The reliability of the United States dollar in international markets is currently wavering, with the US Dollar Index (DXY) teetering around a figure of 97. This is perilously near to its most diminished position in the last three years. The internal political ambivalences in conjunction with hints at forthcoming interventions in monetary policy play a pivotal role in this downturn. Specifically, President Donald Trump’s escalating pressures on the Federal Reserve (Fed), coupled with his pronounced preference for Jerome Powell’s replacement with a chair of a more dovish stance, have sparked trepidations regarding the autonomy of the Fed in market circles.

### Political Pressures and the Fed’s Independence

President Trump’s commentary on Fox News—wherein he advocated for the Federal Reserve to lower its policy rate to between 1% and 2%, and his outspoken intention to replace Powell—has intensified speculation around a monetary policy driven by political motives. The augmentation in speculation came on the back of reports suggesting Trump might soon declare Powell’s successor, thereby potentially accelerating the process. This situation underscores the concerns regarding the Fed’s independence, portraying it as a contributing element to the medium-term structural weakening of the dollar.

The financial markets are also calibrating their projections for the Fed’s upcoming actions against this backdrop. Chair Powell’s testament before Congress, which hinted at the possibility of a rate reduction if inflation doesn’t witness a significant rise over the summer, was interpreted as a dovish signal by the markets. Market anticipations indicate a heightened probability (91.5%) of a 25 basis point reduction come September. Although some market analysts deem these market reactions as overly anticipatory, the pressures bearing down on the dollar remain constant.

### The Impact of Trump’s Fiscal Policies

Another considerable factor undermining the dollar’s steadfastness is the apprehension surrounding the economic policies endorsed by the Trump administration. Projections by the Congressional Budget Office (CBO) suggest that Trump’s $4.2 trillion tax reduction and expenditure package, recently sanctioned by the Senate, could expand the budget deficit by $3.3 trillion between 2025 and 2034. This anticipated swelling in the budget deficit could compromise the U.S.’s debt perspective and, by extension, impact the long-standing status of the dollar as a reserve currency.

Adding fuel to the fire, Trump’s antagonistic stance towards Iran and the rekindled trade frictions with Canada concerning the digital services tax have been instrumental in diminishing global risk appetite and curtailing demands for the dollar. Even as Canada has rescinded the tax and re-engaged in dialogues with the U.S. and China, the looming spectre of new tariffs post-July 9 reintroduces marketplace apprehensions.

From a macroeconomic viewpoint, May data in the U.S. surpassed expectations with a 2.7% year-over-year increase. This prompted an uptick in bond yields albeit sustaining the view that inflation expectations remain stable. This perspective is further bolstered by the drop in inflation expectations as per the University of Michigan.

However, the focal point this week pivots to the employment report. A potential slackening in the labour market, as anticipated, might prompt the Fed to expedite moving towards a rate cut. Conversely, should the optimism hovering over dovish expectations dissipate, it may result in boosted volatility in the week.

### DXY’s Technical Trajectory

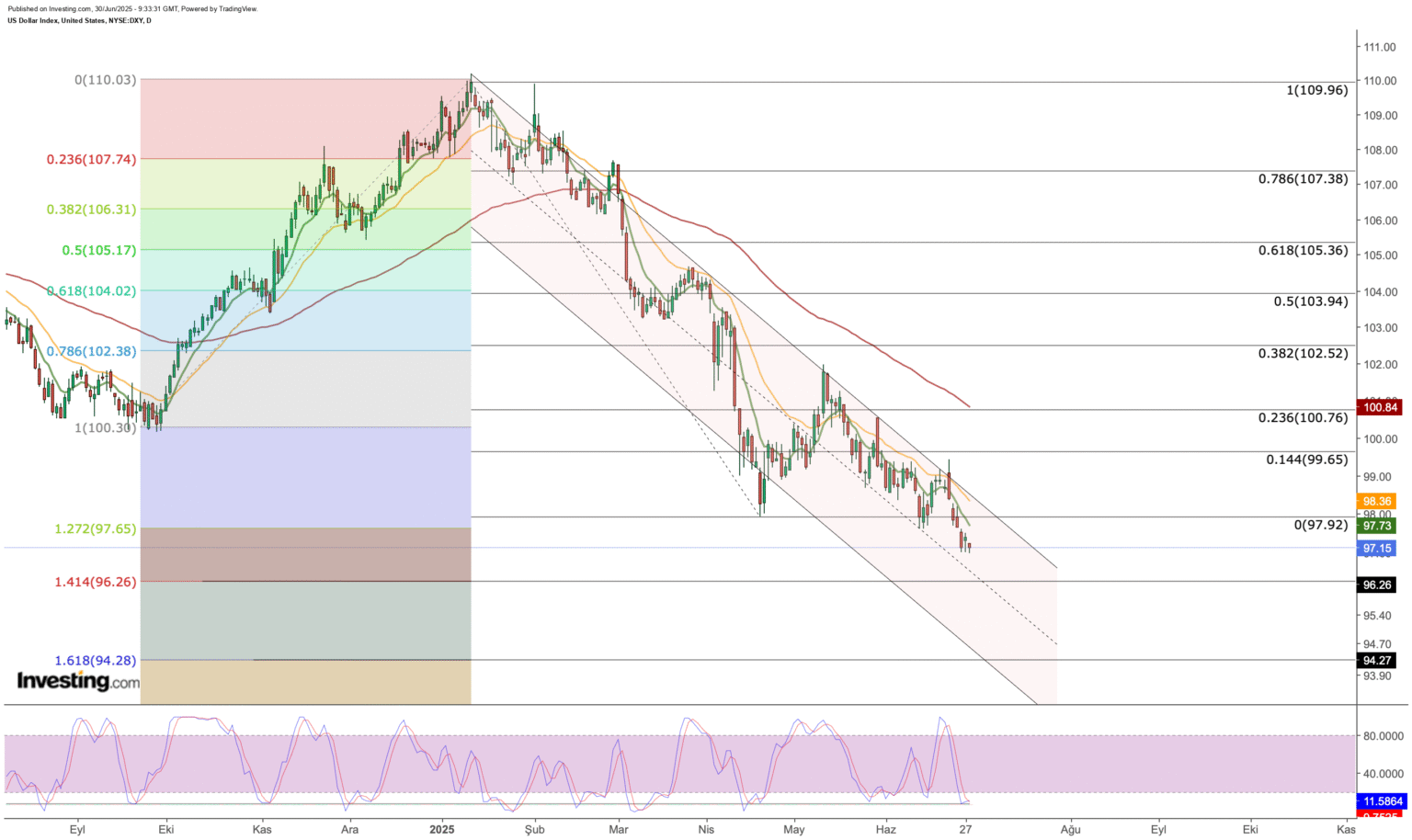

Technical analysis reveals that the DXY has recently dipped to as low as 97, tumbling below a critical support level around the Fibonacci 1.272 extension at approximately 97.65 amidst its decline. This signifies a move into a critical Fibonacci expansion zone. Should the support level at 97 buckle amidst this week’s fluctuations, it might see the index descend toward the 96 mark. Conversely, should the 97 mark hold steadfast, 97.65 could emerge as the next immediate resistance point.

Trump’s vociferous critique of the Fed, bold fiscal policies fostering a widened budget deficit, and the persistent uncertainty in trade dynamics continue to exert structural and short-term pressures on the dollar. The prevailing expectation of a rate cut by the Fed in September underscores the downward pressure on the DXY. In the ensuing period, employment data, inflation metrics, and Trump’s pronouncements post-July 9 will be crucial determinants of the index’s trajectory.

In summary, while the DXY confronts short-term pressures, the Fed’s policy-making approach and macroeconomic data will be decisive in carving its medium-term direction. The unfolding economic landscape presents a complex array of challenges and opportunities, underscoring the criticality of astute, informed decision-making in navigating the current financial milieu.