The financial markets are in a phase of adjustment, manifesting in a series of consolidations which provoke the question: are we observing a topping out of the market? On Thursday, despite a temporary retraction, stock prices moved forward, with the S&P 500 closing with a modest gain of 0.38%. This rally extends the pattern of short-term fluctuations observed in recent times. However, in the hours of early trading, the S&P 500 witnessed a decline against the backdrop of escalating tensions between Iran and Israel. Despite this, the market managed to recover a significant portion of its losses later on.

As far as investor mood is concerned, there appears to be an uptick in optimism. This sentiment is supported by the findings from Wednesday’s AAII (American Association of Individual Investors) Investor Sentiment Survey, which noted an increase in bullish outlook with 36.7% of individual investors showing a positive outlook towards the market, compared to 33.6% expressing a bearish perspective.

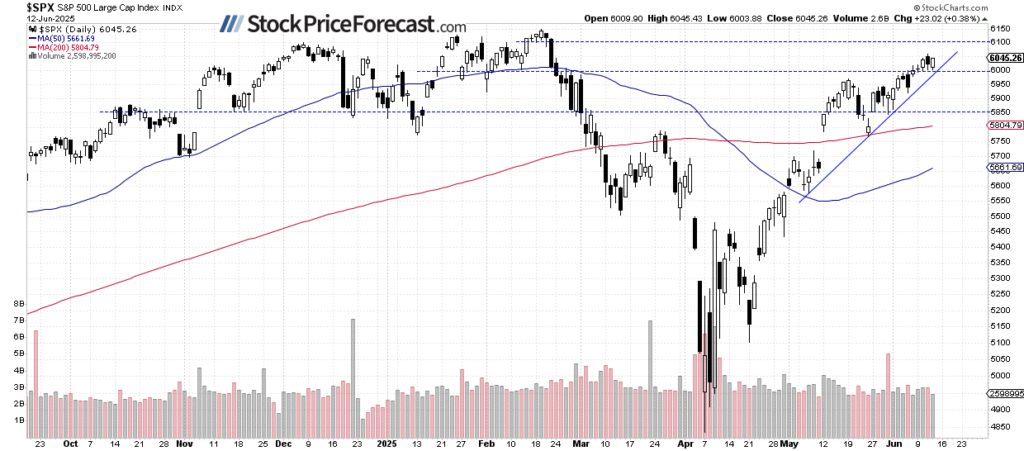

Remarkably, the S&P 500 has solidified its standing above the 6,000 mark, a significant benchmark for the index. This sustained consolidation brings to light the resilience of the market despite the looming uncertainties.

Shifting our focus to the Nasdaq 100, it experienced a slight decline of 0.24% on Thursday but opened 0.7% lower in today’s trading. The fluctuations in this index are particularly influenced by the developments in the Middle East, suggesting a market that is highly responsive to global geopolitical events. Despite the initial setback, the index recovered from its overnight lows, which could be interpreted as a sign of underlying market strength. The support and resistance levels for Nasdaq 100 are currently pegged at 21,700 and 22,000-22,200, respectively.

In the realm of market indicators and volatility measures, the VIX, often referred to as the market’s “fear gauge,” offers insight into investor sentiment and market volatility. On Wednesday, the VIX reached a low of 16.23, indicating a decrease in fear among investors. However, it experienced a resurgence as stocks pulled back but stayed below the critical threshold of 20. Historically, a low VIX suggests complacency amongst investors, while a high VIX points to increased volatility and potentially a market downturn. The nuances of VIX levels provide a complex portrait of market dynamics and investor behaviour.

Turning our attention to S&P 500 futures, we see that they have managed to hover around the 6,000 level after recovering from an overnight low of approximately 5,928. This demonstrates the market’s resilience and its ability to bounce back from interim setbacks. The support and resistance levels are currently identified at 5,900-5,920 and 6,050, respectively, offering traders key thresholds to watch.

In conclusion, as we look towards the end of the week, the trading session on Friday is anticipated to carry a cautious tone, albeit with a sense of cautious optimism after the market’s rebound from its low points. Investors and market watchers are keenly awaiting key economic data releases scheduled for the morning, including the preliminary University of Michigan consumer sentiment index. Additionally, developments concerning the Middle East conflict are likely to continue influencing the market sentiment and trading actions.

To summarize, the financial markets are navigating through a period marked by moderate gains and heightened sensitivity to geopolitical developments. Although the S&P 500 has demonstrated resilience by maintaining its consolidation above the 6,000 level amidst adverse news, the path ahead is shrouded with uncertainties that warrant close observation. The trading patterns and investor sentiment surveys highlight a cautiously optimistic outlook, yet the unfolding geopolitical tensions and upcoming economic data releases hold significant sway over future market movements. In this complex puzzle of factors influencing the stock market, investors are tasked with deciphering the signals amid the noise, in their pursuit of making informed decisions in this ever-evolving landscape.

The is set to extend its consolidation: Is this a topping pattern?

Stock prices advanced on Thursday despite an initial pullback, with the S&P 500 closing 0.38% higher and extending its short-term fluctuations. However, this morning, the S&P 500 opened lower amid overnight news of the Iran-Israel conflict escalation. The market has since retraced a large part of its declines, however.

Investor sentiment has improved, as reflected in Wednesday’s AAII Investor Sentiment Survey, which reported that 36.7% of individual investors are bullish, while 33.6% are bearish.

The S&P 500 has extended its consolidation above the 6,000 level.

Nasdaq 100 Pulls Back from 22,000

The closed 0.24% higher on Thursday, and today, it also opened 0.7% lower. Today’s trading is driven by Middle East developments, so the market is likely to be news-driven. However, the rebound from overnight lows may be considered a positive signal.

Support is around 21,700, while resistance remains at 22,000-22,200.

VIX Remains Below 20

The (VIX) fell to a local low of 16.23 on Wednesday, indicating reduced investor fear. Yesterday, it rebounded as stocks pulled back, but remained below the 20 level.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 Futures: Still Around 6,000

This morning, the contract rebounded from its overnight low of around 5,928, currently trading near the 6,000 level. It continues to fluctuate following its May advances. Support remains around 5,900-5,920, while resistance is at 6,050, among others.

Conclusion

Friday’s trading session is likely to remain on a negative note. However, sentiment has improved after the market rebounded from overnight lows. Investors will be waiting for key economic data this morning – the preliminary University of Michigan reading along with University of Michigan . The market will also be paying attention to news concerning the Middle East conflict.

Here’s the breakdown:

- The S&P 500 opened lower due to Middle East crisis news.

- There are no clear bearish signals yet, but a deeper downward correction is not out of the question at some point.