Prior to the commencement of this week, I had not once engaged in trading any commodities, much less any metals. This changed dramatically over the preceding weekend when I made the decision to venture into the trading of what many might consider a “laggard metal”. Intrigued by its potential, I initiated my foray into this market on a Monday.

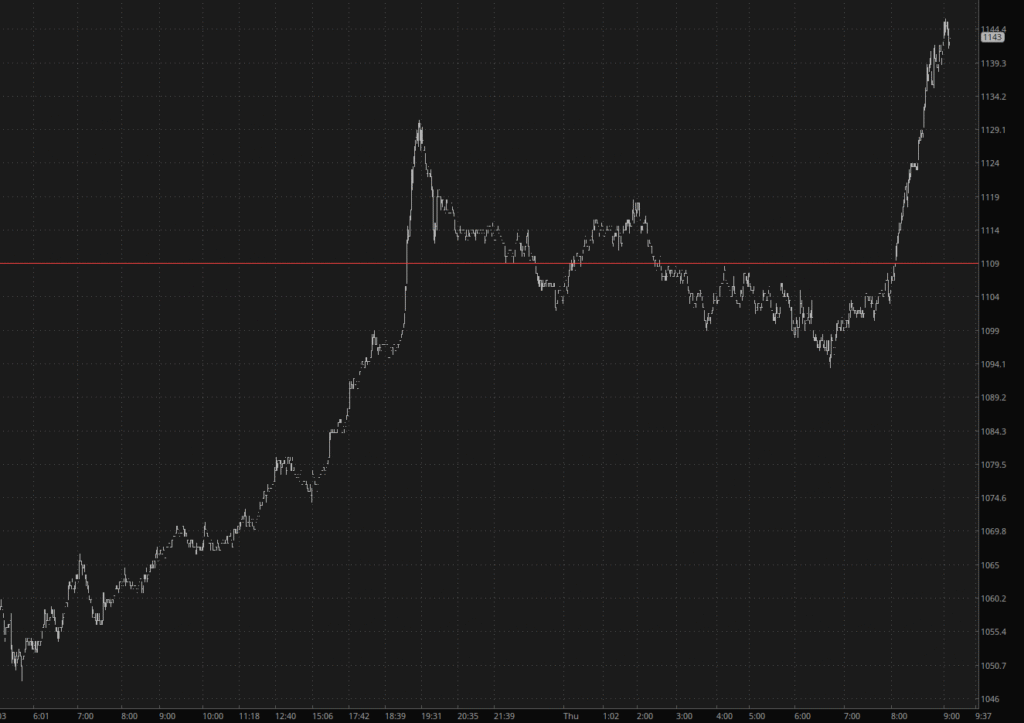

Despite being a newcomer to commodity trading, I found myself embroiled in a wave of emotions and strategies at an accelerated pace. Only yesterday morning, I encountered my first test of resolve as the value of the metal began to decline. The impulse to cut my losses and exit the trade was strong, but upon a closer examination of the market indicators and charts, I resolved not only to hold onto my position but to significantly increase it, embracing a substantial margin to acquire even more of this metal. Fortunately, this decision was rewarded when the value of the metal surged higher later that day. It underwent a minor retraction overnight but resumed its upward trajectory soon after.

As of this morning, the boldness of my actions had resulted in a markedly leveraged position. Yet, the fruits of this strategy were apparent: I had managed to augment the value of my overall account by 20% in a mere 24-hour period. Conscious of the risks associated with such high levels of leverage, I made the prudent decision to reduce my exposure, scaling back from nearly 300% to a more manageable 143%.

While still optimistic about the future prospects of this particular metal, labeled herein as “PALL”, I elected to secure some profits, acknowledging the extent to which I had pushed the envelope of risk.

This scenario mirrored a similar trend observed with another metal a month prior. Despite a prolonged period of stagnation, where it seemed to languish without direction even as its counterpart metals flourished, it eventually experienced a dramatic upswing. Thus, while gold and platinum were basking in the glow of their success, palladium remained overlooked until very recently, when it finally began to demonstrate signs of vitality. My fortuitous timing in executing my trades could not have been better aligned with these market dynamics.

Turning our attention to the trading instrument I utilized for this venture, “PALL”, it is encouraging to note the significant increase in trading volume over the past month, alongside its appreciating price. This suggests a growing interest and bullish sentiment among investors concerning palladium.

Moreover, when examining the performance of palladium relative to the U.S. dollar, a compelling picture emerges. Not only is there a solid foundation being established, but there also appears to be a cyclical pattern, with intervals of approximately eight years separating the phases of accumulation, or ‘bases’, as they are often referred to in trading parlance.

To summarise, while I remain heavily invested in palladium, I have taken steps to moderate the level of my commitment. This adjustment has been driven by a desire for greater peace of mind and to ensure that my trading practices remain sustainable in the long term. As I finalize this account, it’s noteworthy that while the markets for other metals remain unchanged, palladium futures have surged by 7%, highlighting a remarkable period of catch-up in its valuation.

The narrative of my trading journey with palladium is emblematic of the broader dynamics at play within the commodities market. It underscores the importance of both vigilance and audacity in trading strategies. The fluctuations in the value of metals like palladium reveal much about market sentiment, geopolitical influences, and the complex interplay between different commodities. For investors and traders, these movements offer both risk and opportunity, demanding a keen understanding of market trends and a willingness to act decisively when the moment is right. In this context, palladium’s recent performance is not just a personal win but a case study in seizing opportunity amidst uncertainty.