In today’s financial climate, we’re witnessing an extraordinary surge in market allocations, underscoring a pivotal moment of heightened sentiment and speculative action. The essence of what we’re navigating through is not just a mere fluctuation but a profound crossroad that could define the future trajectory of digital assets, particularly Bitcoin, and by extension, the broader expanse of risk assets including the vibrant tech and AI stock sectors.

Historically, Bitcoin has demonstrated characteristics akin to those of a risk asset, mirroring the behavioural patterns seen in liquidity-driven markets and speculative investments. A critical analysis of correlation data alongside indicators of investor sentiment and risk appetite confirms this analogy, particularly drawing parallels with the tech stock market. Recent analytical findings present an undeniable trend: a marked escalation in the levels of greed, speculative ventures, and risk-seeking behaviour amongst investors, especially those focusing on the aforementioned sectors where Bitcoin exhibits a notable correlation.

This phenomenon lays bare a fundamental quandary: Are we on the cusp of witnessing Bitcoin and similar digital assets reach their zenith, possibly indicating a bubble in these risk assets including the exuberant tech/AI stocks? Is this surge an early warning of an impending market correction, a “tripping point” that hints at a market ripe for a downfall? Alternatively, could this be a “tipping point,” signalling the onset of a mass adoption phase for Bitcoin, marking its transition into the mainstream financial world? This stage of rapid embrace could very well resemble the FOMO (Fear Of Missing Out) phase in market cycles, which sees a significant influx of investors.

Discussing the potential of both a tripping and tipping point is intriguing and warranted, given both scenarios present plausible futures based on current market dynamics. This dialogue echoes sentiments previously shared about tech stock valuations, advocating that while valuations reach formidable heights, the undercurrents of strong earnings and speculative mania could potentially sustain and even accelerate market upswings beyond anticipated limits.

Even those with little to no engagement in the Bitcoin/crypto sphere might find it increasingly challenging to remain insulated from its impact. As a barometer of speculative appetites and a constituent of the risk asset category, Bitcoin’s future movements could have wide-ranging implications, not only for technology stocks but for the broader stock market ecosystem.

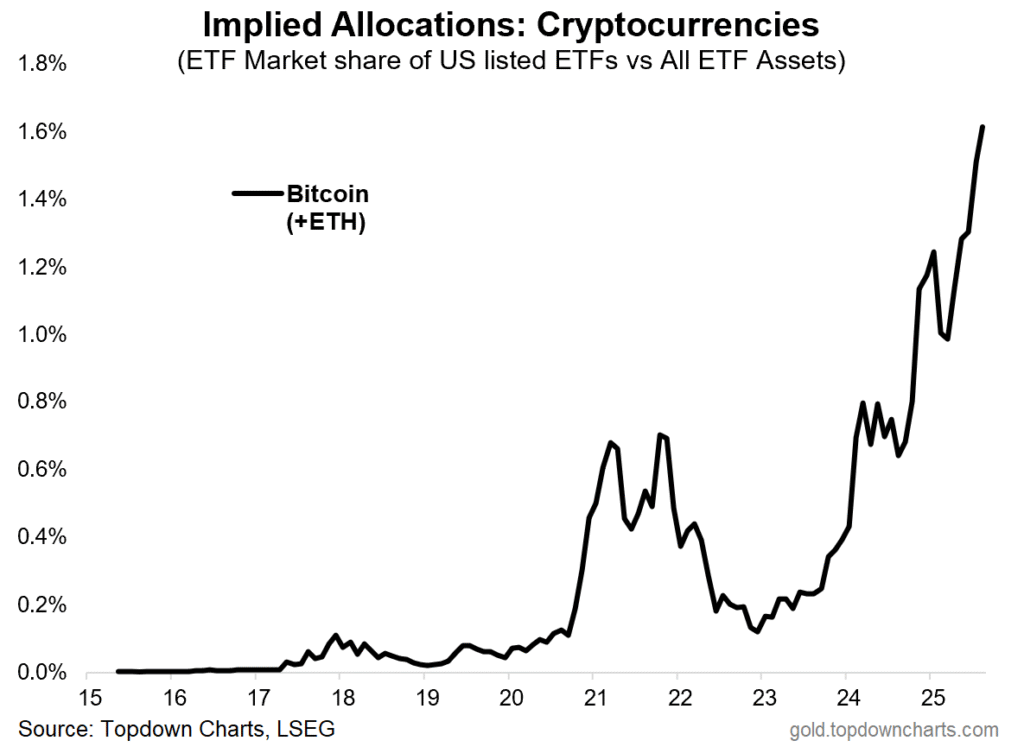

Recent data and surveys provide substantive evidence of this shift towards mass adoption and speculation. A semi-annual Twitter survey, for instance, revealed a significant uptick in both individual and institutional investors allocating investments towards Bitcoin/crypto, highlighting its burgeoning acceptance and mainstream integration. This shift corroborates the burgeoning sentiment and speculative inclinations charted across markets, suggesting a critical phase that may well tip the balance in favour of either sustainable mass adoption or a speculative bubble poised to burst.

Exploring further into related domains, the semiconductor market cap trends offer additional context. They mirror the movements observed in Bitcoin/crypto allocations, unveiling speculative fervours and potentially reshaping what constitutes the ‘new normal’ in this AI-driven epoch. These trends underscore a broader narrative encompassing speculative dynamics and the seemingly inexorable march towards digitalisation and tech integration in financial markets.

Lastly, the synchronised movements of tech stocks and Bitcoin underscore a speculative bull market, reigniting discussions around market correction phases and the resilience of speculative trends. The interconnectedness of these two realms serves as a bellwether for understanding broader market sentiments and the speculative undercurrents propelling them.

In conclusion, as the financial ecosystem grapples with these emergent trends, the pivotal question remains: Are we nearing a moment of reckoning—a tripping point for today’s speculative highs—or embarking on a transformative journey marked by Bitcoin’s tipping point towards universal acceptance? Deciphering this enigma requires a nuanced understanding of market cycles, investor psychology, and the intricate web of factors driving today’s unprecedented market dynamics.