In the intricate world of investments, Global High Yield Bond Funds stand out as vehicles investing in a broad spectrum of bonds. These bonds, issued predominantly by companies and, on occasion, governments across the globe, are distinguished by their ratings. Falling below what is traditionally considered investment grade, specifically BB/Ba or lesser ratings, they offer appealing higher interest rates. This allure stems from the elevated credit risk they bear, a trade-off many investors are willing to make in pursuit of greater returns.

Reflecting on the past year, my initial apprehension towards the high yield sector was palpable. This hesitance was grounded in the prediction that an increasing number of corporations would seek to refinance their debt in the high-yield markets in the ensuing years, with refinancing demands predicted to surge until the end of this decade. As inflation persists, one can logically infer that refinancing rates may maintain their upward trajectory alongside it.

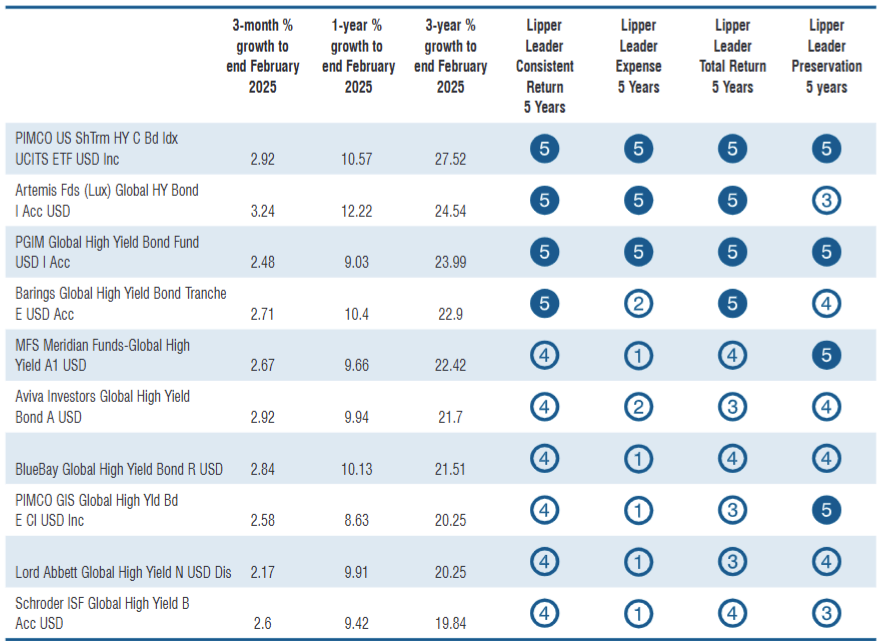

Despite these concerns, the sector has demonstrated resilient performance. In a comparative analysis of various bond sectors over the preceding year, high yield investments not only held their ground but, in fact, exceeded expectations in terms of performance. This outstripping was evident even against global , although both sectors have yielded admirable returns, with the latter recording a commendable 8.67% in the twelve months leading to February’s close. In the same timeframe, the Global Corporate Bond sector logged a lesser, yet decent, return of 6.81%.

One might wonder if my initial caution was an oversight, perhaps even a significant underestimation of the sector’s potential. Or, conversely, is the current optimism surrounding high yield bonds akin to a fleeting, perilous exuberance?

Market movements over the past year provide some insight, with Global High Yield attracting a modest influx of £84m in investments. While seemingly minimal, especially when considering the extravagant costs in today’s metropolitan locales like central London, this figure is not to be dismissed outright. Over a three-year horizon, despite generating respectable returns of 18.23%, the sector faced significant withdrawals, totalling £5.5bn. This highlights a critical lesson: market consensus, much like history, is not infallible, fluctuating from the tulip mania to the dot-com bubble.

However, to offer a counterbalance, it is crucial to acknowledge certain facts. A future spike in refinancing is anticipated, yet, the financial health of high-yield issuers appears robust, with a general improvement in credit quality. A significant portion of these investments, averaging 83%, is allocated in bonds rated at B or BB, representing the upper echelons of the high-yield spectrum. This metric underscores a fundamental resilience within the sector, though whether it is sufficient to withstand potential refinancing challenges at elevated rates amidst persistent inflation remains an open question.

In an era marked by decelerating economic growth, a scenario underscored by the International Monetary Fund’s recent forecasts, high yield bonds might offer a safer harbour than equities, traditionally seen as the vanguard of growth assets. For high-yield bonds, the prerequisite for success isn’t necessarily growth but the consistent fulfilment of payment obligations.

Nonetheless, it’s prudent to consider economic risks that could adversely affect investment portfolios. In this context, the performance of specific funds such as the PIMCO US Short Term High Yield Corporate Bond Index UCITS ETF USD Inc stands out. This passively managed fund, short in duration, has shown resilience in the face of rising rates, though it is not immune to future challenges. Interestingly, its exposure to BB and higher-rated credits has slightly decreased from 83% to 79%, indicating a marginal increase in credit risk compared to the overall sector. This movement points to the nuanced dynamics within passive management in high yield investing, particularly around the issue of overexposure to highly indebted entities.

As we navigate the complexities of the investment landscape, the impending refinancing wave looms large. For investors and analysts alike, maintaining vigilance and a balanced perspective on the dynamic high yield bond market remains paramount. Through careful analysis and a nuanced understanding of market trends, investors can navigate the high yield bond sector, balancing risks with the pursuit of rewarding returns. The journey through the high yield landscape, fraught with potential pitfalls and opportunities, underscores the perennial challenge and allure of investment decision-making in an ever-evolving global marketplace.