As we approach the midpoint of the year 2025, an intriguing trend is unfolding in the financial markets, particularly within the realm of cryptocurrency. Despite the unpredictable global market climate and the tense geopolitical atmosphere, Bitcoin, the leading cryptocurrency, has demonstrated remarkable resilience. After achieving an all-time high of $111,980 in May, Bitcoin is anticipated to conclude the second quarter of 2025 on a strong note, boasting an impressive return of nearly 30%.

Over the past couple of months, Bitcoin has maintained its position within the $100,000 to $110,000 trading range. This period has been characterized by subdued trading volumes across both spot and futures markets, indicative of a cautious stance from individual investors. Such caution has somewhat tapered the potential for a sharp upward trajectory. Nonetheless, the outlook for Bitcoin remains decidedly optimistic, evident from its 15% appreciation since the year’s outset.

A deep dive into Bitcoin’s trading volume reveals a stark contrast to the fevered activity witnessed during the 2021-2022 bull markets. Presently, the spot trading volume stands at a modest $7.7 billion, as per data from Glassnode. This reduced activity hints at a reticence among retail investors to re-enter the market in significant numbers. Conversely, a steadfast commitment is observed among long-term stakeholders, who continue to accumulate Bitcoin. An intriguing statistic in this regard is the soaring percentage of illiquid supply—Bitcoin securely held in wallets showing minimal to no inclination towards selling—now constituting 75% of the total supply. This constrained supply scenario acts as a bulwark against any notable price depreciation.

In parallel, US-listed spot Bitcoin ETFs have seen more than $2.9 billion in net inflows over the past 13 trading days, with iShares Bitcoin Trust ETF leading the pack. While these inflows predominantly emanate from institutional and over-the-counter (OTC) segments, hence not directly influencing the spot market, they unequivocally signify a sustained long-term confidence in Bitcoin.

Furthermore, the SEC’s affirmative approach towards ETF applications associated with other cryptocurrencies, including Ethereum, Ripple, Litecoin, and Bitcoin Cash, potentially heralds an era of broader market expansion.

In another quarter of the market, attention is riveted on the Futures and Options (F&O) segment, particularly in light of Deribit’s revelation of the year’s most substantial Bitcoin options expiry scheduled for June 28—encompassing contracts worth $15 billion. This expiry underlines a ‘max pain point’ at $102,000, where the most substantial losses may manifest. Nevertheless, the decline in implied volatility to below 38, a nadir since October 2023, posits a market expectation of subdued price fluctuations in the near term. Additionally, a slight downturn in open interest alongside a put-to-call ratio of 0.73 suggests a tendency towards a mildly bearish outlook, though not indicative of significant price declines.

Looking ahead to the third quarter, historical data suggests Bitcoin’s performance tends to be less robust during this period. Market participants are closely monitoring the Federal Reserve’s policy direction in July, as it significantly influences Bitcoin’s pricing dynamics. While the market perceives a slim probability of a rate cut in July, expectations for such a move in September are high, nearing 90%. Such a development could catalyze increased market volatility as the quarter concludes.

A reduction in Federal Reserve rates could serve as a catalyst, potentially enhancing risk appetite by conveying a vote of confidence in the economic backdrop. This scenario is further bolstered by factors such as escalated global liquidity, notably from China, and a depreciating US dollar, both of which are supportive of demand for cryptocurrencies with finite supplies.

Yet, the landscape is not devoid of risks. Recent geopolitical developments, including the ceasefire between Israel and Iran, have temporarily assuaged concerns, but attention is now reverting to escalating trade tensions. Speculations of renewed tariff hikes by US President Trump post-July 9 could stoke market volatility. Additionally, a backdrop of heightened geopolitical tensions and a surge in safe-haven demand could exert downward pressure on Bitcoin prices, should investors pivot towards a more risk-averse stance.

Despite the weak correlation between Bitcoin and the US dollar index, recent declines in the latter are viewed with cautious optimism for Bitcoin. However, it’s noteworthy that a weakened dollar does not uniformly translate to higher Bitcoin prices. Nonetheless, rising commodity prices and improving conditions in emerging markets might bolster demand for riskier assets such as Bitcoin.

In conclusion, Bitcoin trades within robust support levels, maintaining stability amidst low spot trading activity, bolstered by continued inflows into Bitcoin ETFs and unwavering buying from long-term holders. For the onset of a new rally, an uptick in demand from individual investors is requisite, potentially triggered by interest rate cuts and advancements on trade agreements, which would likely ameliorate market sentiment and risk appetite.

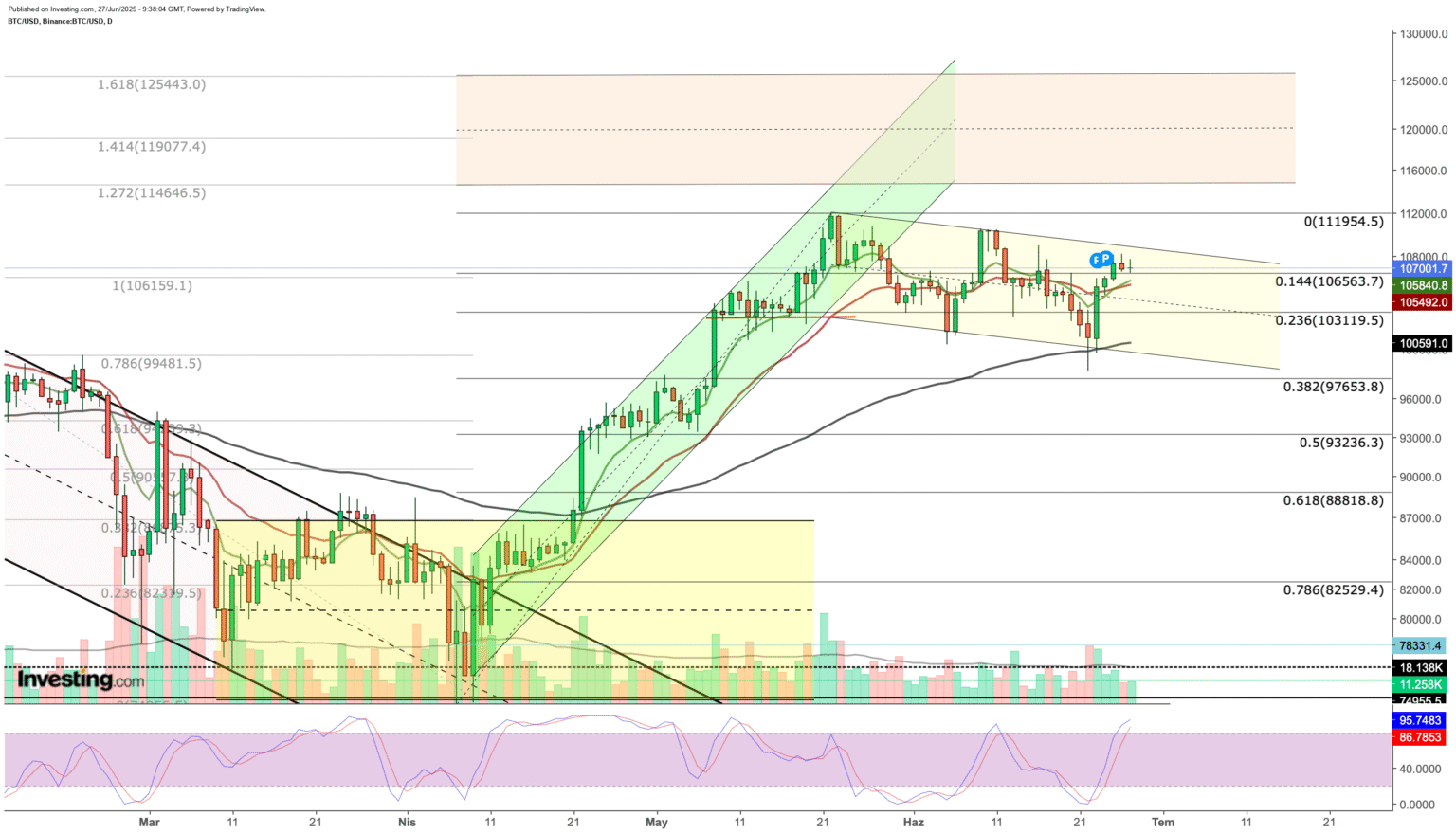

In terms of technical analysis, despite recent fluctuations, Bitcoin has demonstrated resilience by maintaining its foothold above the critical $100,000 threshold. Present momentum indicates attempts to transform the $106,000 resistance zone into a support level. Should Bitcoin sustain above this level, it may well be poised for another ascent towards recent peaks. The trajectory of Bitcoin appears to be within a downward-sloping channel, marked by successive lower highs and lows over the previous month. A breakout above $110,000 could signify the commencement of a new bullish trend.

As the landscape of cryptocurrency continues to evolve, staying abreast of market trends and underlying triggers is imperative for both novice and seasoned investors. Tools and platforms such as InvestingPro offer invaluable insights and analytics, empowering investors to navigate the complexities of the market with confidence and acumen.