In recent years, the burgeoning economic rivalry between the United States and China has intensified, with implications that resonate globally. At the heart of this contest lies a series of aggressive trade policies enacted by the US under the leadership of President Donald Trump. His administration’s decision to impose tariffs on Chinese imports marked a significant escalation in the trade war, aiming to curtail China’s economic dominance. However, China’s internal economic policies, under the stewardship of President Xi Jinping, might be contributing as much, if not more, to the country’s economic challenges.

President Trump’s strategy was clear: to destabilize China’s economy, Asia’s largest, by implementing tariffs that would make importing goods to the US prohibitively expensive. The tariffs, which at one point reached a staggering 145% before settling at 30%, created conditions akin to those seen during the era of the Smoot-Hawley Act, a period characterized by trade protectionism. While these tariffs undoubtedly strained China’s economy, they were perhaps not the singular force affecting its economic growth.

President Xi Jinping’s tenure has been marked by a notable commitment to transforming China into a global superpower. Since ascending to power in 2013, Xi has pursued a vision of making the market forces play a “decisive role” in shaping the economy. Yet, this journey has been far from smooth. A combination of longstanding policies and emerging challenges has hindered China’s potential for economic growth, notably through suppressing consumer spending—a critical driver of a healthy economy.

The Chinese consumer market has shown signs of chronic weakness, with consumer spending struggling to gain momentum sustainably. This phenomenon can be partly attributed to the Chinese populace’s tendency to save rather than spend, fueled by the lack of a robust social security safety net. Despite attempts to incentivize spending, Xi’s efforts have yet to address the root causes of this reluctance effectively.

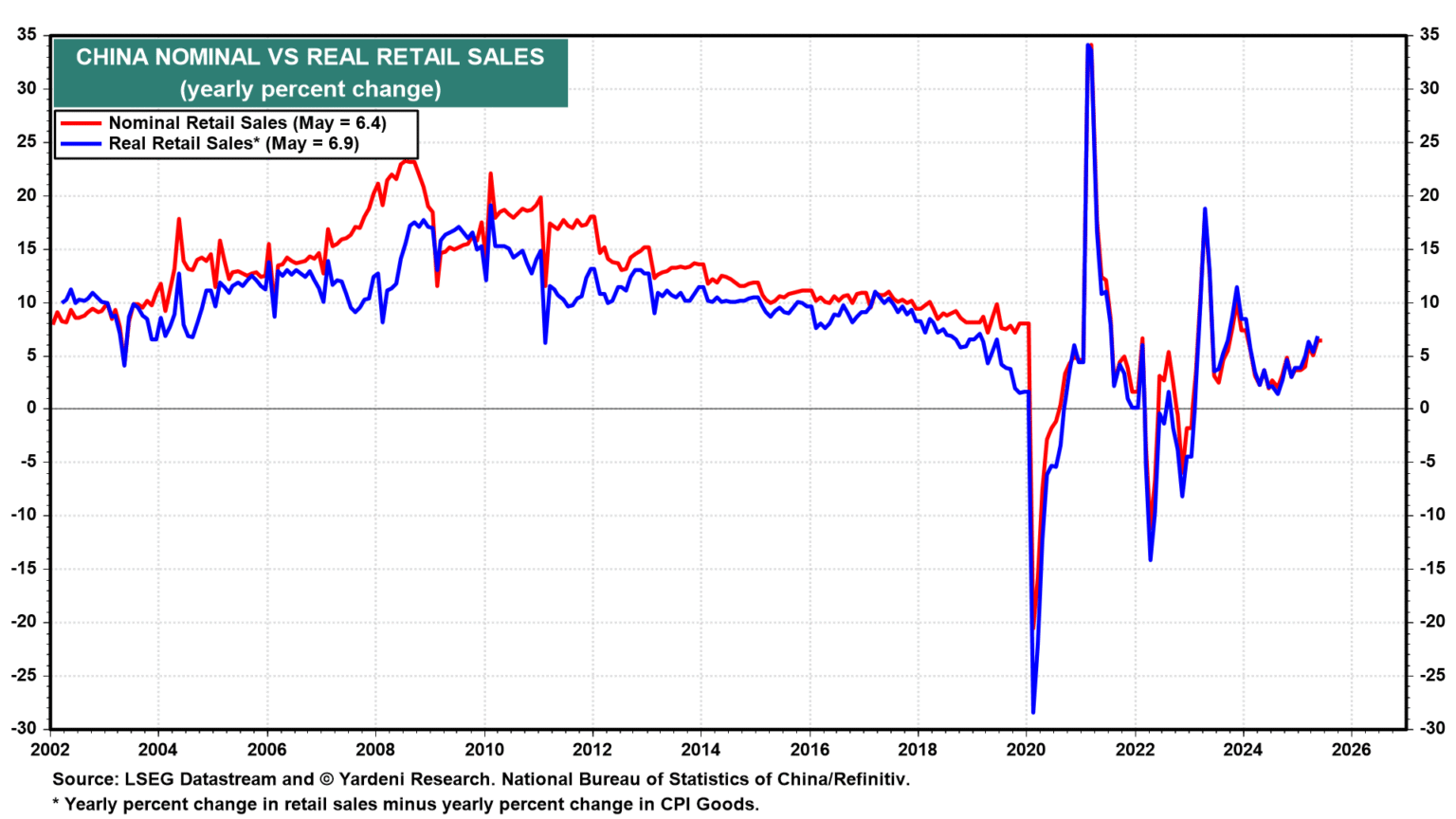

Occasionally, state media in China heralds economic statistics as indicators of forthcoming consumption booms, such as a notable 6.4% year-on-year rise in particular economic indicators. However, these instances appear more as temporary spikes rather than signs of a consistent upward trajectory. Various government initiatives, including central bank easing and subsidies for purchasing home appliances and technology goods, have been implemented to counteract deflationary pressures and encourage consumer spending. Yet, these measures often feel like palliative solutions that do not tackle the underlying economic challenges.

The economy’s underlying conditions, such as weak consumer confidence exacerbating deflation, remain significant concerns. Despite the government’s stimulus efforts, consumer prices fell for several consecutive months, with certain sectors like the automotive industry contributing to the deflation trend through intense price competition.

Other persistent issues plaguing the Chinese economy include sluggish wage growth across multiple sectors, plummeting real estate values, and an unbalanced economic growth heavily skewed towards certain top-tier cities at the expense of broader, more inclusive development. These challenges compound the difficulties in stimulating domestic demand and shifting the economy away from its reliance on exports and investment towards consumption-led growth.

Amid these economic trials, some bright spots, such as the advancements in the “Made in China 2025” initiative, have emerged. This strategy aims to elevate China’s standing in key high-tech industries, including artificial intelligence, biotechnology, and electric vehicles. Yet, the broader economic landscape remains overshadowed by the pressing need for more profound, structural reforms.

The calls for reform are not new. International bodies like the International Monetary Fund have long advocated for policies that would enhance household confidence and stimulate consumption. Such reforms include improving unemployment and health insurance benefits, addressing the productivity gap between state-owned and private enterprises, and contemplating adjustments to the retirement age to counteract an aging population. China’s demographic challenges, with a population projected to shrink in the coming years, further underscore the urgency of these reforms.

Tariff policies, both from the US and potentially from other trading partners, represent an external wildcard that could exacerbate these domestic challenges. Trump’s unpredictable tariff strategy has already placed additional pressure on China’s export-driven economy. Yet, the deeper, more systemic issues lie within China’s borders—stifled consumer spending, lagging wage growth, declining real estate values, and an aging population.

To ignite a more vibrant domestic economy, China faces a critical crossroads: continue down the path of incremental, cautious policymaking, or embrace more radical reforms that could unlock the full potential of its consumer base. The experiences of countries like Japan, which suffered a “lost decade” due to hesitancy in addressing structural economic issues, provide a cautionary tale of what might lie ahead if decisive actions are not taken. Bolstering the social safety net, encouraging consumer confidence, and fostering a more balanced, consumption-led growth model are steps that could chart a new, more prosperous course for China’s economy.