In the ever-fluctuating world of global finance, gold and silver currently find themselves at a crossroads, grappling with the combined forces of a strengthening US dollar, increasing US Treasury yields, and the changing dynamics of geopolitical tensions. These factors are exerting downward pressure on these precious metals, with significant implications for investors and market observers alike. This article aims to unravel the complex interplay of these forces and explore the future outlook for gold and silver prices.

The resurgence of the US dollar and the uptick in Treasury yields are acting as a double whammy for precious metals, which typically do not offer interest returns. This shift has been particularly pronounced in anticipation of the US Federal Reserve’s monetary policy. Market participants are closely watching Fed Chair Jerome Powell for signals that may counter the prevailing expectation of an interest rate hike in the near future. Such a move would keep short-term yields elevated, diminishing the allure of holding non-yielding assets such as gold and silver.

Adding another layer to this intricate scenario is the political maneuvering by former US President Donald Trump, who has been actively advocating for an end to the conflict in Ukraine. This advocacy not only impacts the demand for safe-haven assets like gold but also influences capital flows, especially from Russia. Historically, gold has played a crucial role for Russia in navigating through the challenges posed by banking sanctions and capital controls. However, the prospect of a peaceful resolution in Ukraine could potentially soften Russia’s demand for gold, adding to the bearish sentiment surrounding the precious metal.

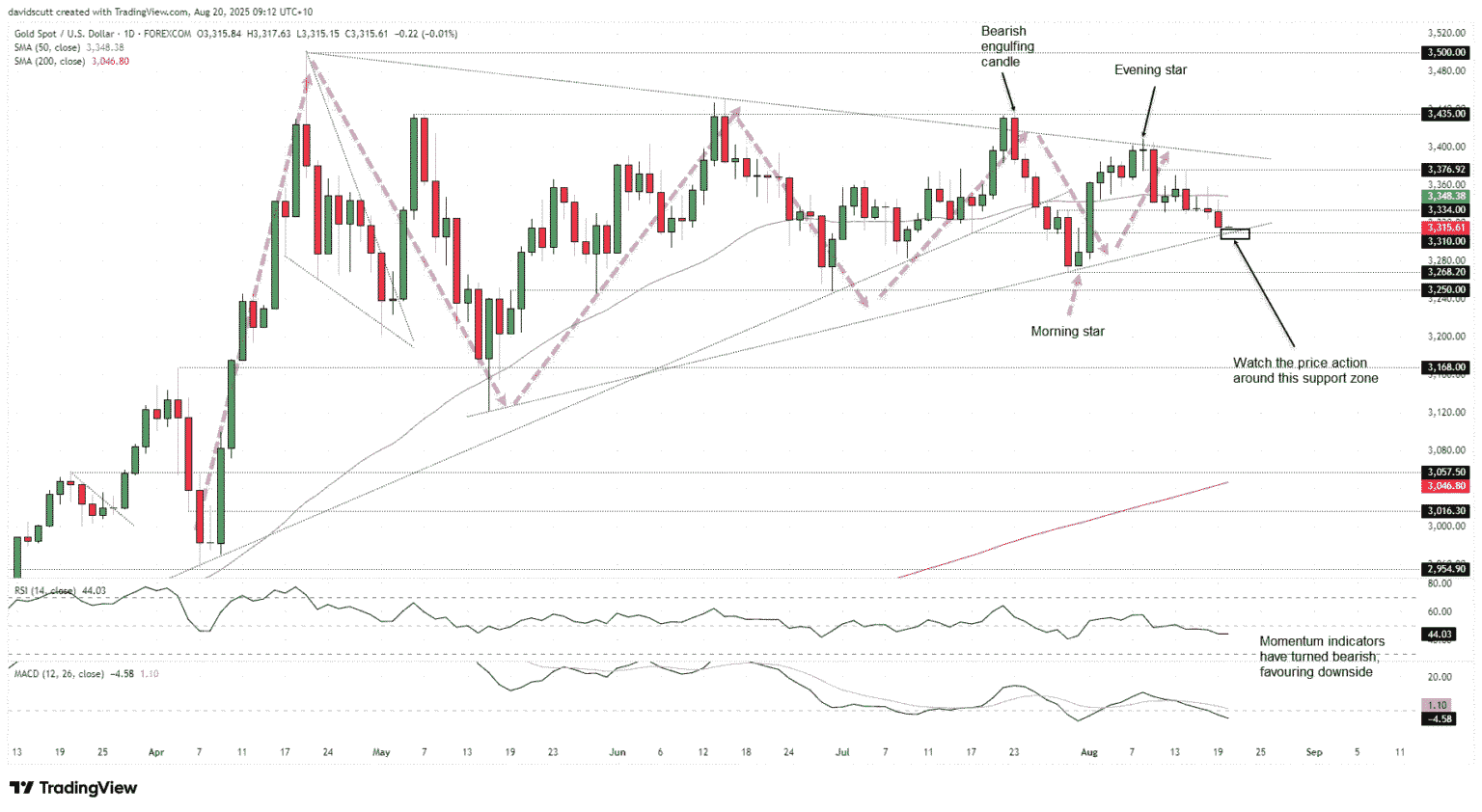

From a technical perspective, the outlook for gold and silver appears to be teetering on the edge. Gold, for instance, is hovering near the brink of crucial support levels, within a pattern that some analysts interpret as a bull pennant, suggesting a potential breakdown could be imminent. A closer examination of its price chart reveals a confluence of support at around $3310, closely aligned with an uptrend from earlier in the year. The absence of a clear signal for a bullish reversal heightens the possibility of gold testing — and possibly breaking below — this critical support zone.

Silver, on the other hand, is currently clinging to its 50-day moving average (DMA), a pivotal level that has historically been a springboard for bullish reversals. Nonetheless, the lack of convincing momentum and the neutral stance of momentum indicators hint at a precarious balance, with the potential for a downward shift. Silver’s failure to maintain above the February 2012 high of $37.46 further underscores the bearish undertones and raises the stakes for its near-term trajectory.

In summary, gold and silver are navigating through a period of heightened uncertainty, influenced by a mix of economic, political, and technical factors. Investors and traders are advised to remain vigilant, as the unfolding dynamics could herald significant price movements for these precious metals. As we inch closer to potential turning points, the ability to interpret and adapt to these complex interdependencies will be paramount in navigating the precious metals market. Whether gold and silver can withstand these pressures or succumb to further declines remains to be seen, but one thing is clear: the path ahead is fraught with challenges and opportunities alike.