In the realm of fiscal policy, the maxim that “more is not always better” particularly holds true when examining the scale of government debt. Recent measures, including the introduction of tariffs and efforts by the Department of Government Efficiency (DOGE), are strategies put forth in an attempt to mitigate the financial gap introduced by President Trump’s recent legislative activities. However, despite these efforts, the United States is bracing for a period of diminished economic growth, with the national debt trajectory raising considerable alarm.

At the heart of the discussion is the fiscal policy direction under US President Donald Trump, marked notably by the One Big Beautiful Bill Act (OBBBA) alongside a series of new tariffs. These developments carry significant weight for the US’s federal deficit and the broader economic landscape. This article seeks to unpack the current financial state of the US, explore the anticipated outcomes of these policies, assess vulnerabilities to external shocks, and project the long-range outlook for government indebtedness.

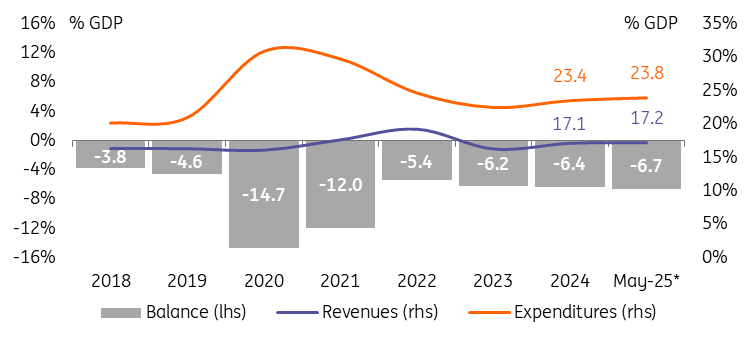

Starting from a precarious position, the US fiscal landscape shows the marks of an economy that has been grappling with disproportionate spending relative to its revenue generation. This imbalance was further exacerbated by the Covid-19 pandemic during 2020-22, a period that saw a spike in government borrowing. Currently, the federal deficit is hovering around 6.7% of GDP, with net government debt—which was a more manageable 35% of GDP two decades ago—poised to eclipse 100% of GDP within this fiscal year. Amidst these worrying signs, the loss of the US’s Triple A credit rating with major agencies such as S&P, Fitch, and as of recently, Moody’s, underscores the growing apprehension regarding fiscal sustainability.

A closer look at President Trump’s fiscal manoeuvres reveals that the One Big Beautiful Bill Act aims to prolong and broaden the substantial tax reductions enacted in 2017. According to projections by the Congressional Budget Office, this legislation is set to diminish tax revenues by approximately $3.7 trillion over the ensuing decade. Concurrently, the proposed slashes in spending will only recoup $1.3 trillion, thereby widening the primary deficit by an additional $2.4 trillion.

While at first glance, the OBBBA seems like a substantial fiscal indulgence, it’s important to recognize that the bulk of the bill merely extends pre-existing tax cuts set to expire. Thus, rather than injecting new vitality into the US economy, it merely prevents a downturn relative to the existing trajectory.

For fiscal conservatives, a silver lining exists in the form of tariffs introduced by President Trump, contributing additional tax revenue alongside “efficiency gains” touted by DOGE, albeit the latter’s contribution is modest, falling short of $200 billion. Nevertheless, while these measures offer some fiscal reprieve, they are unlikely to significantly narrow the persistent deficits or curtail the burgeoning debt, especially when considering inevitable increases in demography-related expenditures.

Furthermore, the policy blend currently being implemented risks stunting economic growth in the near term, prompting concerns that deficit and debt projections may skew too optimistic. The OBBBA, supplementing the 2017 Tax Cuts and Jobs Act with further tax reductions, juxtaposed against significant spending cuts in sectors like green investment and healthcare, constitutes a potential impediment to growth.

Tariffs, on the other hand, aim to foster domestic manufacturing, protect intellectual property, and enhance supply chain resilience, potentially bolstering long-term growth. However, their immediate effect will likely be an uptick in consumer prices and a squeeze on corporate profits, dampening household spending power and discouraging hiring and investment.

Predictions suggest a deceleration of US economic growth from 2.5% in 2024 to an average of 1.5% during 2025-26, a forecast that falls below official projections and paints a grim picture of the fiscal health in the years to come.

This discussion ventures beyond financial metrics, touching on the structural and systemic challenges faced in aligning expenditures with revenues while navigating geopolitical tensions, demographic shifts, and the evolving landscape of global finance. With discretionary spending at a historical low and mandatory spending on an upward trajectory, the fiscal imbalance is a complex maze of policy and demographic pressures.

In synthesising these considerations, it becomes evident that the fiscal initiatives under the Trump administration, while aimed at addressing short-term deficits, raise serious questions about the sustainability of US public finances. Given the looming challenges, a nuanced approach balancing austerity with strategic investment and efficiency gains appears crucial in steering the US away from a precarious fiscal precipice.