The ever-evolving landscape of the financial markets can often appear as complex and unpredictable as forecasting the weather, involving a myriad of variables and stochastic processes that necessitate continual adaptation and analysis. In this context, the use of technical analysis methodologies, such as the Elliott Wave (EW) Principle, has become a valuable tool for investors seeking to navigate the intricate patterns of market movement. Our latest exploration delves into the semiconductor sector, particularly examining the Philadelphia Semiconductor Index (SOX), through the lens of the EW Principle, aiming to present an insightful update on its trajectory based on recent market activities.

Historically, the semiconductor industry has been a critical driver of technological innovation and economic growth, powering everything from computers and smartphones to advanced medical devices and automotive electronics. The sector’s importance has only magnified in the modern digital age, making its market performance a subject of keen interest for investors and analysts alike.

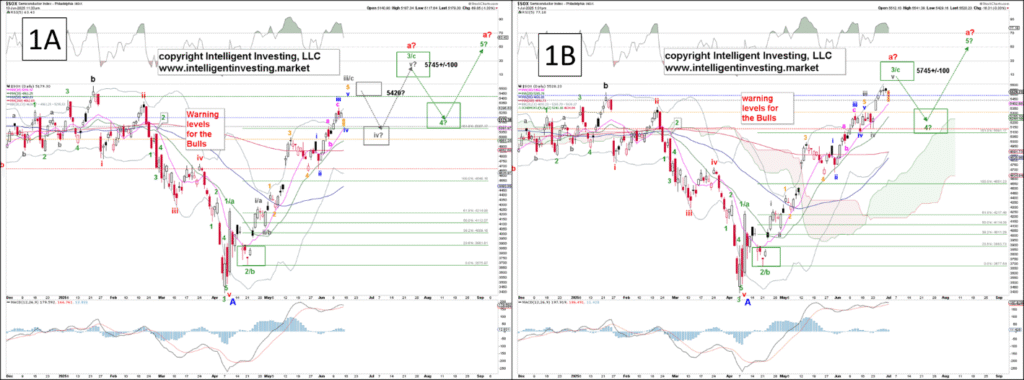

In our previous analysis dated June 13th, we applied the EW Principle to forecast the short-term movements of the SOX. According to our predictions, the index was anticipated to reach a local peak around the vicinity of $5420, which would be followed by a minor correction—referred to as the fourth wave—dropping to approximately $5050±50. Subsequently, a fifth wave was expected to propel the index further upward, aiming for a target zone around $5745±100. This pattern of movement, characterized by a sequence of “up->down->up,” is quintessential of the Elliott Wave framework, providing structured foresight into the probable trends of financial markets.

Our forecast closely mirrored the ensuing market activities. By June 17, the SOX had climbed to a high of $5311, demonstrating a minor deviation from the anticipated peak but remaining within a marginal error range. The subsequent period witnessed a decline to $5140 by June 23, aligning with our prediction of a corrective fourth wave. The index then rallied, reaching $5588 on June 27, thus adhering to our forecasted pattern and showcasing the robustness of the Elliott Wave methodology in capturing the dynamism of market trends.

In essence, our analysis harnesses a blend of technical indicators, moving averages, and the EW Principle, offering a multidimensional view of market dynamics. Our approach entails a vigilant tracking of the index’s performance, adjusting our warning levels—coloured orange, blue, grey, and red—to signal shifts in market trends. These levels are meticulously calibrated as the market evolves, ensuring that our predictions remain as accurate and timely as possible. For instance, a sustained price above the orange level typically indicates no immediate change in trend direction, while breaching the red level would confirm a local peak or trough, necessitating a reassessment of our forecasts.

Looking ahead, our current analysis suggests that the SOX is poised to complete its third wave in the green sequence, targeting the ideal zone of $5745±100 in the near term. The subsequent market movements will be crucial in determining whether we will witness the completion of the anticipated green wave sequence or if the market has already culminated its larger upward trajectory since the initial bounce observed in early April. The Elliott Wave Principle, with its emphasis on wave patterns and key price levels, provides us with a structured framework to anticipate these developments.

In conclusion, the application of the Elliott Wave Principle to financial markets, exemplified by our analysis of the SOX, offers insightful perspectives into the underlying structure of market movements. While predicting market trends is inherently fraught with uncertainty, akin to forecasting the weather, methodologies such as EW provide a coherent framework for navigating the complexities of the financial landscapes. As we continue to monitor the semiconductor index closely, we remain committed to providing updates, leveraging our technical analysis to guide investors through the intricacies of market fluctuations. The semiconductor sector, with its pivotal role in powering technological progress, continues to offer a fascinating lens through which to examine the dynamics of global markets, underscoring the importance of sophisticated analytical tools in deciphering its future trajectory.