As we draw the curtain on the first half of 2025, financial markets are bustling with activity, manoeuvring through the intricacies of the concluding days of June. This period has been earmarked by a significant trend of divestment, primarily fueled by a retraction of investments predominantly centered around the United States. These investment patterns had flourished over an extensive period of fifteen years, only to experience a collective reversal in current circumstances.

The year kicked off under the turbulent tenure of President Donald Trump, setting a complex backdrop for investors worldwide. A palpable shift in strategy is observable amongst market players as they endeavour to diminish their fiscal engagements with the United States. Driving this retreat are multifaceted concerns that loom over the US economy, notably the sustainability of its escalating deficits, a reduction in tax revenues affecting the national treasury, and the erratic nature of Trump’s tariff strategies, casting long shadows of unpredictability.

Delving deeper into the macroeconomic reverberations affecting the US Dollar, several pressing inquiries emerge, attempting to decipher the forthcoming trajectory of economic policies and their implications.

The Ambiguity Surrounding Tariffs

The clock ticks towards the impending deadline for the implementation of tariffs, a development occurring in the backdrop of an active US-UK Trade Deal. With July 9th on the horizon, the financial community is rife with speculation—pondering if the ramifications of such a policy have already been absorbed by the market or if an era of heightened volatility is imminent.

Market’s Preparedness for Tariff Implementation

The potential enactment of tariffs introduces a scenario ripe for a classic “sell-the-news” response, perhaps even setting the stage for a resurgence in the US Dollar’s strength. However, should the market sentiment hold a sliver of hope for negotiation or dread the prospect of escalated outcomes, a reevaluation in the Foreign Exchange markets, with a specific focus on the Dollar, could be witnessed.

Optimism versus Pessimism: The Market’s Stance

The market’s reaction to upcoming developments hinges significantly on its dominant sentiment. An optimistic outlook may find itself blindsided by disappointments, potentially triggering a risk-averse response. Conversely, a market steeped in fear might find solace in unexpected positive developments.

Federal Reserve’s Rate Cut Timelines

The anticipation building around the Federal Reserve’s adjustments to interest rates leans towards a commencement in July, albeit with a prudent approach. The persistence of uncertainty, fueled by a lack of definitive data or clear communications from the Fed, contributes to ongoing volatility in the Forex market.

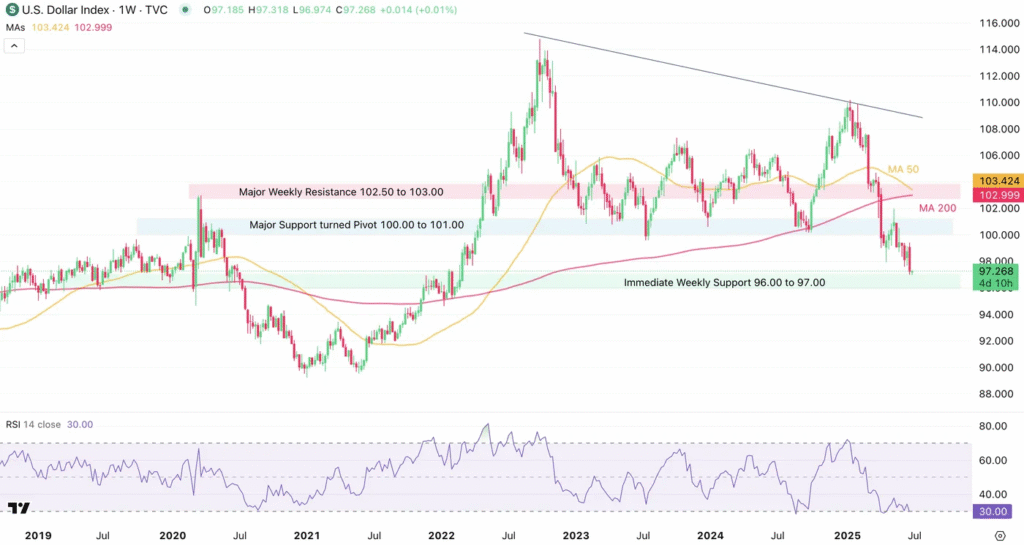

An exploration into the technical analysis of the Dollar Index, from longer-term weekly perspectives down to hourly movements, reveals insightful trends. Despite facing a significant retreat throughout the year and failing to recover in the May to June consolidation period, even amidst geopolitical tensions, demand for the USD has seen a notable decline as stability returned to the Middle East.

Current valuations are testing immediate weekly supports that have historically played a stabilizing role for the Dollar. The looming possibility of a “Death-Cross” formation between weekly moving averages alongside indicators dipping into oversold territories underscores the pivotal moment faced by the Dollar.

A close examination of the daily and hourly charts evinces the Dollar’s trajectory within a descending channel, hinting at sellers maintaining control but requiring further catalysts to breach significant support zones. The nuances of these movements, coupled with anticipated releases and geopolitical dynamics, paint a complex picture of the Dollar’s stance in the global financial landscape.

As we venture forward, the intrigue surrounding macroeconomic policies, their implementation, and the reactive nuances of Forex markets highlight the intricate dance between fiscal strategies and market movements. In such times of uncertainty, a keen eye on developments, coupled with a robust understanding of underlying trends, remains the cornerstone of navigating the tumultuous waters of international finance. Safe trading endeavours as we move into the latter half of 2025, embarking on a journey fraught with challenges but also ripe with opportunities for the astute observer.