In the tumultuous world of stock markets, where every tick can represent fortunes made or lost, a peculiar trend has emerged during the summer of 2025. Significant insiders from corporations such as Amazon, Dell, Chewy, Carvana, and NVIDIA have been observed offloading shares at a rate not seen in recent years. This phenomenon might initially sound alarms for the average investor; however, a deeper exploration into the motivations behind these sales and the current performance of these companies suggests that following in the footsteps of these insiders might not be the savvy move one might assume.

Amazon: Navigating Space and Markets

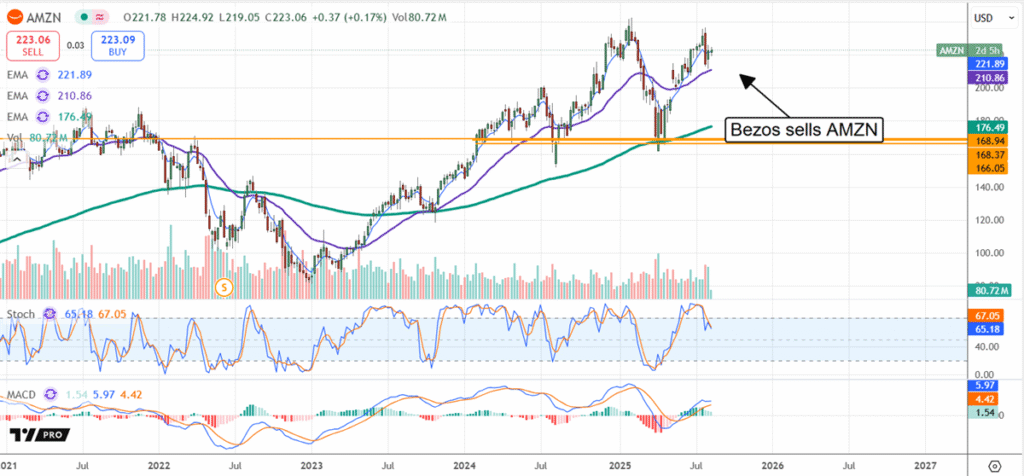

At the forefront of this insider selling spree stands Amazon, a tech behemoth that finds itself leading the pack in terms of the sheer volume of insider sales. Within a mere 90-day period leading into the third quarter of 2025, seven insiders executed no fewer than 24 transactions, marking the highest net activity in this regard over the past two years. The majority of these sales were attributed to Amazon’s founder, Jeff Bezos, whose investments in space exploration and philanthropic ventures have famously required liquidating portions of his stake in the company. Despite these significant insider movements, Amazon’s financial health, spearheaded by advancements in Artificial Intelligence (AI) across its consumer and AWS sectors, presents a compelling case for retention or even augmentation of one’s investment in Amazon. Analysts remain bullish, forecasting a 17% increase in the company’s stock price to reach new zeniths.

Dell: Profit-Taking Amidst Soaring Gains

Dell’s stock ranks second in the volume of insider sales during the same period, a trend primarily driven by profit-taking initiatives. Notably, these sales come after the stock’s impressive rally of more than 200% over four years, with Silver Lake Capital, a significant shareholder, capitalizing on these gains. Despite this sell-off, Dell’s outlook remains robust, buoyed by analysts’ upgrades and bullish forecasts, making a compelling argument for investors to maintain their positions or consider new entries into the stock.

Chewy: Correction Creates Opportunities

Chewy witnesses its own set of insider sales amidst a summer price correction. This adjustment, however, has brought the stock’s price to levels considered attractive by market observers, resting at a supportive base indicative of a resilient uptrend. Encouraging financial results, combined with positive guidance adjustments, have fortified analysts’ confidence in the stock, suggesting a strong recovery and a lucrative entry point for potential investors.

Carvana: Insiders Cashing In on Success

Carvana’s scenario is intricately linked to the story of its CEO, Ernest Garcia III, and his father, whose early investments in the company have borne significant fruit, compelling them to realize some profits. Despite this, the company’s stock is projected to continue its upward trajectory, powered by impressive growth markers and favorable analysts’ ratings, hinting at a price target north of $400.

NVIDIA: A Future Powered by Silicon and Strategy

Lastly, NVIDIA’s landscape is characterized by insider sales led by CEO Jenson Huang under a prearranged trading plan. This activity unfolds against the backdrop of a stock price that has doubled over the last five months, reflecting NVIDIA’s commanding presence in the semiconductor industry. Institutional investors remain keen on NVIDIA’s prospects, their buying activity outstripping sales, with analysts aligning on a positive trajectory for the stock, forecasting further gains.

Conclusion: Insight, Not Impulse

The insider selling observed across these companies in the summer of 2025, while noteworthy, is nuanced by individual circumstances ranging from philanthropy to profit-taking, and strategic re-alignments. For the discerning investor, these movements serve more as a testament to the companies’ existing success rather than a harbinger of doom. With each company continuing to show strong fundamentals and positive future outlooks as per analysts’ ratings, the strategy for investors should not be a reactive sell-off but a thoughtful consideration of each stock’s long-term growth potential. In navigating the complex dance of stock market investments, understanding the undercurrents behind such insider actions can provide a more stable footing, turning what might appear as warning signals into beacons of opportunity.