In the intriguing world of financial markets, few tools are as indispensable to investors and traders alike as the diligent observation and analysis of market trends and performance patterns. This meticulous exercise, often referred to as monitoring purposes, is key to navigating the often volatile and unpredictable waves of stock markets around the globe. A detailed examination of such an analysis provides a fascinating glimpse into the tactical approaches adopted by market participants in their relentless quest for profit and risk management.

To begin, let’s delve into a specific example that underscores the strategic engagements within the market. A particular investor managed to liquidate their long position on the 5th of June, 2025, clocking in a modest profit margin of 0.033% by selling at 5936.30. This sell-off followed an initial purchase of the S&P 500 index (referred to here as SPX) on the 15th of May, 1958, at 5916.93. Such transactions reveal the granular level at which market participants operate, constantly adjusting their positions based on real-time market dynamics.

Throughout the years 2023 to 2024, this investor’s portfolio saw varying degrees of success. From the outset of 2023 to the end of the year, they experienced a commendable increase of 28.12% in their investments. When comparing this to the S&P 500’s gain of 23.38% over the same period, the superiority of their strategy becomes evident. The subsequent year, 2024, continued this trend of outperformance, with their gains skyrocketing to 29.28%, once again eclipsing the SPX’s rise of 23.67%. Such figures not only highlight the investor’s astute market acumen but also underline the volatility and opportunity within the markets that skilled individuals can leverage to their advantage.

Another noteworthy transaction occurred on the 11th of April, 2025, where the investor sold off a position at 49.66, reaping a significant gain of 21.33%. This pattern of timely entries and exits underscores the nuanced understanding of market cycles and the importance of timing in the realm of stock trading.

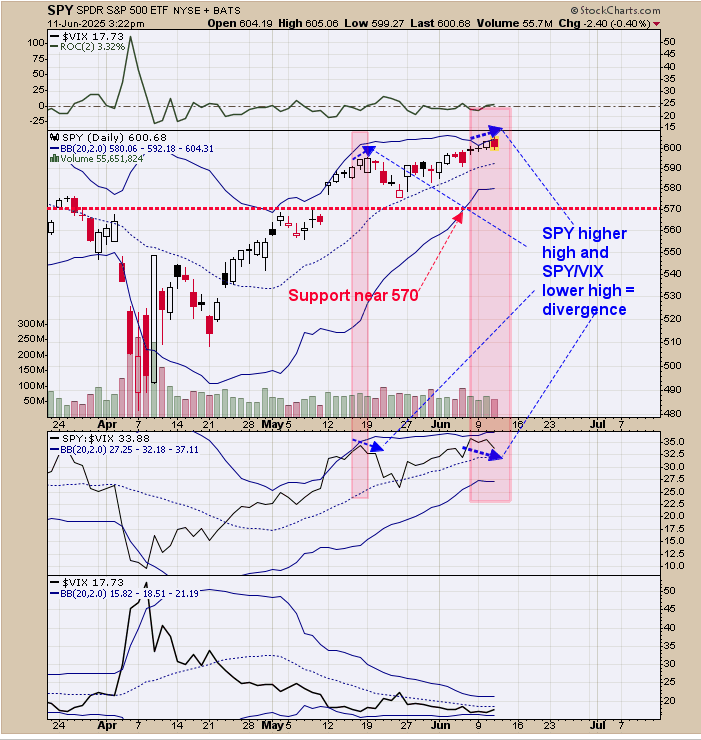

However, this narrative also introduces an element of caution through the identification of market divergences—a scenario where the stock prices form higher highs while a related ratio indicates lower highs, signalling a bearish forecast. Such meticulous observation was crucial in identifying potential pullbacks, guiding strategic decisions like the consideration of a new long position around the 570 marker based on the SPY’s performance.

Interestingly, the analysis extends beyond simple stock indices to explore the relationship between different market segments, as exemplified by the HUI/NDX ratio. This ratio measures the performance of gold stocks against tech stocks, a comparison that reveals underlying market sentiments and sectoral strength. The document explains how a rising ratio, indicated by a Relative Strength Index (RSI) above 50, signifies the outperformance of gold stocks (HUI) over tech stocks (NDX). The observed trend since late 2024 suggested a potential long-term shift favouring HUI, backed by historical patterns indicating a 12-year cycle of peaks and troughs in this ratio.

This entire exercise, from the careful tracking of individual stock movements through SPY and HUI/NDX analyses to the strategic positioning around potential market reversals, exemplifies the critical thinking and analytical prowess exercised in financial market analysis. Beyond the mere numbers and charts lies a complex interplay of economic indicators, sectoral shifts, and investor psychology, all converging to create the myriad opportunities and pitfalls that define the stock market landscape.

For those uninitiated in the labyrinth that is the stock market, this analysis serves as a primer on the importance of constant vigilance, strategic foresight, and timely decision-making in the pursuit of financial gains. It shines a light on the disciplined approach required to thrive in an environment where fortunes can change at a moment’s notice, drawing on historical data, pattern recognition, and a deep understanding of market fundamentals to navigate the future. Whether one is a seasoned investor or a newcomer keen on understanding market dynamics, the insights gained from such detailed analyses are invaluable tools in the arsenal of anyone looking to engage with the financial markets.

Monitoring purposes; Sold long 6/5/25 at 5936.30 = gain .033%; long SPX on 5/15/58 at 5916.93

Our gain 1/1/24 to 12/31/24 = 29.28%; SPX gain 23.67%

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes : Sold long 4/11/25 at 49.66 = gain 21.33%.

We ended up at 29.28% for 2024; SPX up 23.67% for the year. There is a small divergence present where the has made higher highs and the SPY/ ratio has made lower highs and a bearish sign. We noted in shaded pink this divergence.

The last one came in mid-May (noted on the chart), which produced a pullback that lasted nearly a week. Support lies near 570 on the SPY; if the market does get to that level, we may consider a long position.

We have updated this chart from yesterday, and yesterday’s commentary still applies. “Above is the weekly SPY. Last week, the SPY broke above its previous high of two weeks ago on 8% lighter volume, suggesting a false break to the upside. If a market can’t break above a previous high on equal or greater volume, it will reverse and attempt to take out its previous low.

The previous low in this case is also the low of two weeks ago, which is near 575 SPY and a possible downside target. The pattern forming appears to be a Head and Shoulders pattern that has a measured target near the 740 range, which is over 23% higher than current levels. May see a decent bullish setup near 570 SPY.”

The question becomes if the 610 area is reached first before the pull back to 570 begins, or if the pull back starts sooner; right now, we don’t have the answer to that question. Welcome to the summer doldrums.” Added to the above, a close below the previous weekly high of May 19 at 595.54 (noted with red dotted line) would give a target near 570.

The middle window is the monthly HUI/NDX; when this ratio is rising, then is outperforming and vice versa. Above the monthly HUI/NDX ratio is its RSI. Uptrend in this ratio (and in turn HUI) corresponds to RSI above 50 and downtrend below 50. We shaded in green on the RSI when it was above 50 (HUI outperforming NDX) and in light pink when below 50 (NDX outperforming HUI).

Since late 2024, the RSI has been above 50, showing that HUI is outperforming NDX. The pattern forming on HUI/NDX appears to be a “Falling Wedge” (noted on chart) and this pattern has a target to where the pattern began; which in this case is near .06. To get to .06 on the HUI/NDX; HUI would need to outperform NDX by 300%.

There appears to be a 12-year cycle that is identified by red lines (half blue circles) where the ratio peaks and troughs. The next up cycle for this ratio started in early 2024 and could last until 2036.