In recent developments within the financial world, the journey of gold as an asset has experienced significant turbulence. Amidst a global environment ripe with market-altering events, where conflicts have exacerbated volatility and investor uncertainty, gold’s position has been particularly intriguing to observe. Traditionally seen as a safe-haven asset, gold’s recent movements have deviated from expectations, given the broader market dynamics.

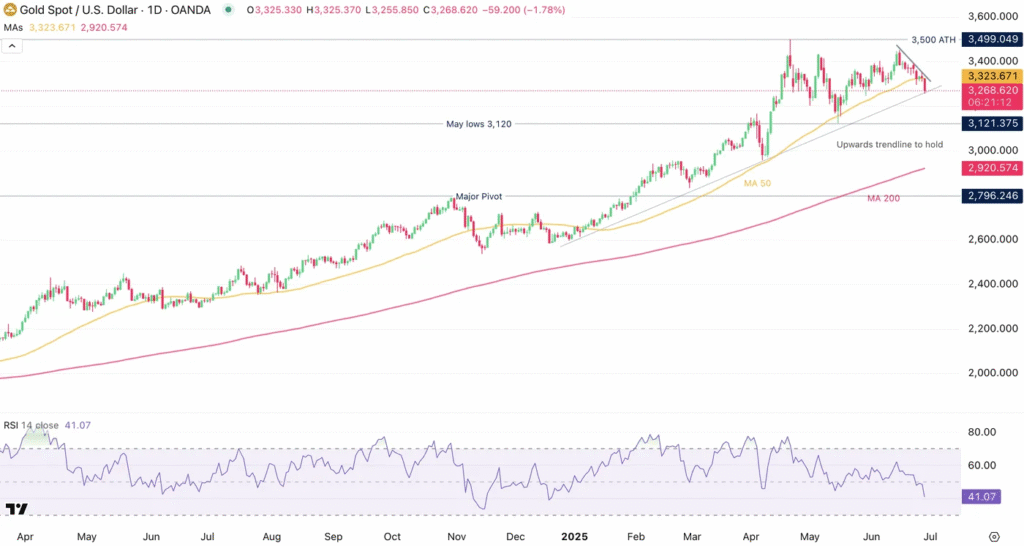

The overarching sentiment this past week, despite widespread market optimism, has visibly impacted gold’s performance. Notably, it has struggled to re-ascend to its previously established peaks, such as the all-time high of $3,500. This inability to reclaim its zenith, especially in a period marked by global unrest suggestive of a conducive environment for gold’s ascent, hints at underlying weaknesses in the precious metal’s current trend.

Market behavior during tumultuous times can often seem paradoxical. Various factors and trading biases intertwine, rendering the market’s reaction complex and sometimes inscrutable. A noteworthy observation is that a market’s failure to set new benchmarks – whether highs or lows – despite substantial fundamental provocations, often signals a forthcoming shift in the prevailing momentum, hinting at potential reversal points.

Historically, such patterns have manifested vividly in different asset classes. For instance, the equities market in 2022 witnessed a significant downturn, ultimately reaching its nadir coinciding with pivotal litigation news surrounding Meta (formerly known as Facebook). Despite looming concerns over rising interest rates and their potential to destabilize the robust U.S. economy, equities managed to rebound, steering clear of further losses and subsequently embarking on an extended recovery phase, further buoyed by the burgeoning interest in Artificial Intelligence.

Focusing on gold’s recent trajectory, its peak was last recorded at $3,450 – a figure slightly shy of its historic high – following a series of tentative bullish movements. However, these gains were quickly relinquished as concerns regarding global conflict began to wane, illustrating the metal’s sensitivity to geopolitical sentiments. Presently, gold finds itself trading significantly below this peak, reeling back to price levels last observed towards the end of May.

This scenario raises imperative questions regarding gold’s immediate future and the driving factors at play. The scenario beckons bulls to muster considerable strength to counter the ongoing correction and steer the precious metal back towards a path of appreciation.

As we delve deeper into the technical analysis of gold across multiple timeframes, a fascinating picture emerges. On the daily chart, for instance, gold has entered a corrective phase characterized by a succession of minor pullbacks, culminating in a discernible selling pressure in today’s trade. This downward trend has been accentuated by the breach below the 50-Day Moving Average and critical supportive pivots, highlighted in previous analytical forecasts.

The 4-hour chart echoes a similar sentiment, with the Relative Strength Index (RSI) indicating oversold conditions. A notable observation is the formation of a ‘doji’ candlestick pattern, signifying market indecision at a critical juncture where daily and 4-hour timeframes converge. Meanwhile, bearish indicators, such as the 20-Period Moving Average crossing below the 200-Period Moving Average, suggest a struggle to maintain momentum below pivotal thresholds.

Transitioning to the hourly chart, gold’s price action reflects a descending channel, with recent dips encountering support at strategically significant levels. The immediate landscape is marked by a consolidation phase, with potential for a rebound if the prevailing bear channel is breached.

In the broader context of financial markets, including equity indices, and upcoming pivotal events such as the Bank Stress Test results, investors and traders alike are keenly monitoring these developments. A negative outcome from the stress test could potentially bolster demand for gold, underscoring the intricate relationship between market events and asset performance.

In conclusion, as gold navigates through a period of adjustment, the amalgamation of technical indicators and broader market sentiment will be critical in determining its future trajectory. Amidst the flux of global events and market dynamics, the precious metal’s journey offers a compelling narrative on the interplay between geopolitical developments, investor sentiment, and asset valuation. In these turbulent times, the prudent observation and thoughtful analysis of these factors will be paramount for those looking to navigate the complexities of the financial markets effectively.