In recent developments, the groundwork laid by political and trade dialogues has infused a sense of optimism into global stock markets, yet hurdles loom large as potential stalemates in negotiations between the US-China and US-Iran threaten to derail progress. Amidst these conversations, major market indices such as the S&P 500 and NASDAQ have been flirting with record valuations, demonstrating a resilience that captivates investors worldwide. However, not all share the same fortune as the German DAX experiences a downward adjustment, and Poland’s WIG20 hovers in a state of flux, eagerly anticipating a defining market movement.

To navigate through this whirlwind of market volatility, accessing actionable trade ideas has become paramount for investors. Subscribing to platforms like InvestingPro can unveil a treasure trove of investment opportunities, backed by the prowess of artificial intelligence in selecting stock winners.

This week, the global financial markets have been predominantly influenced by political and trade dialogues, with the spotlight on newly resumed conversations between Beijing and Washington. These discussions have edged both superpowers closer to a potential agreement, igniting hopes of a breakthrough; however, official endorsement from the respective chiefs of state is still pending. Concurrently, an air of cautious optimism has been fanned by remarks from President Donald Trump regarding a foreseeable solution with Iran concerning its nuclear aspirations. The stakes are high, as the failure to secure an agreement could heighten the prospects of military engagement, an outcome likely to induce turbulence across financial markets.

The specter of conflict has been made more tangible following Israel’s assault on Iranian military installations, amplifying the urgency for a diplomatic resolution. This geopolitical chess game is set against a backdrop of economic data that, whilst not dramatically underwhelming, has fueled speculations that the Federal Reserve might lean towards an earlier interest rate cut, potentially buoying investor sentiment.

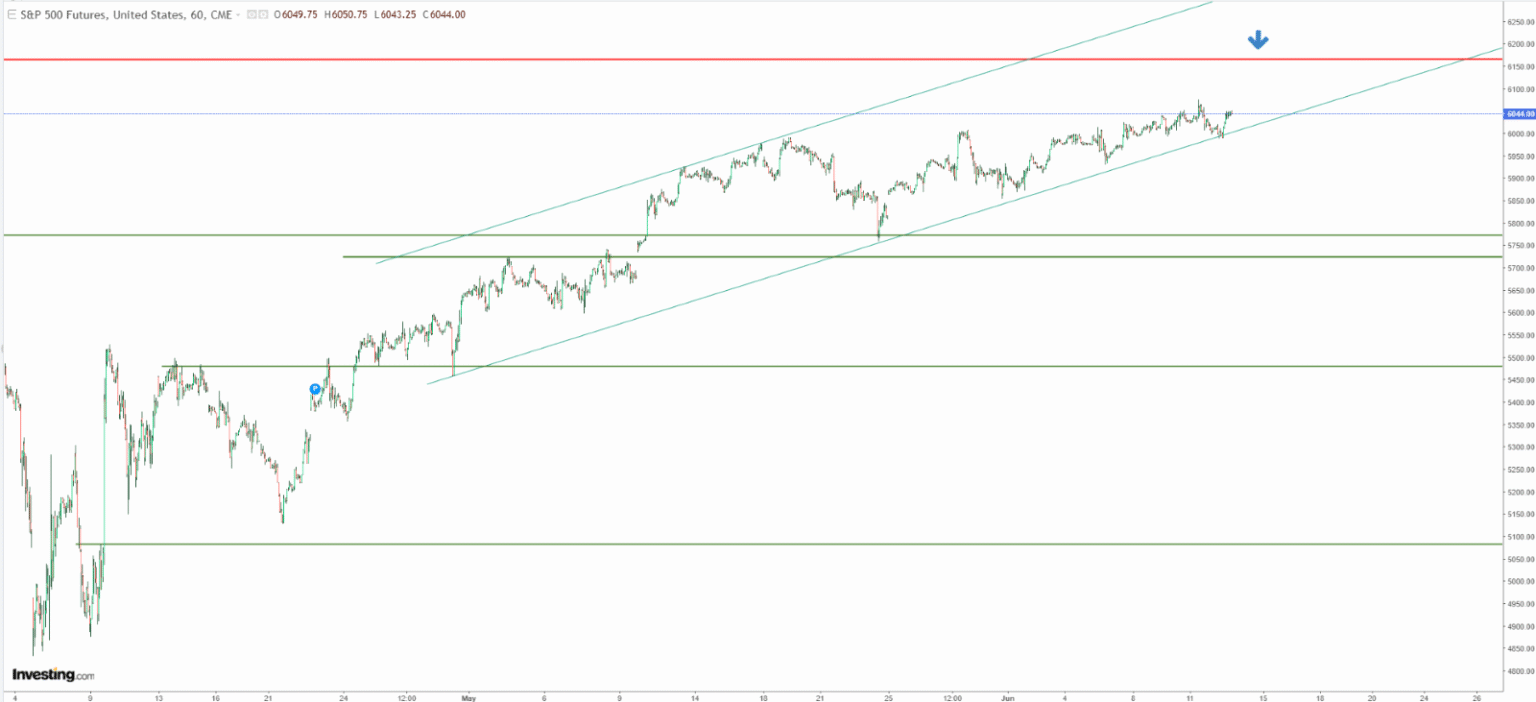

Amidst this intricate tapestry of developments, the S&P 500 continues its relentless march upwards, adhering closely to the contours of its ascending price channel. Having surmounted the critical 6000 level, the index now sets its sights on eclipsing its historic peak just shy of 6200. Nonetheless, vulnerability to a downward correction persists should the index retreat below its current support, which could see it retracing towards the 5800 to 5700 support zone.

Parallel to the trajectory of the S&P 500, the NASDAQ Composite remains steadfast on its upward journey, with the promise of breaching its all-time high around 22300 points within grasp. However, a dip below the 21500 point mark may herald a cautious signal for investors, hinting at a possible extended pullback to the vicinity of 20500 points.

Contrastingly, the German DAX index portrays a narrative of retrenchment, grappling with a stronger pullback that nudges it closer to a critical juncture at 23500 points. A breach of this threshold could pave the path for steeper declines, although the overarching upward market trend suggests that a robust rebound from this level could offer a lucrative entry point for bullish investors.

In a world where uncertainty seems to be the only certainty, platforms like InvestingPro provide a bastion for investors aiming to decipher the market’s complex rhythms. With features ranging from ProPicks AI and InvestingPro Fair Value to an Advanced Stock Screener and insights into the investment strategies of billionaire investors like Warren Buffett, Michael Burry, and George Soros, InvestingPro offers a comprehensive toolkit for those looking to outpace market volatilities.

As we navigate through these tempestuous times in global financial markets, let it be a reminder of the dual nature of investment, embodying both opportunity and risk. The insights and tools provided aim to equip investors with a more nuanced understanding of the market dynamics at play, yet the responsibility of investment decisions and their subsequent risks rest solely upon the individual investor. Lastly, it’s crucial to acknowledge that this discussion does not constitute investment advice but rather serves as a navigational aid in the complex world of finance.