As we edge closer to the commencement of the earnings reporting season, a noteworthy study from the University of California, San Diego, and Aarhus University – utilizing data from Wall Street Horizon – is poised to change how investors approach the anticipation of Q2 2025 results.

This pivotal research, entitled “Warp Speed Price Moves: Jumps after Earnings Announcements,” featured in the prestigious Journal of Financial Economics, offers a deep dive into the efficiency of markets in assimilating the outcomes of earnings announcements. The findings of this study are groundbreaking, revealing that the release of earnings reports is capable of instantly affecting stock prices – this phenomenon isn’t limited to the companies making the announcements but often extends to their industry peers and can even ripple through the market at large.

A unique aspect of this study is its focus on the timing of these earnings releases. It was observed that companies reporting their earnings early in the season, and those choosing to announce results after the market closes, tend to have a more pronounced impact on stock price movements. The data showed that post-market earnings announcements influenced stock prices more than 90% of the time, highlighting the significant volatility that can occur outside regular trading hours compared to periods of non-announcement or during regular market operation hours.

One of the co-authors, Allan Timmermann, a distinguished figure from the UCSD’s Rady School of Business, shared insightful observations on the subject. He elaborated on how traders, who deal with earnings announcements daily, have developed a keen sense for predicting the market impact of companies either meeting, exceeding, or falling short of expectations. “Missing the mark,” Timmermann explains, “often results in a precipitous decline in stock prices, sometimes influencing the valuation of entire sectors.”

An exemplary case of the implications of these findings occurred on Wednesday, June 11, 2025, involving Oracle Corporation (NYSE:). Oracle, known for its pivotal position as one of the first to report each earnings season, unveiled its financial achievements for the fiscal fourth quarter of 2025 – corresponding to the calendar’s second quarter. The multinational tech giant reported impressive earnings, exceeding Wall Street predictions on both revenue and profit fronts, primarily driven by the robust performance of its cloud services. Additionally, Oracle’s optimistic projection that demand for artificial intelligence (AI) would spur a 70% increase in its cloud infrastructure revenue for fiscal 2026 was particularly well-received. The direct outcome? Oracle’s stock soared over 11% post-announcement. This bullish trend cascaded into Thursday, propelling not just big tech stocks but the entire technology sector, and in turn, lifting broader market indices – with the S&P 500 rising by 0.36% and the Nasdaq by 0.21%. By the week’s close, Oracle had reached an unprecedented high.

Looking ahead to the Q2 earnings season of 2025, this study casts the spotlight on a select group of large-cap companies primed for early reporting, especially those releasing their figures after the bell. With the research underscoring the potential market-moving effects of such releases, these companies’ upcoming earnings announcements become a focal point for investors, strategists, and traders alike.

In sum, the unfolding of the Q2 earnings season promises to be a period of keen interest and heightened activity for the financial markets. The insights garnered from the “Warp Speed Price Moves” study underscore not only the inequality in the market-moving power of various earnings reports but also the strategic advantage of early season and after-hours announcements. For investors aiming to navigate the potential market volatility this summer, keeping a vigilant watch on the forthcoming reports from these highlighted companies is advisable.

As we navigate through the intrigue and speculation that traditionally precedes the earnings season, it’s evident that the art and science of forecasting market dynamics remain as complex and captivating as ever. This research provides a valuable lens through which to view the potential ebbs and flows of the market tide, reminding us of the interconnectedness of financial ecosystems and the rapid pace at which they operate.

The unofficial start of the next earnings season is still roughly a month away, but recent research out of the University of California, San Diego and Aarhus University (featuring Wall Street Horizon data) might have investors preparing differently for Q2 2025 results.

The study, “Warp Speed Price Moves: Jumps after Earnings Announcements,” recently published in the Journal of Financial Economics, shows how efficient markets are at pricing in earnings results. The authors found that earnings reports can move stock prices in milliseconds, and not just the stock of the reporting company, but often the stocks of peers in the industry, or even entire markets as a whole.

The research also shows that the effect is strongest from companies that report early in the season, and for companies that report after market close. After-hours earnings announcements cause stock prices to move over 90% of the time, while significant price movements during regular trading hours or in non-announcement sessions were less common.

Co-Author of the study, Allan Timmermann of UCSD’s Rady School of Business commented: “With earnings announcements, traders deal with these every day and they are very good at gauging the impact of companies being able to meet and beat expectations or missing them. We find that it can be very costly to miss expectations – this often leads to sharp drops in prices, sometimes affecting entire sectors.”

Oracle Earnings Push the Tech Sector Higher

A good example of this occurred just last Wednesday, June 11, 2025. Oracle Corporation (NYSE:), one of the early reporters each earnings season, released their results for fiscal Q4 2025 (equivalent to calendar Q2 2025) after-the-bell. The mega-tech company beat Wall Street’s expectations on the top and bottom-line due to strength in their cloud segment. The company also commented that AI demand would drive cloud infrastructure revenue up 70% for fiscal 2026.Such bullish comments lifted the stock more than 11% after the report, and into Thursday big tech stocks also surged with the tech sector leading the index higher for the day. The strength of tech lifted equity markets higher on Thursday, with S&P 500 up 0.36% and the gaining 0.21%, and Oracle closed out the week at a record high.

On Deck for Q2 2025 Earnings Season

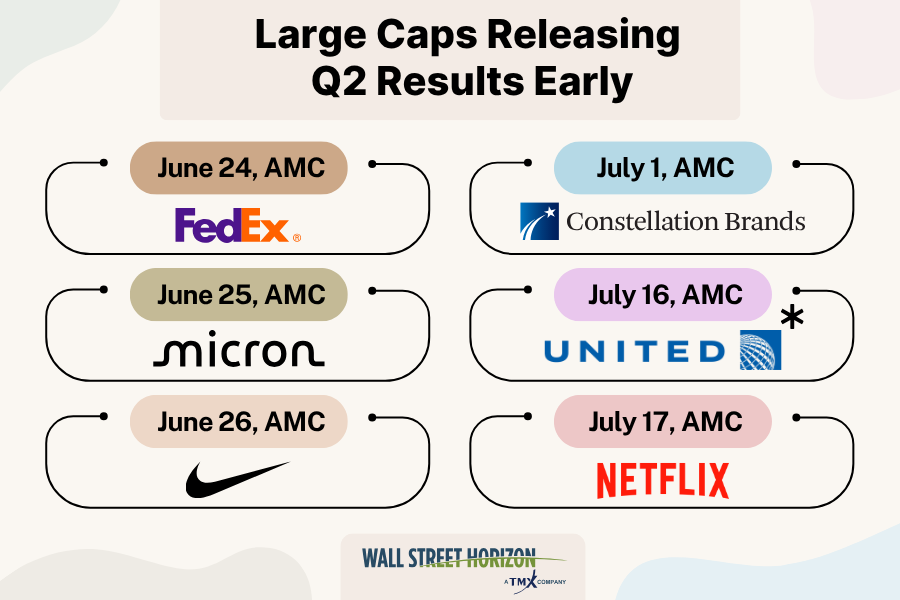

Given this information, we took a look at the large cap names that are releasing results early in the reporting season for Q2, and after-the-bell. According to the study these could be some names to keep an eye on in the coming weeks:

The Bottom-Line

As the unofficial start of the Q2 earnings season draws near, the research suggests that not all earnings reports are created equal in their market-moving potential. The combination of an early reporting date and an after-hours release appears to be a potent formula for influencing not just a single stock, but entire sectors and the market as a whole. The reports from the companies listed above, among others, could therefore be critical viewing for investors looking to gauge how Q2 reports could impact markets this summer.