In the ever-evolving landscape of finance, a fascinating dynamic is unfolding—a narrative filled with the ebbs and flows of interest rates and the consequent ascent of bond markets. With 2023 upon us, navigating these financial waters requires insight and foresight, especially as we stand on the precipice of transformative shifts in monetary policy and market behavior.

Our story begins with an assertion poised to capture the attention of investors and financial aficionados alike: interest rates are on a downward trajectory, anticipated to plummet further than the common forecasts suggest. This projection introduces a realm wherein bonds, including certain bond funds offering a tantalizing 8.7% yield, are on the cusp of experiencing an unprecedented surge.

The fundamental equation at the heart of this discourse is a simple yet profound truth often overlooked amidst the cacophony of market speculation: when interest rates decline, bond values ascend. It’s a principle that seems to have been cast aside, especially in light of widespread discussions revolving around tariffs and their inflationary repercussions.

However, the wheels of change are in motion, steering us into a new era dominated not by traditional central banking policies but by the directives issued from the Treasury. With Scott Bessent now at the helm as the Treasury Secretary, an entirely new approach to rates is being unveiled, rendering the Federal Reserve’s stance almost secondary, particularly the views of its Chair, Jay Powell.

Bessent’s tenure is shadowed by the colossal task of managing the $7 trillion public debt awaiting refinancing within the coming year. His strategy? To engineer a reduction in the 10-year Treasury yield, a fundamental benchmark that dictates the pulse of borrowing costs across the consumer and business landscape. In a turn of events echoing the broader administration’s goals, Bessent, alongside the President, aims to recalibrate the financial narrative towards lower interest rates—an ambition that, if successful, could redefine market trajectories.

The approach to achieve such an ambitious goal is multifaceted, encompassing tariffs (which contrary to popular belief, may not exert inflationary pressures given their drag on economic growth), efforts to decrease energy costs through increased drilling, and a staunch commitment towards deregulation. These strategies, coupled with an anticipated softening of the labor market, paint a picture of a potentially moderated economic climate, ripe for the flourishing of bond markets.

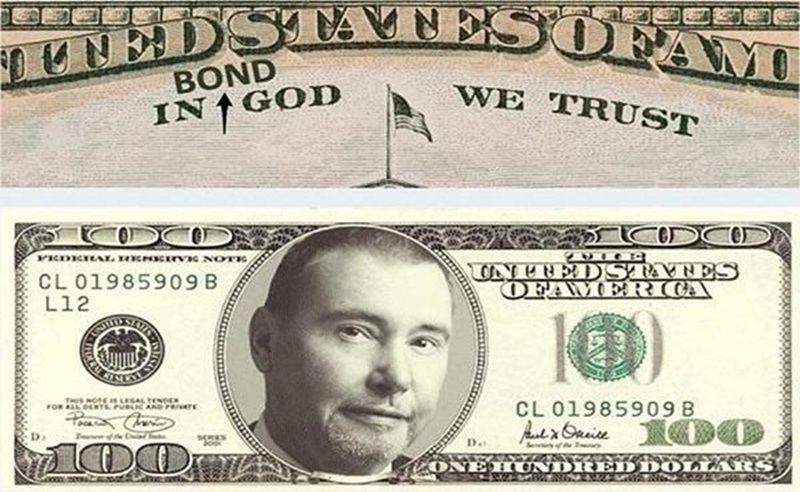

Amidst this backdrop of strategic financial maneuvering and policy reorientation, bonds, particularly those of a certain caliber and yield, emerge as beacons of opportunity. It is here that the DoubleLine Income Solutions Fund, under the stewardship of the so-called ‘Bond God’ Jeffrey Gundlach, comes into focus. Gundlach’s portfolio, laden with below-investment-grade bonds and a smattering of unrated securities, embodies the essence of contrarian investing—a testament to the profound understanding that true value often lies in the uncharted territories of the market.

Gundlach, renowned for his prescient market predictions, including the financial crisis of 2008/09 and the electoral outcomes of 2016, commands a portfolio that not only challenges conventional wisdom but also offers a refuge in tumultuous times. With a strategy that capitalizes on falling interest rates, the fund not only promises higher yields but embraces a vision that sees beyond the immediate horizon.

As 2023 unfolds, the narrative of interest rates and bonds is more than a tale of financial metrics and market dynamics; it’s a story of strategic foresight, contrarian wisdom, and the enduring search for value in a world brimming with uncertainty. With Bessent steering the ship towards uncharted territories, and Gundlach navigating the currents of the bond market, the journey ahead promises to be both intriguing and rewarding for those willing to look beyond the conventional wisdom that has long dominated the financial landscape.