Understanding the Intricacies of Central Banks’ Response to Unruly Bond Yields: A Comprehensive Guide

In recent times, the financial landscapes have been witnessing a series of tumultuous events, notably the flirtation of bond yields with alarming levels. An instance of this was observed a few weeks ago when bond yields nearly breached the 5% mark. This event led to the Federal Reserve’s representative, Collins, affirming in an interview the institution’s preparedness to stabilize the markets. Such a statement underscores an intricate strategy involving ‘injecting liquidity’ into the system, through mechanisms like Large Scale Asset Purchase operations or Quantitative Easing (QE), to stabilisze the bond market.

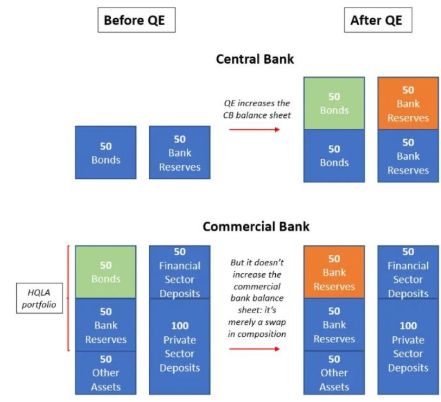

To demystify how central banks like the Federal Reserve manoeuvre to stabilize markets, one needs to grasp the fundamental operations they undertake. These banks essentially create bank reserves, colloquially termed as ‘liquidity’, when executing operations such as QE. The primary ambition behind these operations is to trigger what is known as the Portfolio Rebalancing Effect. But before delving into the mechanics of this effect, it’s crucial to understand its impact on the balance sheets of commercial banks.

Post the Global Financial Crisis (GFC), regulators imposed more stringent requirements upon banks to hold greater quantities of High-Quality Liquid Assets (HQLA) to counter potential depositor outflows effectively. Both bank reserves and bonds are classified as HQLA due to their liquidity prowess, enabling rapid conversion into cash to meet withdrawal demands. However, a preference exists within banks between holding reserves and bonds. Especially in scenarios where quantitative easing has significantly increased reserve volumes, the allure of bonds, offering higher returns and duration hedging attributes, becomes pronounced.

When central banks initiate QE by purchasing bonds from the market, this act removes these bonds from the financial ecosystem and replaces them with new reserves within the banking system. Faced with an accumulation of these lower-yielding reserves, banks are incentivised to alter the composition of their portfolios back towards bonds. This rebalancing kicks off with a preference for safer bonds, and as the quest for yields intensifies, bids for riskier bonds escalate.

This rebalancing strategy catalyses a virtuous cycle promoting lower volatility and a pervasive search for higher-yielding, riskier assets – illustrating the Portfolio Rebalancing Effect in action. Below is a succinct overview of this process:

1. Central banks, aiming to influence the market dynamics, expand their balance sheets by purchasing bonds.

2. As a direct beneficiary of QE, commercial banks find themselves with a disproportionate share of reserves vis-à-vis bonds within their portfolios.

3. Given that reserves yield lower returns compared to bonds – which are not only more lucrative but also regulatory-friendly – banks embark on a mission to rebalance their portfolios.

4. In their quest to rebalance, banks propagate further volatility suppression by purchasing the same bonds acquired by Central Banks during QE, compressing credit spreads in the process.

5. This market condition paves the way for asset allocators and investors globally to broaden the risk spectrum of their portfolios, fostering enhanced flow of credit and capital across economies.

The underlying logic of the Portfolio Rebalancing Effect might be complex, but its implications are profound. It not only elucidates the methodical steps central banks take to stabilize financial markets but also highlights the interconnectedness of commercial banks’ portfolio management strategies with macroeconomic stability goals.

The discourse surrounding these financial mechanisms can seem convoluted, but understanding them is pivotal in comprehending how financial regulators and institutions navigate crises and strive to maintain market stability. At its core, the Portfolio Rebalancing Effect exemplifies the tools at the disposal of central banks to counteract market turbulence and guide economic landscapes towards equilibrium.

This exploration into the essence of central banks’ response mechanisms to fluctuating bond yields elucidates the strategic depths financial regulators delve into, aiming to safeguard economic stability. Whether you’re an avid follower of economic news, an investor trying to navigate these tumultuous markets, or merely a curious observer, grasping these concepts is invaluable. It offers insight into the operational frameworks of financial institutions and the rationale behind regulatory strategies, enhancing one’s understanding of the broader economic narratives at play.

For further insights into the world of macroeconomics and investment, communities like The Macro Compass offer a wealth of knowledge and discussion platforms for macro investors, asset allocators, and hedge funds. Diving into such resources can enrich your understanding, enabling you to align your investment strategies with informed perspectives on global financial dynamics.

In conclusion, while the mechanisms of central banks, like the Federal Reserve’s liquidity injections, might initially appear as mere technical manoeuvres, they are fundamental to the fabric of global financial stability. The interplay of quantitative easing, bank reserves, and the Portfolio Rebalancing Effect serves as a testament to the sophisticated strategies employed to navigate economic challenges, ensuring the resilience of financial markets against potential upheavals.