In the current financial landscape, a significant number of investors find themselves navigating through a challenging terrain marked by near-zero or negative real interest rates. This scenario has extensively pushed investors towards exploring higher-risk asset classes, notably including the realm of high-yield, or so-called “junk,” bonds. Unfortunately, even these traditionally higher-yielding assets fail to promise a real return above inflation, which is experiencing a surge to multi-year peaks.

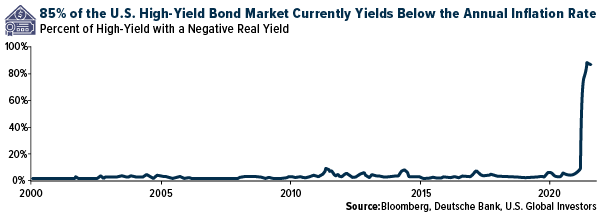

Jim Reid of Deutsche Bank reveals a startling statistic: an overwhelming 85% of the U.S. high-yield bond market is generating yields that fall beneath the annual inflation rate. To put this in perspective, historical records have rarely, if ever, seen this figure exceed a 10% threshold. Moreover, even with a hypothetical reduction of the Consumer Price Index (CPI) from its current rate of 5.4% to 3%, a substantial 35% of the high-yield market would still underperform against inflation.

[Image depicting the proportion of the U.S. High-Yield Bond Market Yielding Below the Inflation Rate]

This phenomenon is not confined to the United States. For the first time, inflation-adjusted yields on European junk-rated bonds have dipped into negative territory, following a decade-high spike in consumer prices across Europe.

[Image showing Negative Real Yields on European Junk Debt]

Parallel to the underwhelming performance of bonds, stock markets have seen appreciable gains so far this year. Notwithstanding, this upswing has rendered dividend yields less attractive. Highlighting this, the dividend yield of the S&P 500 plunged to a near 20-year low of 1.32% as of the last reporting, falling conspicuously below the prevailing annual inflation rate.

[Image indicating the Historical Low in S&P 500 Dividend Yield]

Faced with diminishing yields across traditional assets, some investors have cast their gaze towards cryptocurrency lending as an alternative avenue for yield generation. Crypto lending allows investors to earn interest on their crypto holdings by lending them out, paralleling the securities lending market. Many online platforms have embraced this model, providing their users an option to lend their cryptocurrencies in exchange for yield.

However, this burgeoning interest has hit a regulatory snag in the United States. Coinbase, the nation’s largest cryptocurrency exchange, encountered a significant hurdle as it attempted to introduce its own crypto lending platform. Despite months of preparation, the Securities and Exchange Commission (SEC) issued a stern warning, intimating that the launch of Coinbase’s “Lend” program would prompt legal action. Adding to the complexity, the SEC has not clarified which specific laws would be violated or how Coinbase could align the Lend program with federal securities legislation. According to Paul Grewal, Coinbase’s Chief Legal Officer, the company is left to decide between indefinitely postponing the Lend service without clarity or facing litigation.

In a landscape muddied by regulatory uncertainties, the quest for yield remains a formidable challenge for investors. This illustrates the pressing need for sensible, clear regulatory frameworks that not only protect consumers but also support innovation and fair competition in the financial markets. The analogy of a basketball game eloquently captures the essence of this predicament: without referees (regulations), the game (market) may succumb to chaos, yet an excess of arbitrary and unclear rules only stifles play.

Disclosures: The insights and data shared in this article are presented with the intention of informing and are not a recommendation for any specific investment strategy. External links are provided for further information; however, the content and accuracy of these external sources are not endorsed or guaranteed.

The financial indices mentioned, such as the S&P 500 and the Bloomberg Pan-European High Yield Index, serve as benchmarks for analyzing market trends but do not directly suggest investment recommendations. The Consumer Price Index (CPI) and the Harmonized Index of Consumer Prices (HICP) are critical measures for assessing inflation, offering a glimpse into the economic health and consumer cost pressures across geographies. The dividend yield is a financial ratio indicating how much a company pays out in dividends relative to its stock price, serving as a key metric for yield-focused investors.

The dialogue around yield in today’s economic climate reveals a complex interplay between inflation, market performance, and regulatory action, underscoring the intricate balance required to foster a thriving, innovative financial landscape while safeguarding investor interests.