In the dynamic world of cryptocurrency, there has been a recent surge that’s captured the attention of investors and enthusiasts alike, propelling Bitcoin and Ethereum to new heights. Bitcoin, the premier cryptocurrency, has triumphed over its previous peak, marking a fresh milestone at 124,500. In parallel, Ethereum, the runner-up in terms of market capitalization, has ascended to an impressive 4-year zenith of 4,780, edging closer to its November 2021 pinnacle of 4,868. This crescendo in the cryptocurrency domain has steered the total market capitalization towards a historic $4.20 trillion, signifying the extensive nature of this rally.

Following a period of stabilization, Bitcoin showcased a remarkable 3.5% increment over the last day, navigating past its July 14 record of 123k. This ascent was synchronized with a broader uplift across various financial markets, including notable achievements in stocks and bonds. The current bullish energy within the cryptocurrency sphere is largely attributed to growing anticipation that the U.S. Federal Reserve may implement another rate cut in the upcoming September. Recent economic indicators, namely a softer-than-expected inflation report, have escalated these expectations, transitioning the likelihood of a rate reduction from a pre-data 57% to an astonishing 90% post-data revelation.

The potential for a more lenient monetary policy has enveloped financial markets in optimism, fuelling an upswing in risk assets universally. Within this same vein, cryptocurrencies are receiving a substantial push from several other factors, enhancing their appeal and solidifying their stature within the financial landscape. These supporting elements include an improved regulatory clarity and the significant move by the former U.S. President, Donald Trump, who signed an executive order permitting Americans to integrate cryptocurrencies into their 401(k) retirement plans. This action opens up a gateway to a lucrative market comprising trillions of dollars, wherein even a fractional allocation towards cryptocurrencies could dramatically increase market liquidity and establish long-term demand.

Institutionally managed and often tied to regulatory contributions, these 401(k) plans may well transform Bitcoin and its counterparts into recognized and legitimate asset classes. Such a development could set the stage for an invigorated market as we step into September and the final quarter of the year, historically observed as a bullish period for Bitcoin with an average return of 85% in Q4, outperforming the combined returns from the first three quarters.

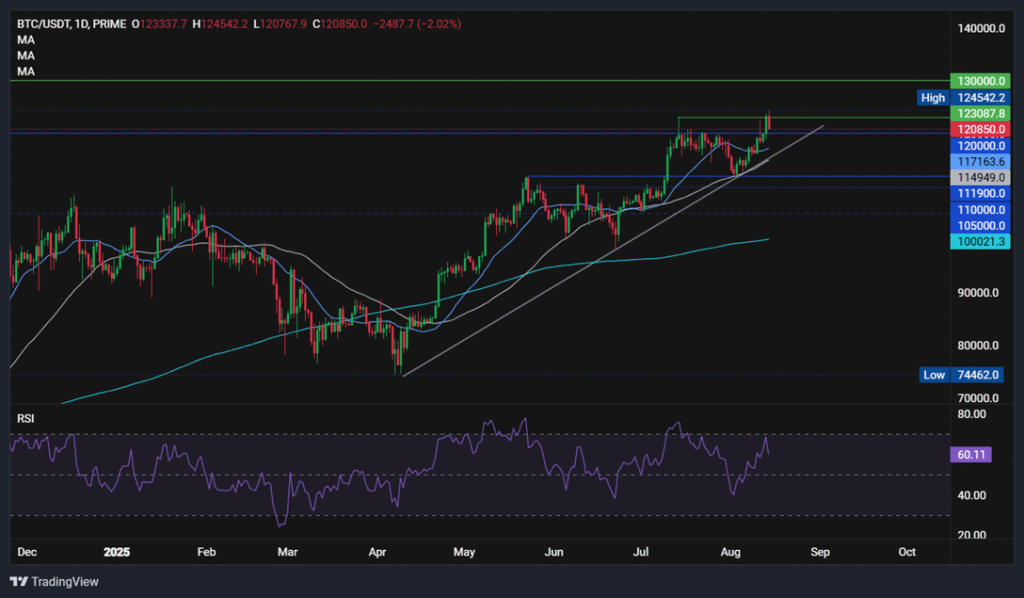

Focusing on the technical aspects, Bitcoin, having breached the 123k barrier to touch a new apex of 124.5k, recently moderated slightly to 122k. A sustained position above the crucial 120k level could prompt a trajectory towards 130k. Conversely, a downturn below the August trough of 112k would necessitate a reevaluation of the ongoing bullish chart structure.

Ethereum’s narrative isn’t vastly different, with its value surging past 4700, marking a significant move towards its historic high. This uptick is supported by an explosive demand for ETH Exchange-Traded Funds (ETFs) and heightened corporate treasury interest. Furthermore, Ethereum’s network activity is experiencing unprecedented volumes, reinforcing the prognosis for its price trajectory in the near term.

With an interplay of robust technical indicators and an advantageous macroeconomic backdrop, both Bitcoin and Ethereum appear on the cusp of further expansions. As the landscape of cryptocurrency continues to evolve, these movements underline the growing integration and acceptance of digital currencies within the broader financial ecosystem, promising a fascinating journey ahead for investors and market observers.

It’s essential, however, to approach this dynamic market with caution. The inherent volatility in cryptocurrency investments can lead to significant financial risks. Prospective investors should undertake comprehensive research or seek professional guidance to navigate these complexities effectively. Remember, past performance, while insightful, isn’t always a reliable predictor of future outcomes in the ever-fluctuating world of cryptocurrency.