The landscape of Artificial Intelligence (AI) and its underlying technology is a realm marked by rapid innovation and fierce competition. Among the stalwarts of this vibrant sector is NVIDIA, a company that has, for many years, been at the forefront, dominating the AI GPU and infrastructure space. However, the notion of a clear and unchallenged leader in this dynamic field is more nuanced than it appears at first glance. Enter Advanced Micro Devices (AMD), a formidable contender that is not only challenging NVIDIA’s dominance but also presenting compelling advantages that are reshaping the playing field.

AMD’s GPUs, notably the MI 355X, have garnered attention for their remarkable attributes that stand out against NVIDIA’s counterparts, such as the Blackwell GPU. What makes the MI 355X a particularly appealing choice for many in the AI field is its superior memory capacity and bandwidth. This advantage is not trivial; it directly translates to enhanced performance for large AI models and workloads, which are increasingly becoming the norm as the boundaries of AI capabilities continue to expand. The notion that AMD offers more dollar-cost efficiency, user-friendliness, and superior compatibility with a diverse range of third-party products further bolsters its position as a viable, if not preferable, alternative to NVIDIA in various scenarios.

The journey of AMD in the AI domain is one marked not by complacency but by relentless pursuit of growth and innovation. This is evident from its strategic efforts to fast-track the development of its comprehensive AI system. A significant chunk of this ambitious trajectory is bolstered by a series of acquisitions, including the acquisition of three companies in the second quarter: Eno Semi, Brium, and Untether AI. These acquisitions are not random undertakings but carefully chosen investments aimed at accelerating AMD’s technological evolution and innovation pipeline. Particularly notable is Eno Semi, a company specializing in co-packaging and photonics. Its focus on developing high-speed, high-bandwidth, and efficient optical solutions is expected to significantly bolster AMD’s capabilities in AI and data centers — areas of critical importance in the current and future landscapes of technology.

The ripple effects of AMD’s strategic moves are far-reaching. A landmark development underscoring AMD’s ascending trajectory in the AI realm is its partnership with OpenAI. This collaboration is geared towards harnessing OpenAI’s expertise for the development of AMD’s next-generation MI450 line of GPUs and the Helios server platform. With OpenAI’s involvement, particularly with projects such as ChatGPT, the potential to enhance AI-related workloads and utility is immense. This partnership not only signifies AMD’s proactive approach to innovation but also hints at a potential shift in the balance of power in the AI infrastructure domain, challenging NVIDIA’s long-standing dominance. The broader implications are significant, with major hyperscalers and AI infrastructure providers, including industry giants like Microsoft and Oracle, turning to AMD GPUs to power their advanced data centers.

The strategic vision of AMD’s leadership, spearheaded by CEO Lisa Su, anticipates a substantial surge in AI inference demand, projected to increase by 80% by 2026. This forecast is grounded in the expanding development and application of AI technologies, a trend that is expected to persist as business adoption of AI accelerates. AMD’s commitment to fostering an open ecosystem, exemplified by the open-source project Brium, positions the company well to capitalize on these trends. This approach not only advances innovation but also democratizes access to advanced AI capabilities, a principle that could have transformative impacts across various sectors.

Another testament to AMD’s growing influence and potential in the AI and technological landscapes is its collaboration with Digital Ocean. This partnership aims to leverage AMD’s advanced GPU capabilities to cater to the evolving needs of Digital Ocean’s digital-native clientele, emphasizing the increased memory capacity of AMD’s offerings. This capacity enhancement is crucial as it facilitates the operation of larger models without necessitating model splitting across multiple GPUs, a significant technical advantage that showcases AMD’s commitment to meeting the sophisticated demands of modern computing tasks.

The financial markets have taken note of AMD’s strides and potential, with analyst activity post-AMD’s Q1 2025 earnings report reflecting a bullish stance on the company’s stock. Predictions of a rebound in AMD’s share price, backed by increased coverage, upgrades, and raised price targets, underscore the growing confidence in AMD’s trajectory. Although the company faces challenges and resistance points, there is palpable optimism regarding its direction and the possibilities it heralds for the AI and broader technological landscapes.

In summary, the narrative around AI infrastructure and GPU leadership is evolving, with AMD emerging as a powerful force that not only challenges established norms but also drives innovation and opens new possibilities. Through strategic acquisitions, partnerships, and a steadfast commitment to development, AMD is not just keeping pace but setting new standards in the realm of artificial intelligence, promising to reshape the future of technology in profound ways.

While NVIDIA (NASDAQ:) remains the undisputed leader in AI GPU and infrastructure, its first-mover advantage doesn’t mean it’s better. Advanced Micro Devices (NASDAQ:) GPUs offer advantages to NVIDIA in many use cases due to their dollar-cost efficiency, user-friendliness, and superior compatibility with a wide range of 3rd-party products. The advantages run into performance. Advanced Micro Devices MI 355X has superior memory capacity and bandwidth to NVIDIA’s Blackwell, making it an exceptional choice for large AI models and workloads.

The critical factor for Advanced Micro Devices investors is that it is working hard to accelerate the development of its full-stack AI system and, by extension, its AI business. Recent developments include three calendar Q2 acquisitions aimed at accelerating technological development and innovation in the pipeline. They include Eno Semi, Brium, and Untether AI, compounding a string of 2025 acquisitions aimed at AI stack development.

The addition of Eno Semi will produce the most significant results fastest. It is a co-packaging and photonics-focused semiconductor company that develops high-speed, high-bandwidth, and high-efficiency optical solutions for AI and data centers. Acquisitions of Brium and the engineering team from Untether AI accelerate the innovation pipeline, including AMD’s AI-specific hardware and software.

OpenAI to Use AMD’s Next-Gen MI450 GPUs and Helios Servers

Developments affirming AMD’s growing importance to the AI revolution include a new partnership with OpenAI. OpenAI will assist in the development of AMD’s upcoming MI450 line of GPUs and the Helios server that will be made from them. ChatGPT’s role is to enhance utility for AI-related workloads; the company plans to utilize it once completed, potentially dealing a blow to NVIDIA’s leadership position. Other leading hyperscalers and AI infrastructure providers, including Microsoft (NASDAQ:) and Oracle (NYSE:), are also using AMD GPUs to power their advanced data centers.

AMD CEO Lisa Su forecasts AI inference demand will increase by 80% in 2026. The increase will be underpinned by expanding development and use of AI applications. The growth will remain robust for years as business-adoption of AI accelerates and penetration deepens, potentially outpacing the robust forecast and accelerating annually. That’s why the company is investing heavily in an open ecosystem, with open-source Brium a primary example.

Digital Ocean, a cloud provider, is another example. The company is collaborating with AMD to offer advanced GPU capacity and access to its digital-native clientele. They cite the company’s increased memory capacity, which allows larger models to operate without the need for model splitting across multiple GPUs.

Analysts Signal a Rebound in AMD Share Price

The analyst activity since AMD’s calendar Q1 2025 earnings report has been bullish, signaling a rebound in the stock price after several quarters of price target reductions. The activity includes increased coverage, upgrades, and numerous price target increases, forecasting a 12% increase at the consensus relative to mid-June trading levels and a 65% increase at the high end.

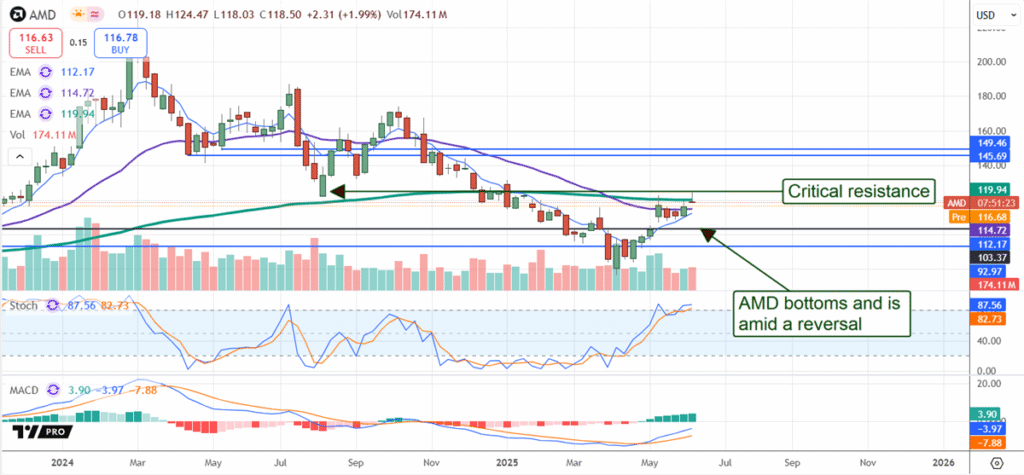

A move to the consensus would be significant, taking the market above a critical resistance point to confirm a reversal that has been underway since March.

The price action is bullish, although resistance is present. The market is amid a Head & Shoulders Reversal, and it will likely move higher to confirm it as a complete reversal, potentially trending higher later this year.

The neckline and critical resistance point are located near the $120 level and the 150-week exponential moving average (EMA). If it can not be surpassed, this market will likely trend sideways until more news develops.

The caveat is that the FQ2 earnings release is due by early summer and will likely catalyze the market. The analyst forecast a substantial 27% increase in revenue, but with weaker margins. This forecast is likely to be outperformed on both the top and bottom lines, with strength compounded by robust guidance.