In the ever-evolving sphere of cryptocurrencies, recent weeks have brought a cautiously optimistic air into the market. Following months of volatility and uncertainty, a newfound stability has emerged, sparked in part by geopolitical developments and strategic buying behaviours. This article delves deep into the current state of the cryptocurrency market, shedding light on the factors influencing its fluctuating dynamics and offering insights for both seasoned traders and newcomers alike.

The cryptocurrency landscape witnessed a slight reprieve as news broke of a ceasefire between Israel and Iran, a pivotal moment amidst rising geopolitical tensions that had cast a long shadow over the digital asset realm. Before this ceasefire, the market was on a steady decline throughout June. Yet, the narrative began to shift following a statement on social media by Donald Trump, inviting a resurgence of interest in cryptocurrencies. Institutional investors, in particular, saw an opportunity amidst the chaos, choosing this moment to bolster their positions predominantly in Bitcoin.

This strategic institutional buying propelled Bitcoin’s market dominance to a staggering 65%, a figure not seen since January 2021. This resurgence is noteworthy, considering Bitcoin’s resilience during these turbulent times, maintaining a valuation exceeding $100,000 even amid peak geopolitical disruptions. The ceasefire, albeit provisional, has kindled optimism, catalysing a renewed interest in altcoins over the last day.

Nevertheless, the permanence of this ceasefire remains a question, casting a shadow of uncertainty over the future market movements. Should geopolitical tensions significantly subside, the market’s focus might shift towards other pressing global and domestic issues, potentially unlocking further capital flows into the altcoin sector, which has borne the brunt of recent market anxieties.

A crucial metric in the coming days will be Bitcoin’s market dominance. A potential slip below the 62% threshold could signal a weakening in its recent bullish trend, possibly indicating a broader reallocation of funds towards altcoins. Moreover, a sustained easing of geopolitical tensions could pivot investors’ attention back to broader financial indicators such as inflation rates and job growth in major economies like the US. Speculation around a possible rate cut by the Federal Reserve in July adds another layer of complexity to the investment landscape. Any indications of a softer policy stance from the Fed could invigorate the crypto market, sparking a relief rally.

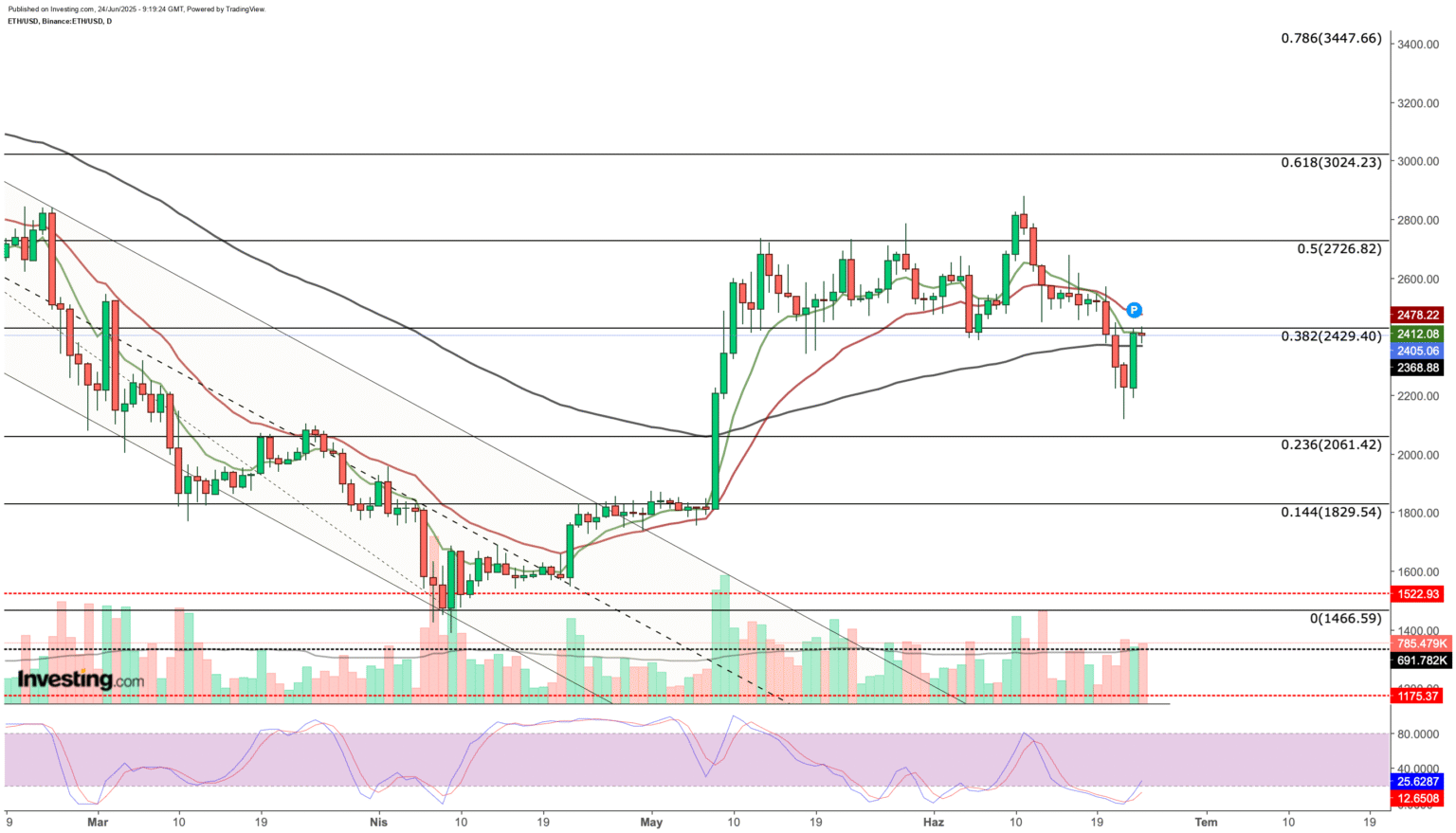

Despite this cautiously optimistic outlook, the inherent volatility of global geopolitics and the economic landscape suggests that the market could swiftly pivot. In such an unpredictable environment, due diligence and a keen eye on support and resistance levels become paramount for investors navigating the crypto market.

Recent market movements have seen altcoins such as Ethereum, XRP, and SUI attempting to rebound. Ethereum, in particular, is on the cusp of breaking through crucial resistance levels, aiming to reestablish its presence in a higher trading range. XRP, maintaining support at $2, shows potential for an upward trajectory, while SUI seeks to reaffirm its position above critical support zones after a volatile period.

In conclusion, the current state of the cryptocurrency market is a reflection of the intricate interplay between geopolitical developments, institutional strategies, and macroeconomic indicators. For investors and traders, staying informed and agile is key to navigating this complex landscape. Services such as InvestingPro offer a comprehensive toolkit, leveraging AI and in-depth analysis to guide investment decisions and unearth potential market winners amid the chaos.

Remember, the world of cryptocurrencies is fraught with risk and uncertainty. Any investment decision carries inherent risk and should be approached with caution and thorough research. The market’s future is unpredictable, and while opportunities abound, they come with their share of challenges. Stay informed, stay cautious, and most importantly, stay nimble in the fast-paced world of crypto investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, nor does it solicit, recommend, or encourage investment in any asset. Investing in cryptocurrencies is highly speculative and carries significant risk. The responsibility for investment decisions lies solely with the investor.