Market Dynamics and Structured Analysis of Silver Trading

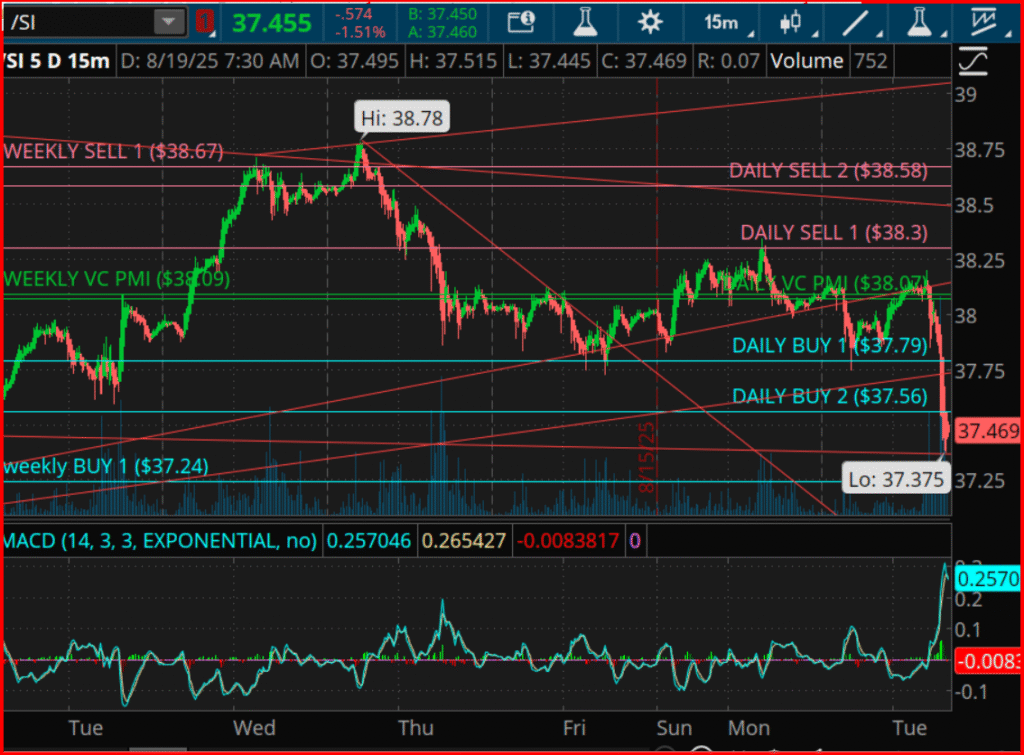

In the ever-evolving commodities market, silver continues to capture the attention of traders and investors alike. Currently trading at $37.455, silver has seen a decline of 1.51%, a continuation of its retraction from the peak of $38.78 reached on 7th August. This downturn was anticipated as the price approached the Daily Sell 2 ($38.58) level, forging a convergence of resistance that enabled sellers to reclaim dominance in the market.

When analysing from a perspective of short-term mean reversion, we observe that the price has descended below two pivotal equilibrium points: the Daily VC PMI ($38.07) and the Weekly VC PMI ($38.09), which now act as barriers of overhead resistance. Given the market’s current trajectory towards the Daily Buy 2 ($37.56) zone, with a momentum inching closer to the Weekly Buy 1 ($37.24), this alignment signifies that silver is in a corrective phase within an overarching cycle. The timing and price harmonics hint at an approaching inflection point as we head towards the latter part of August into September.

This phenomenon in silver trading can best be understood through the lens of the VC PMI Daily & Weekly Alignment, which highlights the Weekly VC PMI at $38.09 representing a neutral balance level, with prices below it indicating a bearish slant. Furthermore, the Daily VC PMI at $38.07 suggests that failing to sustain this level corroborates intraday selling pressure. As it stands, with prices testing the Daily Buy 1 ($37.79) and Buy 2 ($37.56) zones, a reversal at these junctures might present a quintessential mean reversion opportunity. Notably, the Weekly Buy 1 ($37.24) marks a crucial structural support point; a close beneath this threshold could expose the market to deeper declines.

A fascinating aspect to consider is the application of Gann’s 360-Day Cycle Progression in analyzing silver prices. According to this model, the major cycle anchor is poised for 28th September 2024, marking a pivotal low from which silver initiated its current yearly cycle. This progression is segmented into quarters, each playing a significant role in the cycle’s dynamics. Notably, the 360° Full Cycle Completion is projected for 28th September 2025, earmarking the anticipated completion of this cycle.

This cyclical analysis is pivotal, especially when taking into account that the 7th August high at $38.78 concurs with the final pre-cycle top window (21st–28th August), according to Gann’s time-price harmonics. Subsequently, this heralds the market’s entry into the final downward phase leading to the 28th September cycle low. While short-term rebounds are plausible, the prevailing cycle pressure is downwards into late September, rendering any rallies towards $38.07–$38.30 as potential selling opportunities, unless a closure above the Weekly VC PMI is achieved.

Further insights can be gleaned from exploring the Square of 9 and price geometry in relation to silver trading. The August high of $38.78 is nearly aligned to a 90° resistance rotation from the September 2024 anchor within the Square of 9 spiral. Current downside targets such as $37.56 and $37.24 find themselves on harmonic support levels, with $36.90 being the subsequent geometric extension if these are breached. This intimates that the $37.24 pivot isn’t just a mere VC PMI level but also represents a crucial time-price confluence zone.

Addressing potential trading strategies and their probability outlooks highlights two primary scenarios. A bullish scenario, where a reversal from $37.56–$37.24 might trigger a mean reversion rally back to equilibrium at $38.07–$38.30, boasts a probability of 65% if the support holds. Conversely, a bearish outlook suggests that a decisive breach and closure below $37.24 could pave the way to $36.90–$36.50 leading up to the 28th September cycle low, with a 70% probability if momentum escalates.

Looking forward, an anticipation of continued bearish drift into late August prevails. Observers should remain vigilant for the ultimate capitulation into the 28th September 2025 cycle low, post which silver is expected to commence a formidable new 360-day cycle advance.

In summation, silver is navigating through the final descent of the 360-day cycle that commenced on 28th September 2024. The high on 7th August at $38.78 marked the terminal pre-cycle peak, with prices now gravitating towards the $37.56–$37.24 support band. Despite the likelihood of mean reversion rallies from this zone, the predominant cycle suggests that a prevailing weakness will persist until late September. Traders should brace for a conclusive low around 28th September 2025, potentially ushering in a significant bullish reversal as Q4 2025 approaches and thereafter.

This narrative underlines the essence of informed decision-making in trading—highlighting the importance of understanding market dynamics, historical analysis, and embracing a forward-looking approach to navigate the intricacies of commodity trading effectively. It is imperative to acknowledge that trading derivatives, financial instruments, and precious metals involves substantial risk of loss and is not suitable for every investor. Past performance, as illustrated, is not necessarily indicative of future results, underscoring the need for a cautious and well-informed trading strategy in the volatile commodities market.