In the intricate world of investment, Treasury Inflation-Protected Securities, or TIPS, have emerged as a topic of intense discussion, particularly amidst the current financial climate marked by discussions of inflationary pressures. For those uninitiated or perhaps a bit bewildered by the intricate dance of investments, TIPS offer a fascinating insight into how modern economies attempt to shield savers from the eroding effects of inflation.

The essence of TIPS rests in their unique mechanism designed to adjust an investor’s principal with the ebbs and flows of inflation, as measured by the Consumer Price Index (CPI). This adjustment not only ensures that the purchasing power of the invested funds is preserved but also illustrates a broader commitment by the U.S. Treasury to offer more secure investment avenues in times of economic uncertainty.

For decades, investors have treasured the stability offered by traditional Treasury bonds, which promise a fixed interest return over a specified term. However, the traditional bond market, while reliable, exposes investors to the risk of inflation, which can significantly diminish the real value of their returns over time. It was this limitation that motivated the creation of TIPS, drawing inspiration from a similar model pioneered by Canada. Introduced in the late 1990s, TIPS were specifically designed to combat inflationary losses, ensuring that the invested principal grows in line with inflation, thereby preserving its value in real terms.

The operation of TIPS is quite sophisticated. The bond pays a fixed rate of interest semi-annually, but, unlike traditional bonds, the principal amount to which this interest rate is applied can increase (or decrease) in accordance with the CPI, a measure reflecting changes in the cost of living. At the bond’s maturity, the investor is assured of receiving the higher of either the original principal or the inflation-adjusted principal.

Let’s delve into an illustrative scenario to better understand how this mechanism functions in real life. Consider a TIPS bond with an original principal of $1,000 and a coupon rate of 3.375%. If, over the bond’s term, inflation leads to a 27.09% increase in the CPI, the principal would adjust upwards accordingly, and the cash flows from interest and the final repayment of the principal would also increase, to reflect the inflation impact, thereby safeguarding the investor’s purchasing power.

An additional protective feature of TIPS comes into play in deflationary periods – a scenario that often sends shivers down the spines of economists and policymakers alike. In such cases, TIPS guarantees that the investor will not receive less than the bond’s original principal amount at maturity, a safeguard not typically found in regular bonds.

This backdrop sets the stage for a broader discussion on the current pricing anomalies witnessed in the TIPS market, which have raised more than a few eyebrows amongst investors and market analysts alike. Despite median inflation rates hovering around 2.9%, the 10-year breakeven inflation rate – essentially the market’s inflation expectation over the next decade – has been anomalously low. This divergence has led to real yields on 10-year TIPS turning negative, a scenario that, on the surface, challenges conventional investment wisdom.

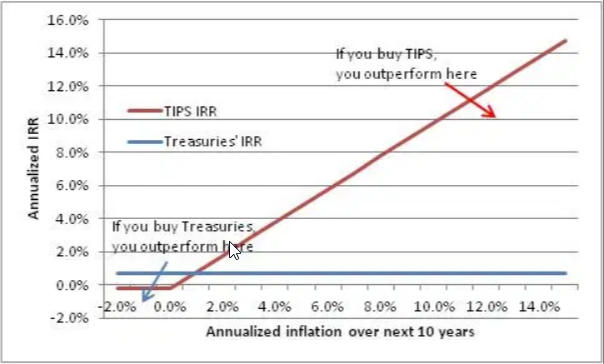

The implications of this situation are multifaceted. If actual inflation exceeds the breakeven rate, TIPS stand to offer superior returns compared to traditional nominal bonds over the same period, providing a clear benefit to investors in an inflationary environment. Conversely, should inflation underperform expectations, TIPS may offer lower yields than their nominal counterparts, although the ‘floor’ mechanism limits the potential downside.

Analyzing the investment landscape through this lens reveals a compelling case for including TIPS in one’s portfolio, especially in a market characterized by the risk of rising inflation. This narrative is underpinned by the notion that TIPS offer an embedded ‘call option’ on inflation, allowing investors to benefit from inflationary pressures without bearing the concomitant risk of principal loss in deflationary times.

Graphical representations of investment returns across varying inflation scenarios starkly illustrate this point, demonstrating that TIPS can provide significant hedging advantages against both inflation and deflation, albeit with nuances in performance depending on the actual inflationary trajectory.

The decision to invest in TIPS, like any investment decision, is not devoid of complexities and requires a nuanced understanding of one’s risk appetite, investment horizon, and broader economic outlook. However, in an era marked by significant fiscal stimuli and monetary easing, the spectre of inflation looms large, making the case for TIPS not just compelling, but, perhaps, essential for preserving the value of one’s investments in real terms.

In conclusion, while the peculiarities of current TIPS pricing may seem baffling at first glance, a deeper exploration reveals a logical underpinning, grounded in the unique attributes and protections that these instruments offer. In navigating the uncertain waters of today’s economic environment, TIPS stand out not only as a beacon of security but, importantly, as a testament to the innovations in financial markets aimed at protecting investors from the age-old adversary of inflation.