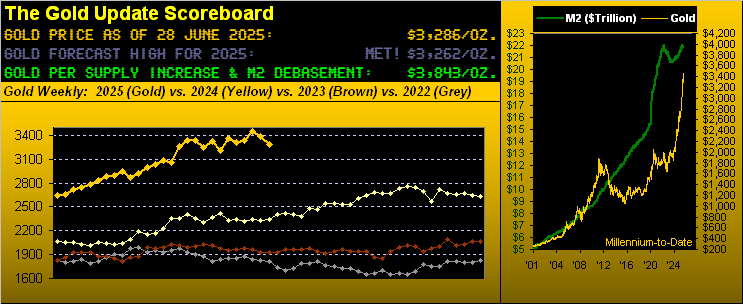

In the intricate world of financial markets, the glimmer of gold always offers a captivating story, especially when it navigates through its ups and downs. Only a mere seven days prior, excitement buzzed around the possibility of gold making a pivotal shift in its weekly parabolic trend from Short to Long—a move that narrowly missed realization by a mere four points. Despite hopeful anticipation, the price of gold failed to ascend towards the newly adjusted flip level of 3476, thus marking the completion of its seventh consecutive week following a Short trend. This occurred despite the price of gold concluding the week at 3286, marginally higher than its starting point at 3220 on the 19th of May.

As the halfway point of 2025 approaches, gold has etched a notable narrative with its second instance of consecutive weekly declines, a scenario only witnessed once before in this calendar year. Over the last ten weeks, gold has experienced a dip on six occasions, encapsulating a period of fluctuating fortunes. By the completion of the 26th week of 2025, gold stood at 3286, slightly above our forecasted high of 3262 for the year—though this position is not necessarily an indication of support but rather a mark of its lowest weekly settlement in the past six weeks.

A deeper dive into the analytics reveals a looming concern, as indicated by a negative weekly moving average convergence divergence (MACD) crossover. This technical indicator, far more visible in the trading and investing communities than our deMeadville analytics, suggests a growing bearishness in gold’s trajectory. Historically, gold has managed to maintain an upward journey despite occasional negative MACD crossovers, with the average price drop preceding a positive swing standing at a negligible 52 points. However, the recent crossover emerges from a pronouncedly higher level, eliciting caution reminiscent of David Cassidy’s prophetic words from 1975: “The Higher They Climb, The Harder They Fall.”

Turning our gaze towards the daily market behaviour of gold within the broader context of the BEGOS Markets over the last 21 trading days reveals an interesting trend. The consistency of day-to-day regression trends, depicted by baby blue dots, shows a notable deviation. Seven of these markets exhibit positive trends, with gold being the sole exception. Its trendline has recently shifted to negative, accompanied by a sharp decline of the “Baby Blues” — a stark reminder to heed the direction of these trends.

Gold’s magnanimity transcends currency biases, a fact accentuated by its performance relative to the Euro and Swiss Franc. Despite global currency fluctuations, gold maintains its stoic value, unaffected by the shifting landscapes of fiat currency markets. The U.S. dollar, for instance, has been the underdog in the fiats’ “Ugly Dog Contest” this year.

The Federal Reserve’s approach to monetary policy, particularly its decision-making in relation to interest rates, further complicates the narrative against the backdrop of May’s hotter-than-expected “Fed-favoured” inflation statistics and a seemingly unacknowledged economic downturn. The ensuing economic conditions, juxtaposed with an S&P 500 binging on perceived value, spotlight the dissonance between marked-to-market wealth and the stark realities of an overextended market capitalization.

Gold’s year-over-year performance, when compared to top-tier precious metal equities and exchange-traded funds, reveals a complex landscape of gains and leverage plays. Notably, Agnico Eagle Mines leads the charge with a remarkable 79% increase, showcasing the unique volatility and potential of precious metal investments. This comparison draws attention to the nuanced disparities and opportunities within the sector, highlighting gold’s inherent value and its relation to broader market dynamics.

Furthermore, market profiles for both gold and silver indicate a prevailing sentiment of resistance, with the gold/silver ratio pointing towards an undervaluation of silver relative to gold. This ratio, if adjusted to its historical average, suggests a significant upside for silver, painting a picture of unexplored potential within the precious metals market.

As we delve deeper into the intricacies of gold’s market structure from 2010 to the present, a pattern of resistance emerges around the 3400 level, underscoring the challenges of sustaining high price points amidst fluctuating market conditions.

In summary, as we advance through the year 2025, the interplay of geopolitical tensions, market dynamics, and economic indicators will be crucial in shaping the trajectory of gold prices. Despite the potential hurdles, the enduring allure of gold as a safe haven and a hedge against uncertainty remains unshaken. For those looking to navigate the complexities of the financial markets, the timeless wisdom of buying the dip in gold prices may well serve as a prudent strategy to maintain financial health amidst the inevitable ebbs and flows of economic cycles.

As we close this chapter, it’s worth noting the peculiarity of the financial world where, despite evident challenges, the pursuit of wealth and stability through precious metals like gold continues to inspire both caution and optimism among investors and traders alike. Cheers to the journey ahead, as we navigate these golden opportunities with insight and anticipation.