In the vibrant and fluctuating world of finance, the decision made by Moody’s to adjust the credit rating of the U.S. Treasury debt has sparked considerable dialogue and speculation. This pivotal event, which took place on the 16th of May, 2025, after the close of the market, saw the credit rating being downgraded from its Aaa level. Such a maneuver was not merely incidental but appeared deeply intertwined with the fiscal tensions surrounding the Trump Administration’s proposed tax and budget legislation. The preceding week had witnessed notable resistance from Republican members of Congress, an aspect that arguably laid the groundwork for Moody’s decisive action.

The interplay of politics and economic strategy is nothing new, yet the intricacies of the negotiations surrounding major Congressional bills seem to have reached a critical juncture. Moody’s, in its assessment, perhaps saw the continuation of a pattern of expenditure that warranted a reevaluation. The impassioned critique by Texas Representative Chip Roy (R., Tx) on major news networks, decrying the proposed fiscal measures, could very well have been the catalyst contributing to Moody’s reassessment.

Amid these discordant tunes lies the contentious issue of Medicaid, alongside the State and Local Tax deductions (SALT) to a lesser extent. With proposed Medicaid spending cuts amounting to $880 billion intended to finance parts of a $1 trillion defense bill and anticipated tax cuts, the stakes were undeniably high. The nuances of these financial re-arrangements open a window into the complex balancing acts required to manage national expenditure and revenue.

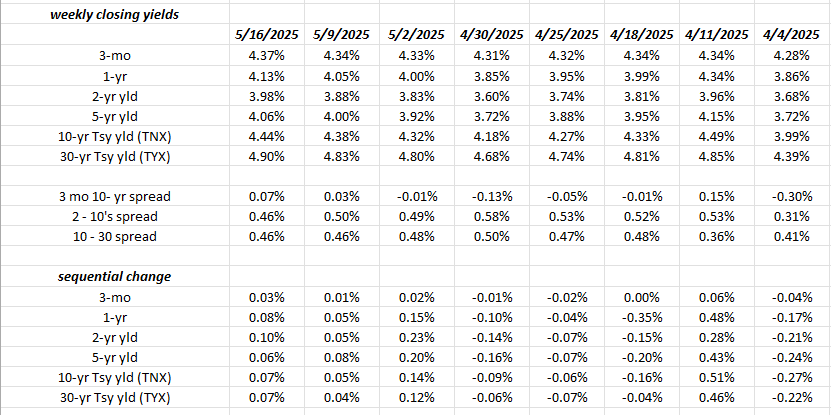

The illustration of the Treasury yield curve, updated weekly, offers a quantifiable glimpse into investor sentiment and market dynamics, pertinent since the so-called ‘Liberation Day’ sell-off in early April 2025. A subsequent surge in Treasury yields in mid-April, followed by a plateau, encapsulates the market’s response to unfolding economic policies and their perceived implications. Questions now linger on how the credit rating downgrade may influence the resilience of the 10-year and 30-year Treasury bond yields, previously bounded by rates of 4.5% and 5% respectively. Historical data suggests these benchmarks as critical resistance points, yet market dynamics in the wake of such fiscal discourse suggest an evolving scenario.

The unfolding of economic indicators throughout 2025 has, to some, held surprises – particularly in the realms of inflation and core Personal Consumption Expenditures (PCE) data. These indices, reflective of the broader economic climate, had shown encouraging signs up until the recent upheaval. In a scenario devoid of the market turbulence introduced by ‘Liberation Day’, one might have envisioned a closer move towards a reduction in the federal funds rate, spearheaded by the Federal Open Market Committee (FOMC) and its Chair, Jay Powell. However, the interjection of tariffs into the economic equation reiterates the delicate balance between fiscal policy and its inflationary impacts, thereby complicating the central bank’s stance.

Notably, the market’s reaction, juxtaposed against the broader economic narrative, offers insights into investor confidence and risk perception. The resilience of high-yield credit spreads, despite peaking during the tumultuous week of April 11th, suggests a nuanced investor optimism, albeit clouded by the complexities of Treasury returns.

In dissecting the underpinnings of the fiscal strategy outlined by Treasury Secretary Bessent following ‘Liberation Day’, the ambitious target of reducing the budget deficit from a record 7.5% of GDP to a more manageable 3.5% features prominently. This fiscal recalibration, powered in part by tariff-induced revenues anticipated to be in the $700-$800 billion range post-negotiation, underscores a bold attempt at reining in the budgetary deficit.

The narrative extends beyond domestic policies to the global stage, as evidenced by the President’s trip to Saudi Arabia and subsequent OPEC announcements of significant production cuts. This manoeuvre, interpreted as a bid to temper U.S. inflation and enhance discretionary spending among Americans, embodies the multifaceted approach to fiscal and monetary policy calibration.

The centrality of Treasury debt interest within the U.S. budget highlights the imperative need for strategic adjustments across the board, including potential Federal Reserve actions to adjust the fed funds rate in concert with Medicaid spending reductions. Amidst these strategic shifts, confidence in the Treasury market, high-grade corporate credit, and high-yield bonds remains a focal point of investor strategy, albeit contingent on broader labour market dynamics and the subsequent influence on monetary policy.

A cautious optimism permeates the outlook for Treasuries and the credit market within ’25, tethered to the overarching goal of deficit reduction and its credible execution. Institutional and individual investors alike have adjusted their portfolios, reflecting a strategic pivot in response to unfolding fiscal and monetary policy developments. The divestment from municipal bonds following the election and the shift in Congressional control underscores a broader recalibration within investment strategies, indicative of the dynamic interplay between politics, policy, and the market.

As we stand on the brink of potential fiscal and economic reconfiguration, the path forward is fraught with uncertainty and complexity. The ambitious fiscal targets, intertwined with global economic interactions and inherent market sensitivities, present a challenging yet pivotal moment in economic stewardship. This confluence of policy, politics, and market dynamics encapsulates the intricate dance between governance and financial markets, charting a course through uncharted waters towards fiscal sustainability and economic resilience.

Disclaimer: This contemplation of economic and fiscal dynamics serves as an analytical perspective rather than prescriptive advice. The fluid nature of markets and policy outcomes underscores the speculative essence of such discussions, with past performances not necessarily indicative of future results.

Thank you for engaging with this exploration of fiscal strategy and market dynamics amidst a transformative period in economic governance and policy enactment.