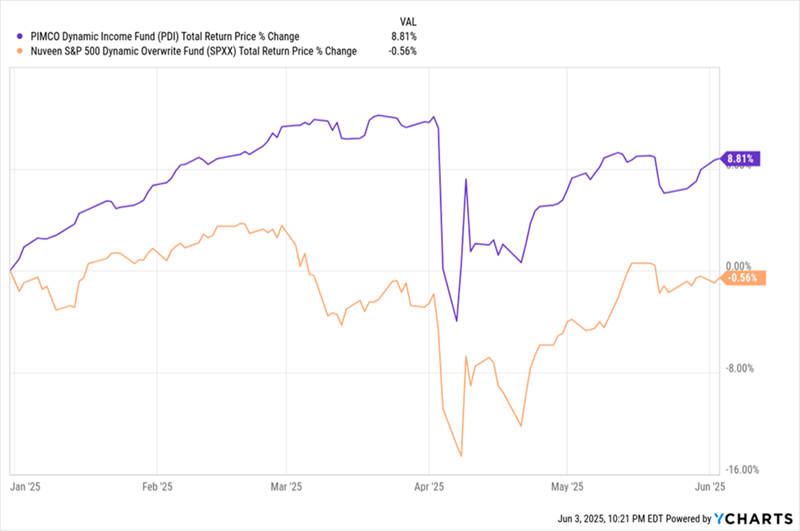

Reflecting on the performances of specific funds like the Nuveen S&P 500 Dynamic Overwrite Fund and the PIMCO Dynamic Income Fund over the current year provides empirical evidence of the viability of selective diversification. The former has maintained stability through a conservative strategy of selling call options on its holdings to bolster dividend support, while the latter has shown impressive returns, significantly outpacing many of its counterparts.

This synergistic approach shared between stock and bond investments illustrates not mere diversification, but effective diversification, which bolsters average returns surpassing stocks alone for the current year, also ensuring a hefty average dividend yield.

However, it’s critical to distinguish between effective diversification and seemingly convenient options that promise broad exposure but potentially lead to subpar performance. This notion is exemplified in the Clough Global Opportunities Fund, which, despite its worldwide exposure and noteworthy short-term gains, demonstrates the risks associated with over-diversification. Against broader benchmarks, such as the Vanguard All-World Ex-US ETF, it significantly underperforms over the long term, underscoring the importance of strategic selection over mere global exposure.

The narrative unfolding around these investment strategies is not merely a financial recommendation but a testament to the evolving dynamics of global finance. It reflects a transition from traditional, geographically constrained investment philosophies towards a more nuanced understanding of risk, return, and the imperative of global economic interconnectedness.

As we navigate these turbulent waters, the counsel of seasoned investment strategists like Brett Owens and Michael Foster becomes invaluable. Their advocacy for contrarian approaches to income investing, focusing on undervalued stocks and funds across US markets, reinforces the principle that, in diversification, as in all things, wisdom lies not in the breadth of one’s reach but in the precision of their grasp.

In conclusion, while the allure of ‘selling America’ for broader horizons garners media fascination, the astute investor recognizes the balance between embracing the global marketplace and maintaining a concentrated, effective portfolio. It’s a ballet of financial acumen, where diversification done right can lead to a secure and prosperous future.

The media is still obsessed with the “sell America” trade.

That is, in a word, overblown. But there is something valuable here—especially for us income investors.

Because even though the US has the world’s most diverse and dynamic economy, bar none, we do need to make sure we’re spreading at least some of our assets beyond a single country or asset class.

For maximum safety (both for our portfolio value and our income streams) we also need exposure to alternative asset classes beyond US blue chips, such as global stocks, real estate investment trusts (REITs) and corporate bonds.

But here’s where a potential pitfall lies: Important as diversification is, we can not make the common blunder of letting it take over our investment decisions. That way lies “locked-in” ho-hum (or worse!) returns.

I think it’s better to be a little overexposed to, say, the US (or one specific asset class) and book greater returns than to suffer through year after year of missed profits.

Diversification Done Right: A Bond/Stock CEF Combo With a 10.7% Average Yield

Let’s unpack this more using three high-yield closed-end funds (CEFs) that show the right and wrong ways to diversify: The first two are US-focused but have completely different portfolios, with one holding blue-chip stocks and the other corporate bonds.

Taken together, they’re a great example of diversification done right.

And we are, of course, talking income here, so I’ve included a dividend target, as well. In all of the examples we’ll get to, we’re aiming for a $100,000 yearly income stream.

With, say, a collection of CEFs yielding 7%—an easy-to-get yield with these funds—you can get that $100K in payouts with just $1.43 million invested. That’s less than a fifth of what you’d have to pile into the typical S&P 500 stock.

For the most safety, though, we want to diversify so that when one asset class is down, another will pick up the slack. But again, we do not want to become so fixated on this that we let it drag down our overall returns.

Let’s start off with what’s happened so far this year. The Nuveen S&P 500 Dynamic Overwrite Fund (NYSE:), a CEF that yields 7.3%, is about flat, including reinvested dividends as I write this. The fund holds all the stocks in the S&P 500, as the name says, and sells call options on its holdings—a low-risk way to support its dividend.

Meantime, the 14.1%-yielding PIMCO Dynamic Income Fund (NYSE:), the biggest corporate-bond CEF out there, has returned 8.7% year to date.

Stocks and Bonds Team Up for Better Performance, Dividends

PDI (in purple above) is easily covering its payouts this year, so we have no worries there. But if SPXX (in orange) doesn’t recover, it would have to cut payouts or sell stocks—and eat into investors’ capital—to maintain them.

But fortunately, SPXX has outearned its payouts, with an 8.2% annualized total return, based on the performance of its underlying portfolio, in the last decade. So there are no worries here, either, for long-term SPXX holders.

This combo, in other words, is an example of effective diversification: The stock and bond picks are working in tandem to deliver a strong average return (better than stocks alone for this year)—and we’re getting a 10.7% average dividend, too.

Not bad!

Now let’s look at a fund that offers “one-click” diversification that sounds great—it may even tempt you to simply buy, call yourself “diversified” and call it a day. But that would be a mistake, since not all diversification is created equal.

“Convenient” Diversification Leads to Fading Returns

That would be another CEF called the Clough Global Opportunities Fund (NYSE:). It holds the bulk of its portfolio in the US but devotes a large slice to the rest of the world, as well. That differs from SPXX’s domestic focus and PDI’s US-dollar-centric investments in bonds and bond derivatives.

GLO’s geographic diversification is clever, tilting toward US multinationals with foreign consumer bases while also including high-quality international firms like Airbus and ICICI Bank (NYSE:). Plus, the fund yields a generous 11.3% as I write this. That gets us our $100,000 income stream on just $884,000 invested.

GLO Is a Winner in the Short Term …

Above we see GLO (in blue) nearly matching the top-flight run of our bond fund (PDI, in purple). So GLO’s global setup has been a big hit so far this year. That makes sense, as foreign markets have beaten those of the US.

So, GLO is a clear winner for income and diversification, right? Well, not so fast.

… But Not the Long

While SPXX (in orange above) and PDI (in purple) have had strong gains over the last decade, GLO is up a paltry 3.2% annualized, much less than its current yield.

To be fair, this performance isn’t entirely the fault of GLO’s management: The rest of the world has lagged SPXX and PDI in the last 10 years. But the Vanguard All-World Ex-US ETF (NYSE:), in orange below, has nearly doubled GLO. (VEU is a good benchmark for global stocks.)

GLO Can’t Hold Off a “Basic” Global ETF

As you can see, GLO (in purple) was a big winner during COVID and after, but in the end couldn’t hold off VEU (in orange). This is why GLO is better avoided, even though it might seem like a good idea in the name of diversification.

The bottom line is that when we diversify, we of course want to set ourselves up for long-term price gains and strong yields. Pairing top-quality stock and bond funds like PDI and SPXX can deliver these. But we do not want stocks or funds that will lag others (and particularly their own benchmarks) by wider and wider margins. That’s why I see GLO as a sell.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”