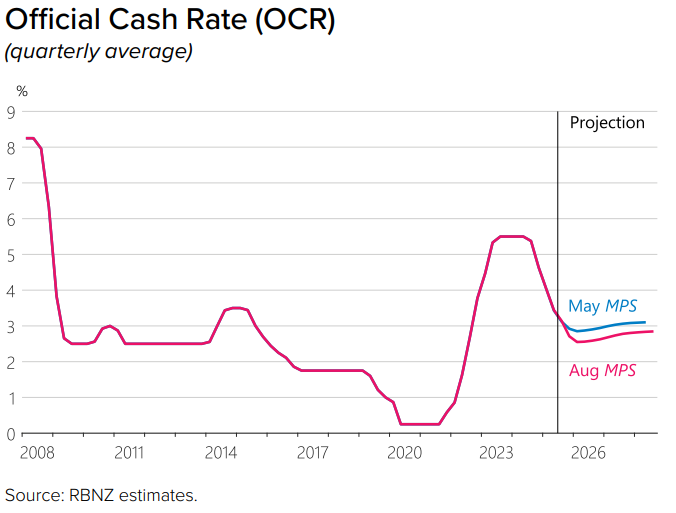

In a decisive move that sent shockwaves through the financial markets, the Reserve Bank of New Zealand (RBNZ) recently took significant action by reducing its Official Cash Rate (OCR) to 3%. This decision, made in August, not only reduced the overnight lending rate but also drastically altered the forecast for future rate pathways, signalling the possibility of further reductions. The announcement was especially surprising because two members of the decision-making committee advocated for an even more substantial cut of 50 basis points, underscoring a notably dovish stance that has since impacted the New Zealand Dollar (NZD).

Understanding the RBNZ’s Decision

The RBNZ’s mandate involves maintaining price stability, promoting full employment, and contributing to New Zealand’s economic prosperity. To achieve these objectives, the central bank employs various monetary policy tools, including the manipulation of the OCR, which influences the country’s interest rates and, subsequently, inflation and employment.

In this particular instance, the downward revision of the OCR to 3%—with plans to potentially reduce it to a 2.5% trough by the March quarter of next year—marks a stark divergence from the trajectory observed six months prior. Then, predictions had suggested rates would bottom out at 3% or higher. This shift implies a more aggressive approach to stimulating the domestic economy, which the RBNZ characterizes as having “stalled” in the second quarter. Factors cited for this stagnation included global economic uncertainty, a deterioration in employment figures, and decreases in household spending due to climbing essential goods prices and falling house values.

Impact on the Markets

The RBNZ’s dovish pivot has significantly impacted financial markets, most noticeably through the devaluation of the NZD against major currencies. The NZD/USD pair, for example, breached critical support levels following the announcement, leading to speculation about new lows. Furthermore, the anticipation of further OCR cuts has led to a notable shift in short-dated NZ bond yields, with the Kiwi yield curve experiencing a bull steepening—a financial phenomenon that occurs when the yields on longer-term bonds rise faster than those on short-term bonds, generally indicative of upcoming interest rate cuts.

In contrast to the NZD’s depreciation, the AUD/NZD pair has seen an uptrend, rallying robustly from its 200-day moving average in response to the RBNZ’s rate decision. This movement reflects broader market sentiments and anticipations concerning the comparative economic outlooks of Australia and New Zealand, with the former seemingly positioned more favourably in the eyes of investors following the RBNZ’s announcements.

Analyzing the Broader Implications

The RBNZ’s actions speak volumes about its assessment of New Zealand’s economic landscape and its readiness to employ aggressive monetary policy adjustments to foster recovery. This scenario presents a stark reminder of the delicate balancing act central banks around the world must perform in navigating the post-pandemic economic recovery. The decision to lower rates and the openness to future reductions underscore the challenges many economies face, including subdued growth, inflationary pressures, and uncertainties in global trade and investment.

Moreover, the central bank’s dovish pivot may have broader implications beyond the immediate financial market fluctuations. For businesses and households, lower interest rates could ease borrowing costs and potentially stimulate spending and investment, albeit at the risk of exacerbating housing market dynamics or inflation should the economy react more vigorously than anticipated. Conversely, savers and investors face an environment of diminished returns, prompting a reassessment of risk and investment strategies.

Understanding the Global Context

Globally, the RBNZ’s actions reflect a broader trend among central banks to adopt more accommodative monetary policies in response to economic slowdowns exacerbated by the COVID-19 pandemic. This global economic environment, characterized by significant uncertainty and volatility, presents a complex backdrop for policymakers striving to foster sustainable growth.

In conclusion, the RBNZ’s recent decision to cut the OCR and signal further reductions represents a pivotal moment for New Zealand’s economy. It highlights the central bank’s proactive stance in addressing economic headwinds and underscores the ongoing challenges facing global economies in the aftermath of the pandemic. As New Zealand navigates this period of economic recalibration, the impacts of the RBNZ’s dovish turn will be closely monitored by market participants and policymakers alike, with implications for financial markets, economic growth, and the broader global economic landscape.