In the intricate world of finance and monetary policy, the journey towards establishing equilibrium and stable growth, particularly in the UK, showcases an ongoing narrative of adjustment, strategic decision-making, and the ever-present quest for balance. As 2023 unfolds, the status quo of liquidity conditions depicts a tale of steadiness and calculated moves amidst the ebbs and flows of economic dynamics.

The narrative begins in the earlier months of the year, where liquidity provisions—essentially the lifeblood of banking and finance sectors—have maintained a robust stability. This steadfastness stems, in part, from the anticipated deceleration of Quantitative Tightening (QT) initiatives and a hearty engagement with liquidity facilities, which has curtailed the depletion of bank reserves significantly. Notably, within the bustling arena of money markets, instruments bearing maturities of less than a month have grown increasingly sought-after. This surge in demand can be attributed to stringent investment mandates and regulatory frameworks, facilitating a downward pressure on rates and underscoring the intricate dance between policy and market behavior.

Amidst this financial landscape, the Bank of England (BoE) navigates with cautious optimism, steering its monetary policy with an eye towards normalization yet adjusting its pace in response to evolving economic indicators. Despite an aura of skepticism from investors, predictions linger over the BoE’s inclination to enact further rate reductions within the year. This speculation, however, treads a tightrope as market sentiments and the persisting specter of inflation inject a dose of uncertainty. Nevertheless, the “landing zone” for BoE rates is anticipated to hover around 3.5%, presenting a noteworthy yield advantage for short-term maturities.

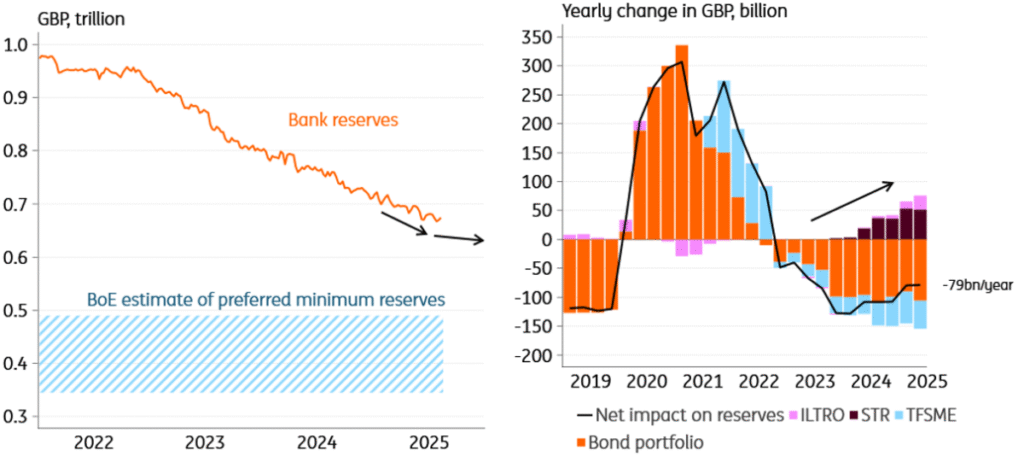

Come September, the BoE stands at a crossroads, tasked with deliberating the forthcoming rhythm of QT. The potential reduction in the pace at which the gilt portfolio is unwound—an endeavor initially set at £100bn annually—is propelled not solely by liquidity concerns but significantly influenced by the dynamics of longer-dated gilt yields. Record-setting yields, alongside global fiscal pressures, kindle a fervent desire within the BoE to safeguard the gilt market against undue strain.

If the Bank of England opts to alleviate the pace of its bond portfolio reduction, this gesture could herald an era of prolonged ample liquidity. Interestingly, the QT’s draining effect on bank reserves finds counterbalance through the strategic employment of repo liquidity facilities, such as STR and ILTRO, infusing approximately £70bn of reserves back into the system over the past year. This intricate balance of withdrawals and injections ensures a relatively serene landscape for money markets in terms of liquidity provision.

However, signs of tightening liquidity conditions subtly emerge as bank reserves experience a decline, albeit hinting at an approaching equilibrium state. The SONIA rate’s position—a modest 3 basis points beneath the Bank Rate—suggests a potential stabilization, mitigating the upward pressure on rates banks offer to attract deposits.

In exploring the broader spectrum of money market instruments, the year’s journey reveals minimal signs of constriction, with spreads on treasury bills and commercial paper maintaining their range. Here, an intriguing paradigm surfaces: The insatiable appetite for instruments with maturities of a month or less, propelled by investment mandates and regulatory imperatives, invariably nudges those rates beneath the SONIA swap curve. The cascading implications of such preferences and mandates sculpt the pricing landscape for these short-duration assets.

Exploring further along the money market curve, a stark contrast becomes apparent in the broader spreads for deposits. While repo transactions embody the essence of secured borrowings, unsecured deposits naturally command higher interest rates, albeit with nuanced dynamics at play for maturities under 30 days.

Tracing the roots of this financial tapestry reveals an intricate interplay between policy directives, economic fundamentals, and the collective response of market participants. In the grand narrative of UK money markets and the pursuit of policy normalization, the nuanced choreography of slowing QT, strategic liquidity provisions, and shifts in investor sentiment sketches an evolving landscape. As actors within this financial saga adapt and recalibrate, the enduring quest for stability and growth continues unabated, underpinning the complex yet fascinating realm of monetary policy and market dynamics.