In recent times, the economic landscape of the United States has experienced a rollercoaster of changes, marked by pressing concerns over potential interest rate reductions. This speculation has led to significant impacts on the US Dollar, positioning it as the weakest principal currency both currently and for the week thus far. The unfolding of these events bears critical implications for the global financial markets, stirring urgent questions regarding the future direction of the world’s most dominant currency.

Unpacking the US Dollar’s Weakening Stance

Over the past few days, the financial markets have been abuzz following a series of economic reports from the United States. Initially, the focus fell on a particularly disappointing jobs report, which not only fell short of expectations but also revisited the figures for the preceding two months, casting them in a more negative light. This was closely followed by an inflation report that, while not dismal, failed to inject much optimism into the market. The cumulative effect of these developments led traders to rapidly adjust their expectations, now nearly unanimously anticipating a cut in interest rates by the Federal Reserve in the upcoming month.

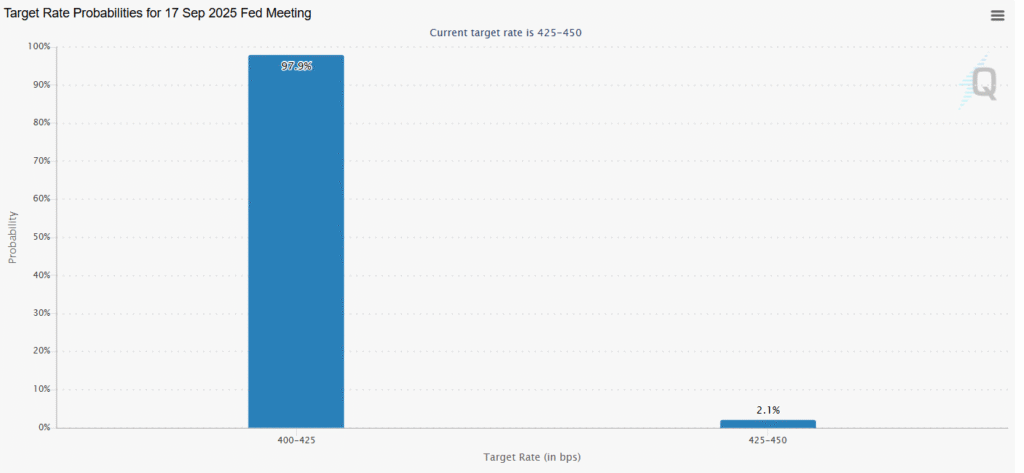

Just a fortnight ago, the sentiment was notably different, with a 60% likelihood assigned to the Fed maintaining interest rates within the 4.25-4.50% bracket during its September gathering. However, the landscape has shifted dramatically, with current market predictions now fully pricing in an imminent rate cut by the Fed.

The market’s revised stance is underscored by projections anticipating approximately 61 basis points of easing from the Fed by the year’s end. This forecast encapsulates two to three 25 basis points cuts across the remaining meetings of the year. Adding to the discourse, US Treasury Secretary Matthew Bessent has voiced support for a more aggressive approach, advocating for a 50bps adjustment in September, with further reductions to follow.

The notion of a swift transition towards aggressive monetary easing, notably championed by a traditionally conservative Federal Open Market Committee (FOMC), remains speculative. Particularly, given the recent core Consumer Price Index (CPI) readings which exceeded expectations. Nevertheless, the Treasury Secretary’s remarks hint at a broader shift in the perceived realms of possibility regarding the Fed’s forthcoming decisions.

The financial community now keenly awaits additional economic reports, including another jobs report and inflation data, alongside the highly anticipated Jackson Hole Symposium later this month. These events are expected to further shape expectations for the Fed’s policy trajectory in the final quarter.

Implications of the US Dollar’s Downturn

The anticipation and subsequent speculation regarding interest rate cuts have pressured the US Dollar, rendering it the most underperforming major currency in recent days. This decline is not without consequences, as risk assets, including equities and cryptocurrencies, flirt with record valuations in contrast.

Technical Analysis of the US Dollar Index (DXY)

From a technical analysis standpoint, the US Dollar Index (DXY) presents an intriguing narrative. Following a brief resurgence, the index faltered at its 100-day Moving Average (MA), reverting to test its short-term bullish trend line around the upper 97.00s. Although a bounce from this level is technically plausible, the breach of the equivalent trend line by the 14-day Relative Strength Index (RSI) suggests potential for a more substantial downturn in the index itself.

Should this break materialize, focus shifts to imminent support levels, including a late-July nadir near 97.15 and a multi-year trough around 96.40 marked on July 1st. While a temporary recovery may occur, the broader trend appears bearish, with sustained recovery unlikely unless the index can reclaim a position above the 100-day MA placed in the lower-99.00s.

As the financial world watches the unfolding of these dynamics, the ramifications for the global economy remain significant. The strength and stability of the US Dollar not only influence domestic economic conditions but also affect international trade, investments, and currency valuations worldwide. As such, the decisions of the Federal Reserve in the coming months promise to be of monumental importance, potentially reshaping the global economic landscape in profound ways.