In recent market updates, optimism has prevailed, dispelling the shadows of the previous week’s downturn. Mid-morning trading sessions in London witnessed a commendable resurgence, with the financial indices experiencing a notable uplift. The index surged by 0.8%, a significant leap highlighting the renewed confidence among investors. This resurgence wasn’t confined to the UK alone; European stocks experienced a similar wave of enthusiasm. Germany’s prestigious index exemplified this bullish trend by advancing 1.4%, demonstrating the contagious nature of market optimism.

However, the story was somewhat different for the , which faced constraints due to fluctuations that, paradoxically, lent support to the currency pair, maintaining it above the $1.34 mark. This intricate dance of numbers reflects the nuanced dynamics at play in global finance.

The undercurrent fuelling this optimistic rally is multifaceted, incorporating elements of geopolitical hope, strategic exemptions from technology tariffs, and mounting anticipations of the Federal Reserve slashing interest rates potentially as soon as September. Particularly in Europe, the travel and leisure sector indices were buoyant, their performance underscored by robust earnings reports. Curiously, even as troubling indicators emerged—such as Germany’s industrial output experiencing a sharp 1.9% month-on-month decline, marking its most significant drop almost in a year—investors’ spirits remained largely undampened.

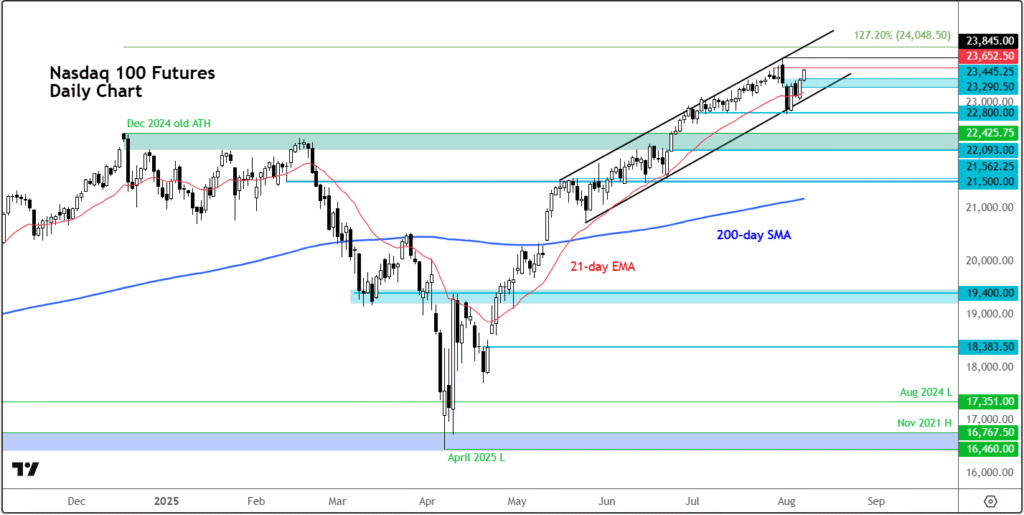

Shifting focus to the technical realm, the Nasdaq 100 futures paint a picture of persistent bullish momentum. Trading tantalizingly close to its historic zeniths, the future’s market trajectory is adorned with markers of upward continuity—be it through consecutive higher highs, ascending trend lines, or supportive moving averages. Despite a fleeting moment last week that suggested a potential reversal, the index’s resolve remained unshaken, vigorously bouncing back from its supportive threshold near 22,800.

The breaking of the resistance zone, previously bracketed between 22,290 and 23,445, has now transformed it into a crucial support level for any forthcoming pullbacks. Subsequent focus levels include the rising channel trendline and the essential 22,800 mark, with an eye on ascending to 23,650—a capstone that briefly restrained progress last week. Ambitions stretch beyond, towards the record zenith at 23,845, and even the 127.2% Fibonacci extension at 24,050, symbolizing uncharted territories of growth.

The buoyancy observed in the markets can also be attributed to significant geopolitical movements and tariff adjustments. News of a potential summit between Trump and Putin injected a dose of optimism, suggesting possible de-escalation in the Russia-Ukraine tension, a development eagerly welcomed by European stakeholders keen on regional stability.

Moreover, in a notable shift in trade policy, while a 100% tariff was imposed on imported semiconductors, an exemption for U.S.-based manufacturers like Apple provided a semblance of relief, mitigating fears within the tech sector. However, Swiss goods remain under the shadow of tariffs, following an unsuccessful appeal.

Amid these developments, the prospect of interest rate cuts has emerged as a beacon for risk appetite. With the U.S. economy showing signs of cooling, speculation is rife about the Federal Reserve’s next moves. Statements from three Fed officials, including Mary Daly, have highlighted economic concerns, with Daly hinting at the possibility of rate adjustments “in the coming months.”

Despite the fervor, a note of caution persists beneath the surface. The momentum seems more driven by sentiment and technological advancement hype, particularly around AI, rather than fundamentals. While volatility remains suppressed and earnings robust, the bulls are firmly in the driver’s seat. However, the sustainability of this rally, amid escalating macro-economic uncertainties, is a matter of speculation, with many bracing for a potential correction looming on the horizon.

For market enthusiasts seeking deeper insights, InvestingPro offers a treasure trove of tools designed to enhance decision-making. With a foundation of over 25 years of comprehensive financial data, the platform provides subscribers with cutting-edge analytics, ranging from ProPicks AI’s machine-learning-based stock recommendations to the WarrenAI tailored for financial market predictions. Additionally, the InvestingPro Fair Value model furnishes a rigorous, data-driven stock valuation, amalgamating insights from up to 15 esteemed valuation methodologies.

Moreover, for those chasing precision in their investment journey, the platform’s advanced stock screener, boasting 167 custom metrics alongside pre-defined searches, stands ready to redefine market analysis. All these features collectively aim to streamline the investment process, equipping users with the necessary arsenal to navigate the often tumultuous waters of the stock market with confidence.

In the ever-evolving narrative of global finance, these developments underscore a period of tentative optimism, marked by strategic gambles, geopolitical manoeuvres, and the perpetual quest for growth. With every twist and turn, the markets tell a story of ambition, caution, and the relentless pursuit of prosperity.

Please note that this article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any asset. It’s important to conduct your own thorough research and consult with a professional advisor before making any investment decisions, as all investments come with risks.