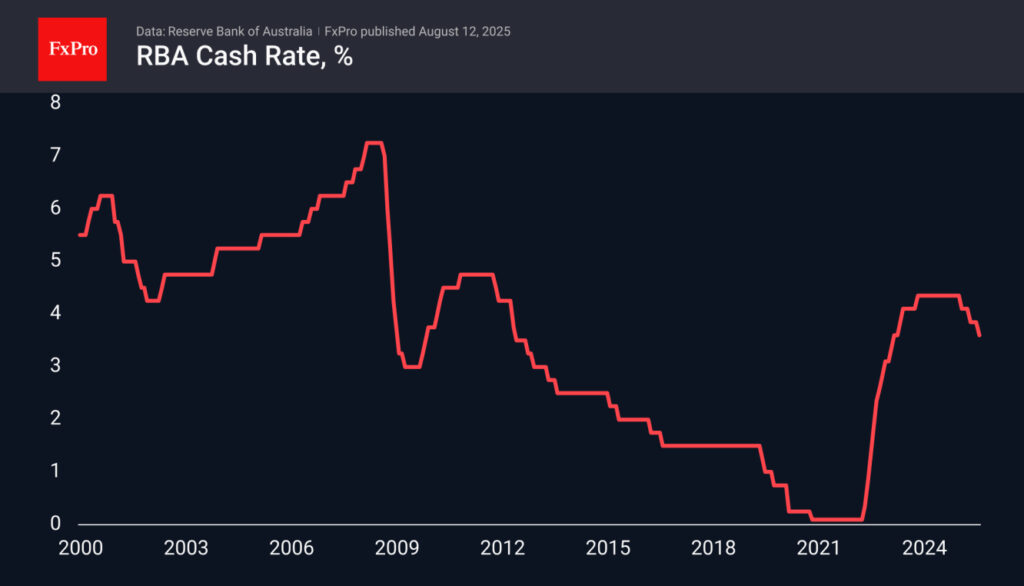

In a strategic move that reflects the ever-evolving landscape of the global economy, the Reserve Bank of Australia (RBA) has decided to lower its principal interest rate by 25 basis points, bringing it to a new level of 3.60%. This adjustment, marking the third reduction in the current economic cycle, continues the Bank’s pattern of reducing rates every quarter or at alternate meetings, underscoring a calculated approach to monetary policy in uncertain times.

The decision by the RBA emerges against a backdrop of fluctuating economic indicators and global uncertainties that have significant implications for Australia’s economic trajectory. According to data released by the Bank, inflation rates have shown signs of alignment with the RBA’s forecasts. The trimmed mean inflation rate—a measure that strips out the most volatile items to give a clearer view of underlying trends—declined to 2.7% on a year-over-year basis. Meanwhile, the headline inflation figure, which includes all items in the consumer price index, also saw a reduction, coming in at 2.1%.

These developments suggest that inflation is gravitating towards the RBA’s target zone of 2-3%, a comforting sign for policymakers who aim to keep inflation under control while fostering sustainable economic growth. The Bank’s forward-looking statements further anticipate that the key interest rate will continue on its downward trajectory, a reflection of both domestic and international economic conditions.

The RBA’s commentary shed light on several factors exerting influence on Australia’s economy. On one hand, concerns among businesses, escalating cost pressures, and moderating wage growth paint a picture of a challenging domestic environment. Yet, on the other, there appears to be a silver lining with the gradual rebound in domestic demand, signalling resilience in the face of adversity.

These mixed signals are in no small part a consequence of broader geopolitical tensions, notably trade wars, that have introduced volatility into global markets. Australia’s economy, renowned for its robust trade relations, particularly with partners in Asia, finds itself at the nexus of these turbulent dynamics. Export performance, invariably tied to the health of these Asian economies, has felt the brunt of these challenges.

Despite these headwinds, an unexpected beneficiary has emerged in the form of the Australian stock market. Encouraged by reports of delays in trade and the RBA’s accommodative policy stance, the market ascended to unprecedented heights, a testament to investors’ enduring optimism amidst prevailing uncertainties.

The Australian dollar (AUD), often regarded as a barometer of the nation’s economic health, experienced a modest downtick, depreciating by 0.2% to a value of 0.65 against the US dollar. This period has seen the AUDUSD exchange rate traversing a relatively narrow band, fluctuating between 0.6350 and 0.6600 since the latter part of April. The currency pair’s movement has been particularly constrained from the end of July, hemmed in by the 200-day moving average on the downside and the 50-day moving average on the upside. This tight range trading scenario underscores a delicate equilibrium between opposing market forces.

In this context, excluding a noticeable dip in April, the AUDUSD pair has demonstrated an upward trend since the commencement of the year. This trend sees the exchange rate reverting to its average values observed over the preceding two years, presenting a nuanced picture of the currency’s performance amidst fluctuating economic indicators and policy adjustments.

From an investment perspective, these dynamics render the AUDUSD pair less appealing for long-term carry trade strategies, primarily due to the diminished yield spread which typically attracts such investors. Similarly, the absence of a clear directional trend complicates the landscape for medium-term speculators. However, for those engaged in range trading, the current environment offers fertile ground, featuring opportunities to capitalize on fluctuations within the established trading band.

As articulated by the analysis team at FxPro, these intricate market movements and policy adjustments underscore the multifaceted nature of currency trading, where diverse strategies can find their niche amidst the broader economic currents shaping global finance.

In sum, Australia’s recent rate cut is set against a complex economic tableau, characterized by both domestic challenges and the broader geopolitical shifts affecting global trade dynamics. As the RBA steers the course of monetary policy through these uncertain waters, the implications for inflation, currency performance, and overall economic health remain subjects of keen interest for observers near and far.