The digital currency landscape has once again gripped the financial world’s focus, with Bitcoin finding itself in the midst of a significant correction after recently setting a dazzling new record high. Last week, the cryptocurrency titan soared to unprecedented heights, striking a breathtaking peak of $124,527. This remarkable milestone, however, was swiftly followed by a decline, with the price retreating to the vicinity of $112,000 – $113,000. This recent downturn has ignited a flurry of speculation and inquiry among investors: Is this recent drop merely a temporary hiccup in Bitcoin’s otherwise upward trajectory, or does it signify the dawn of a foreboding bear market?

### Short-Term Pressures on Bitcoin

#### The Dynamics of Profit-Taking and Liquidations

Following an impressive rally that commenced in July, a pronounced wave of profit-taking activities has emerged, significantly contributing to the sharp retraction of Bitcoin’s value from its peak of $124k down to near $112k. Such movements can often be attributed to traders and investors deciding to cash in on their gains following a significant price increase. Concurrently, there has been a notable liquidation of leveraged positions within the market, further exacerbating the downward pressure on Bitcoin’s value.

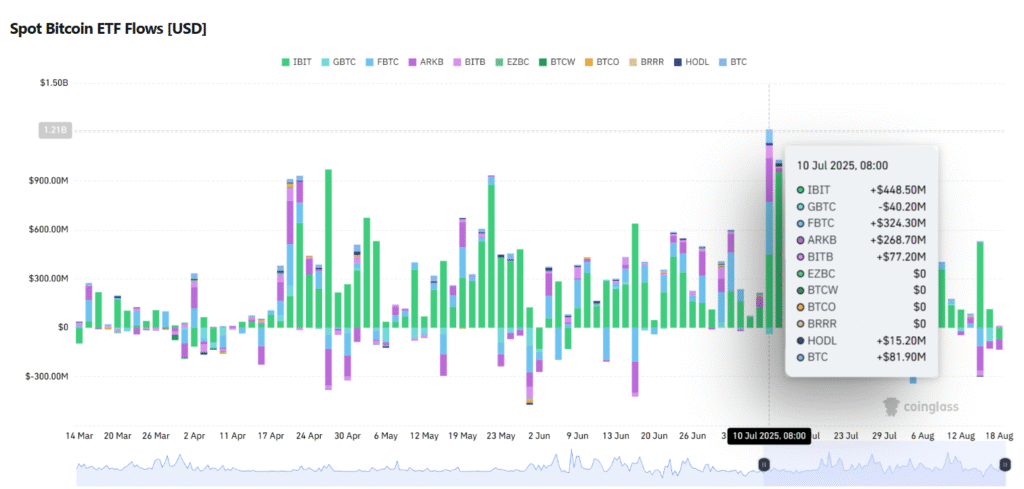

#### A Shift in ETF Flows

The landscape of Bitcoin Exchange-Traded Funds (ETFs) witnessed a remarkable surge in inflows in July 2025, setting new records that symbolised a high level of institutional interest in the cryptocurrency. However, recent developments have marked a slowdown in these inflows, with last week observing a shift towards net outflows. This change indicates a growing sense of caution among institutional investors, who play a critical role in the broader acceptance and valuation of Bitcoin.

Furthermore, the digital currency domain is currently navigating through stormy waters as the Securities and Exchange Commission (SEC) launches an investigation into Alt5 Sigma, in collaboration with World Liberty Financial, linked to a project associated with the Trump family. Allegations surrounding overstated profits and manipulation of stock prices have added a layer of legal uncertainty and risk to the cryptocurrency sector. Such scrutinies have historically cast a shadow over market sentiment, potentially influencing investor confidence.

### Macro Factors and the Jackson Hole Symposium

A key event that the market is keenly anticipating is the address by Federal Reserve Chair Jerome Powell at the Jackson Hole symposium. With expectations pointing towards a potential rate cut in September, the cryptocurrency market, along with other risk assets, could witness early gains driven by a “buy the rumor” effect. Nonetheless, should the signals from the event suggest otherwise, the market could experience acute volatility.

### Technical Perspectives

#### Identifying Key Levels

From a technical analysis standpoint, two crucial support levels currently under scrutiny are $112,000 – $113,000, corresponding with the Fibonacci 23.6% retracement level, and the subsequent $105,000 – $107,000, aligned with the Fibonacci 38.2% mark. Conversely, resistance levels are observed at $117,000 – $119,000, where a successful breach could potentially propel Bitcoin to retest its recent high at $124,527.

Despite the near-term pullback, the dominant long-term uptrend has not been invalidated, as demonstrated by the price maintaining its position above the 200-day Simple Moving Average (SMA200), a widely regarded indicator of long-term market trends.

Additionally, on the 4-hour chart, cluster analysis and footprint charts indicate a reaction at support levels, with some instances of ‘bottom-fishing’ driving a modest price rebound. Yet, the Cumulative Delta, which assesses the net strength of aggressive buying versus selling, implies that buying pressure remains subdued. This suggests that the current rebound could predominantly be technical, potentially lacking the momentum required for a sustained recovery.

### Implications for Traders and Investors

For traders, particularly those with short-term horizons, the advice would be to await clear signals indicating a resumption of buying strength before attempting to pinpoint market bottoms. Tools such as the Cumulative Delta and RSI (Relative Strength Index) metrics exiting oversold conditions could serve as valuable indicators for such timing.

Meanwhile, long-term investors might consider maintaining their positions as long as the key trend support represented by the Daily SMA200 remains intact. Nonetheless, given the prevailing uncertainty surrounding macroeconomic policies and regulatory scrutiny, a cautious approach, with vigilant risk management strategies, is advisable.

In summary, while Bitcoin’s recent downward shift has stirred a mix of apprehension and speculation among investors and market observers alike, the overarching narrative surrounding the cryptocurrency remains complex and multifaceted. Factors ranging from profit-taking behaviours, shifts in institutional investment patterns, regulatory investigations, to macroeconomic developments, all weave into the broader tapestry of Bitcoin’s market dynamics. As always, a balanced and informed approach, grounded in both technical and fundamental analysis, will be crucial for navigating the ever-evolving landscape of digital currencies.