In recent times, the global oil markets have experienced a remarkable period of stabilization, notably oscillating within a defined range of $65.50 to $70. This phenomenon followed a tumultuous phase where geopolitical unrest significantly impacted commodity prices. Over the past month, this newfound calm has replaced the turbulence initially stoked by conflicts, particularly noting the downturn in energy commodity prices that took root around 2025. As we ventured into June, there seemed to be a shift in momentum; however, a clear trend has yet to materialize amid this backdrop of uncertainty.

This period of tranquility has, however, been underpinned by ongoing geopolitical tensions, with renewed conflicts in the Middle East and the frustrating stalemate in negotiations between Ukraine and Russia. Despite these undercurrents, oil prices have not seen a dramatic escalation beyond the range mentioned earlier.

An In-Depth Analysis of US Oil Markets Across Various Timeframes

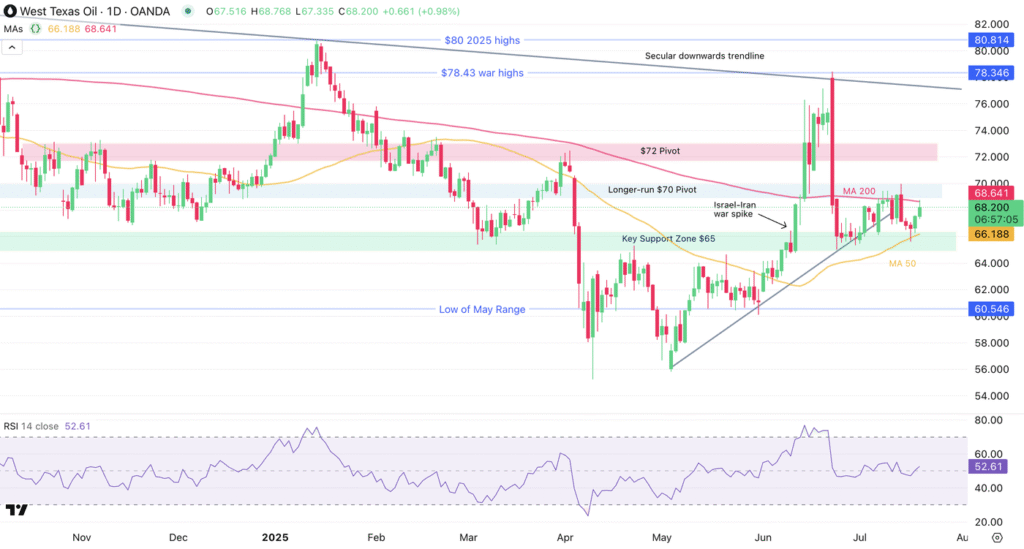

Delving deeper into the intricacies of the oil markets through multi-timeframe technical analysis offers unique insights. According to data sourced from TradingView, we observe that oil prices have been navigating between two pivotal moving averages (MAs), with the 50-day MA providing support and the 200-day MA posing as a significant barrier to upward movements.

The price peaks close to $79 observed in late June were followed by a reversal, casting a shadow of ambiguity over market participants. Counteractions near these levels have led to fluctuations around a neutral zone, despite the moving averages serving pivotal roles. Market sentiment, as per these observations, leans towards optimism, albeit laced with a degree of caution as stakeholders await further developments, especially concerning tariffs imposed during the Trump administration. Moreover, the impact of previously depressed oil prices has prompted shale producers in the US to cut back on North American output.

A further zoom into the 4-hour chart reveals more details of the range-bound activity, with specific emphasis on the fluctuations between the lows of $65.62 observed on a Wednesday and the highs of $70 recorded on a Monday. This pattern suggests a potential for upward movement, contingent on broader market sentiment and global consumption trends, which generally influence prospects for what is often referred to as ‘Black Gold’.

From Thursday onwards, there has been noticeable buying activity around the principal support zone of $65, suggesting a trajectory towards breaking past the Monday highs to set a new trend. However, should this upward momentum not materialize, the market could continue to witness range-bound prices.

Short-term Outlook and Future Speculations

On an intraday basis, considering the 30-minute chart, the early week’s selling momentum has somewhat eased, giving way to a modest upward reversal. This aligns with observations from broader timeframe analyses, where prices exhibit sensitivity to overbought conditions, tilting the short-term momentum in favor of buyers.

For this bullish momentum to cement itself, breaking above the daily highs of $68.67 becomes crucial. A failure to achieve this could see a reevaluation of the key $65 support zone. While tariff discussions have historically played a significant role in market sentiment, their influence appears to be waning, thus redirecting attention to potential breakouts above $70 or notable drops below critical support levels as pivotal moments for traders.

Conclusion

As global oil markets navigate through these uncertain times, trading cautiously remains the watchword, with keen observation on geopolitical developments and global consumption patterns being paramount. The intricate dance between buyers and sellers, played out against a backdrop of international tensions and policy decisions, continues to shape the narrative in the quest for fresh momentum in oil prices.

Staying informed and prepared for any shifts in market dynamics is essential, as these will significantly impact trading decisions. So, to traders and market observers alike, tread carefully in these uncertain times.