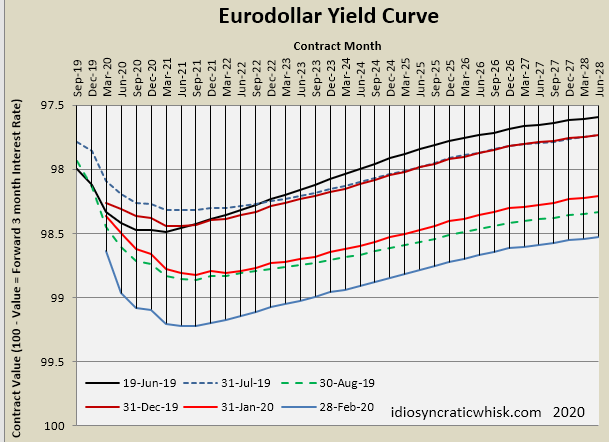

In recent developments, a significant turning point has been reached that may well push the Federal Reserve’s (Fed) inclination towards a more aggressive policy stance into action. The current scenario indicates that the Fed is positioning itself to align with the natural interest rate, potentially reducing it to zero. This move is anticipated to be the harbinger of a conventional economic downturn or recession, reflecting a typical response to the economic cycle. Contrary to what was hoped for, with an expectation of seeing the data points climb, the forecast now seems to lean markedly towards the left. This adjustment is illuminated through a chart that aggregates monthly averages, revealing that the yield has significantly dipped beneath its February marker, highlighted in red. The anticipation now is that the Fed will make an announcement that aligns with these projections, a move which seems not only advisable but necessary.

To understand these developments, a moment to reflect on the backstory and context might be helpful, especially for those not closely following economic news. The Federal Reserve, the central bank of the United States, plays a pivotal role in managing the country’s monetary policy, with its actions having far-reaching implications on economic conditions. Interest rates, set by the Fed, influence borrowing costs, impacting everything from consumer loans to the bond markets. There’s a natural interest rate that’s considered neither stimulative nor restrictive to economic growth, and the Fed adjusts policy rates with this benchmark in mind, aiming to stabilize inflation and sustain employment.

Examining the EuroDollar Yield Curve reveals potential for further gains in long bond positions, despite the overarching expectation of economic contraction. This suggests that, even amidst downturns, selective investment strategies can yield positive outcomes. On the other hand, the housing market exhibits a bullish trend and seems to maintain a defensive posture in the face of current financial fluctuations, offering a relatively safe haven for investors.

However, when it comes to other asset classes, the situation appears less clear-cut. Stock markets may experience declines, potentially entering bear market territory, although a precipitous drop is not guaranteed. The volatility anticipated in the stock market, nevertheless, presents a “trader’s market,” where opportunities might arise for acquiring undervalued stocks poised for recovery.

A particular point of interest in this month’s financial review is the behavior of the yield curve. Since early 2019, the short end of the yield curve has been inverted—a condition often interpreted as a precursor to recession. Predictions had placed the nadir of interest rates around September 2021. However, recent data suggests a shift, with potential delays extending the expected low point to late 2021 or even early 2022. This shift indicates a departure from the path to a normalized yield curve, potentially necessitating further intervention by the Fed to gradually elevate interest rates over time.

Amid these deliberations, the emergence of COVID-19 has introduced unprecedented variables into the equation. Despite the considerable drop in yields, primarily at the shorter end of the spectrum, markets seem to anticipate a responsive adjustment by the Fed. Recent trends have shown a slight uplift in the yield curve, moving the anticipated low point of interest rates to June 2021. This adjustment suggests that, despite the adverse developments confirmed by recent indicators—a contraction tied to the yield curve dynamics—the market remains hopeful that the Fed’s responsive measures will mitigate the duration and depth of the pending economic downturn.

The unfolding of these events brings to light the intricate dance between economic indicators, central bank policies, and market reactions. As the landscape evolves, the hope remains that strategic interventions will navigate the economy through challenges, moderating the impact on growth and employment. Observers and participants in the financial markets continue to watch closely, understanding that the decisions made in the coming months will shape the economic trajectory in a post-pandemic world.