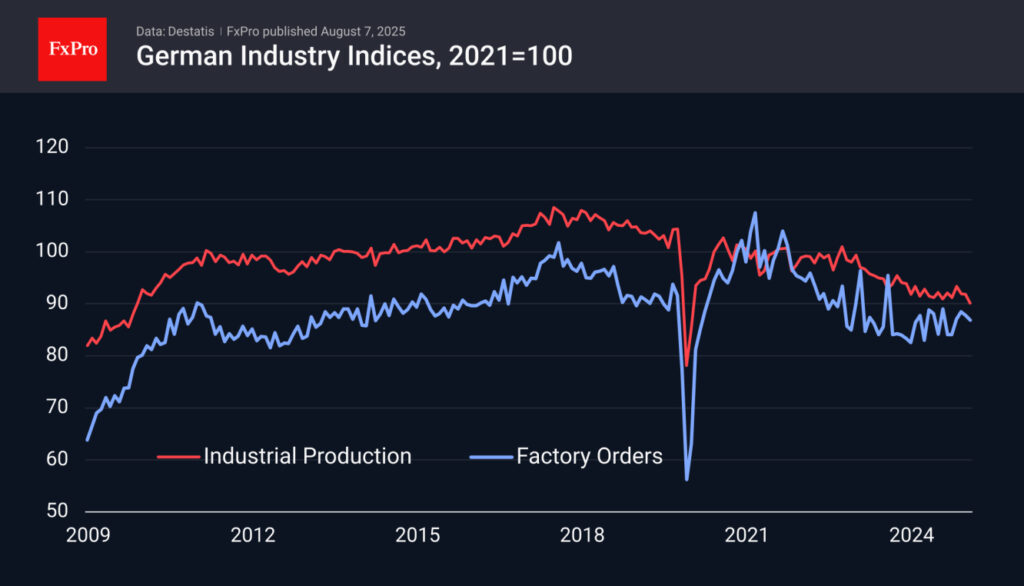

In recent times, the German industrial landscape has experienced a significant downturn. Over the last quarter, reports have shown a consistent decline in the nation’s industrial production. This downturn marks a notable shift, with April observing a 1.6% decline, followed by a marginal 0.1% drop in May, and a more substantial 1.9% decrease in June. As a result, the industrial production index has plummeted to its lowest point since April 2010, with the exception of a temporary falloff in March 2020—a month marred by the global onset of the COVID-19 pandemic.

The situation, initially showing signs of stabilisation and even growth in the preceding year and the early months of this year, has taken a concerning turn in recent months. This reversal seems to be a continuation of the declining trend observed since as early as 2018, and more conspicuously, since 2023.

Adding to the industrial sector’s woes, the index of industrial orders—a leading indicator of future industrial activity—has also witnessed a downturn, with a 0.8% decrease reported in May, followed by a 1.0% fall in June. This succession of declining orders signals potential further strains on industrial production.

Another facet of the economic challenge confronting Germany comes from its foreign trade dynamics. Recent data has revealed a contraction in the nation’s trade surplus, which shrank from 18.6 billion euros to 14.9 billion euros over the month of June. Imports have demonstrated a recovery trend, surging from 104 billion euros to 115.6 billion euros from the beginning of 2024 up to June. On the contrary, exports have seemingly plateaued, hovering around the 130 billion euro mark for nearly three years. This stagnation in export growth suggests a troubling inertia in one of the country’s crucial economic sectors.

The resonance of these developments is felt not only within the borders of Germany but also across the Eurozone. As Germany stands as a linchpin in the European Union, particularly in the realms of exports and industrial production, these downward trends exert substantial pressure on the economic health of the region. This scenario foreshadows a challenging phase for the euro currency, which is struggling to maintain its value against the dollar, especially as it approaches the $1.17 mark.

Given Germany’s pivotal role in European economic dynamics, the sluggish performance in exports and industrial output not only underscores domestic issues but also signals broader economic headwinds for the Eurozone. If other member countries fail to produce more optimistic industrial and export data, the European Central Bank (ECB) might find itself compelled to consider further reductions in its rate, a move that typically acts as a bearish factor for the currency.

This scenario unfolds within a complex tapestry of global and regional economic challenges—inflation pressures, supply chain disruptions, geopolitical tensions, and environmental concerns—all of which echo the interconnectedness of modern economies. The German industrial downturn, while immediately reflective of domestic policy and market conditions, also surfaces questions about global economic stability and resilience.

As the world marches towards increasingly uncertain economic horizons, the situation in Germany acts as a reminder of the intricate dance between domestic policy, industrial capacity, international trade, and global market dynamics. As stakeholders from policymakers to investors and from industrial conglomerates to local businesses watch these developments, the unfolding narrative of Germany’s industrial production and its implications for the Eurozone and beyond continue to hold significant attention on the global stage. The road ahead, albeit fraught with challenges, also holds the potential for strategic reorientations and structural strengthening, as economies worldwide navigate through these turbulent times.