The eradication of what’s often termed as ‘phantom wealth’ through default represents a critical, albeit drastic, method for purging the financial system of the unsustainable debt loads and entrenched wealth inequalities that chronically ail it. This principle underscores the fundamental notion that the systemic health of global finance deeply intertwines with the mechanisms of debt resolution.

Historically, the belief that the world could persistently escalate its debt profile, provided the cost of borrowing—signified by interest rates—remained at negligible levels, was fundamentally flawed. This misconception hinged on the premise that we could indefinitely leverage future financial capacity to satisfy present excesses, contingent on the progressively diminishing cost of servicing this ever-expanding debt. However, such an approach was inherently precarious.

From the inception of financial systems, dealing with the conundrum of excessive indebtedness has unmistakably relied on the concept of default. Though often cloaked in less alarming terminology, such as debt jubilees or refinancing efforts, the crux remains unchanged: obligations that cannot be fulfilled inevitably lead to losses for the holders of said debt.

Every instance of default serves as a jubilee of sorts for the debtor, liberating them from their repayment duties, albeit transferring the financial strain onto the creditor or debt owner. In a strict sense, each debt write-off necessitates the acceptance of total loss by the creditor, with the fanciful hope of recoupment dimming unless governmental interventions redirect these losses towards the taxpayer through bailouts, thereby socializing the losses.

In essence, the act of default is tantamount to a radical form of refinancing where the repayment obligation is nullified and the asset’s value is obliterated. It’s worth noting that the prerogative of holding debt as an asset is predominantly the domain of the more affluent segments of society. While ordinary households might indirectly possess such assets through pension schemes or mutual funds, the bulk of personal loans, mortgages, and corporate or governmental bonds are disproportionately amassed by the wealthier, rentier class.

The narrative often propagated is that widespread defaults would precipitate economic catastrophe. However, this perspective betrays a misleading simplicity, obscuring the reality that mass defaults would primarily erode the artificial wealth accumulation by the rentier class, who have profited substantially from the global inflation of debt. It invites a reevaluation of the fundamental dynamics of debt, which inherently signifies a transfer of wealth from the borrower to the debt owner.

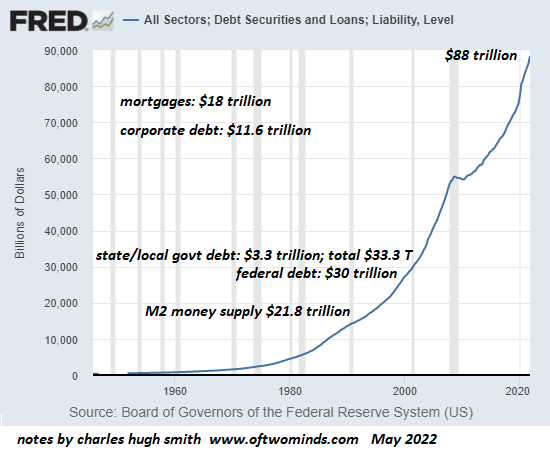

The illusion of a global economy capable of perpetually swelling its debt without consequence was a temporary aberration, grounded in a unique convergence of low interest rates and inflationary conditions. This detachment from reality is coming to an abrupt end as the global appetite for consumption and the requisite financial growth needed to sustain an ever-expanding debt burden diminishes, exposing the $300 trillion global debt as untenable.

Given these circumstances, the conventional stopgaps employed by states, such as monetary expansion or redistributing financial losses to the public ledger, stand on precarious ground. The reawakening of inflationary pressures and a more discerning public sentiment render these approaches increasingly untenable. It underscores a growing awareness and rejection of policies that socialize losses while privatizing profits.

Indeed, the allegiance of state mechanisms to the affluent sectors means that defaults impacting this demographic are vigorously resisted. The expectation traditionally set is for the state to cushion the wealthy from financial losses, perpetuating a cycle of moral hazard.

Explorations into the Core-Periphery dynamic highlight the nuanced ways in which debt relationships manifest across various levels, illuminated in discussions about the European Union’s neofeudal and neocolonial-financialization paradigms. In this framework, defaults exhibit a distinct asymmetry, with certain states possibly navigating defaults through currency devaluation strategies, while most others face the stark repercussions of unrestrained monetary expansion.

Debt, thus, reveals itself as a double-edged sword; it simultaneously enables expansive economic activities and ingrains disparities and dependencies that ultimately prove unsustainable when the curtain of default falls. Strip away the ability to borrow, and the fragility of over-leveraged entities is laid bare.

The only sustainable course through the labyrinth of over-indebtedness is a return to living within one’s means, prioritizing income stability and diversification. This approach naturally favors those situated closer to the core of economic stability and diversification, showcasing a stark contrast against those tethered to volatile income sources.

In conclusion, confronting the spectre of ‘phantom wealth’ and the overbearing dominance of rentier interests through defaults appears not only as an inevitable resolution to systemic over-leverage but as a necessary recalibration of financial systems gravely out of balance. As we stand on the precipice of potentially monumental defaults—estimations suggest at least $100 trillion of the global debt pie may evaporate—it prompts a critical inquiry into who will ultimately bear the brunt of these losses. The choices made in this regard could either pave the way for a more equitable financial future or precipitate further crises through socio-political upheavals or monetary collapse.