The intricate dance of gold prices on the global market stage is taking a dramatic turn as the precious metal approaches a pivotal junction in its price trajectory. Over the past few months, the lustrous asset has been caught in a web of fluctuation, channeling between critical price levels that might soon lead to a significant breakout. For investors and traders keeping a keen eye on gold’s performance, understanding the nuances of this oscillation is crucial.

### The Crux of Gold’s Pricing Dynamics

Gold has historically been a beacon of value, often sought after during times of economic uncertainty and a preferred choice for diversifying investment portfolios. After a robust start to the year, the price dynamics of gold have somewhat plateaued, leading to a conundrum wrapped in a narrowing trading range. At the heart of this predicament lies the interaction between uptrend support and horizontal resistance.

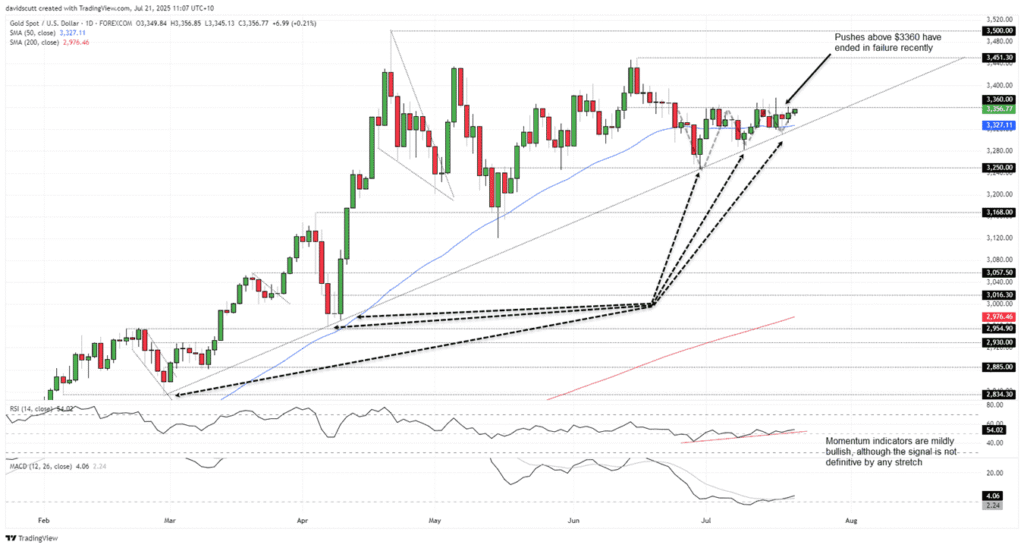

Trading patterns reveal that gold has been oscillating within a constricted range, pivoting between pivotal levels. The uptrend support has notably withstood six attempts of breach, acting as a resilient floor buoying the price. Conversely, a persistent resistance at $3360 has effectively capped upward attempts, posing a formidable barrier to bullish ambitions.

### A Technical Crossroad Approaches

As these two forces converge, gold finds itself near a technical crossroad that could dictate the direction of its imminent price movement. Encapsulated within an ascending triangle pattern, the setup tilts the scales slightly in favor of a bullish breakout. This assertion is mildly corroborated by indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), both of which hint at a gentle incline towards positive momentum.

Nonetheless, the price volatility coupled with momentum indicators presents a complex picture that stops short of guaranteeing a breakout. It underscores the importance for traders to maintain a balanced perspective and readiness for various outcomes.

### Potential Outcomes and Key Levels to Watch

Should gold manage to decisively pierce and sustain above the $3360 resistance, it would set the stage for further upward movement. The immediate challenge in such a scenario would be crossing the July 16 high of $3377, following which the psychological thresholds of $3400 and the mid-June peak of $3451.30 would come into play. Surmounting these levels could pave the way for gold to retest its record highs, potentially reaching the $3500 mark.

Conversely, a downward departure presents its own narrative. The amalgamation of the 50-day moving average and the existing uptrend support forms a robust defensive line against bearish advances. A breach below this stronghold could see gold retreat towards the July lows of around $3310 and $3283, subsequently opening up the possibility of a dip towards the $3250 support zone.

### Historical Context and What It Means for Traders

The ongoing tug-of-war between bulls and bears in the gold market is not just a story of numbers but one that is deeply entrenched in global economic sentiments, trade dynamics, and historical precedents. Gold’s allure, while rooted in its physical beauty and use in jewellery, has been magnified by its role as a hedge against inflation and currency devaluation.

For traders standing at this precipice, the historical resilience of gold, juxtaposed with the prevailing economic indicators, offers a canvas ripe with opportunities albeit filled with cautionary tales. The convergence of technical boundaries beckons a decisive move; however, the path gold chooses to embark upon remains veiled in uncertainty.

### Conclusion

As gold teeters on the brink of a potentially definitive breakout, the market waits with bated breath. The confluence of technical indicators, historical patterns, and global economic undertones crafts a narrative rich with speculation and potential. For investors and market enthusiasts, the unfolding saga of gold’s pricing dynamics offers a window into the broader discourse on value, stability, and the ever-evolving dance of supply and demand. Whether gold will ascend to new highs or retreat under pressure is a question only time will unravel, but what remains certain is the unyielding allure and mystique that surrounds this ancient store of value.