The Broader View: Navigating the Commodities Market through Keen Observation

In the complex and often fluctuating world of commodities trading, success often hinges on the adept interpretation of market signals and trends. A prime example of such a commodity that has seen significant interest and volatility is crude oil. Its price movements offer valuable lessons on market dynamics and the importance of strategic planning in trading.

Understanding the Market’s Recent Behaviour

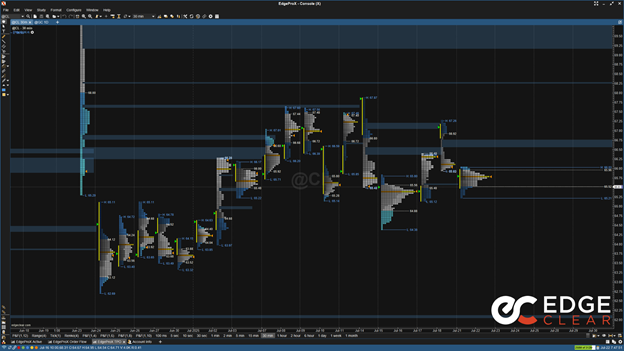

The recent phase in the crude oil market has been one of cautious consolidation, followed by a positive momentum. A noteworthy observation came on July 14th during Regular Trading Hours (RTH), when a peak at $67.87 was established, only for the market to recede, leaving a trail of singular transactions above this level. This pattern indicates a robust resistance zone, one that traders have been wary of.

Since June 24th, the crude oil market has ventured into a phase of price discovery, characterized by a multi-distribution profile. This indicates a period where the market is assessing various price levels, trying to establish where value can be built and sustained.

Evaluating the Market’s Performance

As we delve deeper into the market’s actions, a bull flag formation appears evident in the hourly time-frame. This pattern is a bullish continuation pattern that signifies a pause in the upward momentum before another rally. The market’s current trajectory suggests it is attempting to move higher within this framework.

Predictions and Key Levels Moving Forward

Financial markets are renowned for their unpredictability, yet certain patterns and key levels can provide insightful guidance on future movements. For crude oil, the following zones have emerged as crucial:

- Neutral Zone 1: Spanning $67.16 to $67, this region acts as an immediate area of interest.

- Neutral Zone 2: Positioned between $66.45 and $66.30, providing another layer of support or resistance.

- Yearly Open: The $66.34 mark represents the price at the year’s commencement, a significant benchmark for the market.

- Neutral Zone 3: Found between $65.23 and $65.03, this area could serve as a critical support level.

- 2025 Mid-Range: At $64.14, offering a longer-term perspective on where the market might find balance.

Two potential scenarios stand out based on the current market dynamics:

- Scenario 1 – A False Break, Retracement, and Surge: In this scenario, an attempt is made to escape the bull flag formation, albeit unsuccessfully. However, Neutral Zone 3 provides a safety net, encouraging buyers to re-enter the market and push towards the year’s opening price and Neutral Zone 2.

- Scenario 2 – Break and Falter: Here, the market might succeed in breaking out of the bull flag formation but struggle to maintain the upward momentum, particularly around the $66 mark. This could lead to a regression towards Neutral Zone 3, resulting in further consolidation.

A Deeper Dive into Market Dynamics

The evolution of crude oil prices encapsulates the intricate interplay of supply and demand, geopolitical shifts, and broader economic indicators. Its recent performance is more than a series of numbers; it represents the culmination of global events, market sentiment, and strategic manoeuvres by key players.

Historically, crude oil has always been a barometer for economic health and geopolitical stability. Price fluctuations can trace back to significant events ranging from the OPEC oil embargo of the 1970s, through the financial crisis of 2008, to the very recent pandemic-induced volatility. Each of these events tells a story of how external factors can sway the market, emphasizing the need for traders to remain vigilant and informed.

Looking Ahead: Navigating Uncertainty with Informed Decisions

As we project future movements, it’s essential to recognize that trading in derivatives, such as those related to crude oil, embodies substantial risk. Past performance, while informative, is not a guaranteed indicator of future outcomes. Markets are influenced by an array of unpredictable factors – from geopolitical tensions to sudden economic downturns.

In crafting a strategy, traders must consider not just the potential financial return but also the risk involved. The scenarios outlined above, while grounded in current trends, underscore the importance of preparedness for any outcome. This requires a blend of technical analysis, understanding of global events, and an appreciation for the market’s inherent volatility.

Final Thoughts

In the realm of commodities trading, crude oil continues to captivate and challenge traders with its dynamic price movements and the complex factors that drive them. The recent developments in the market provide a clear testament to the importance of diligent analysis, strategic planning, and an understanding of the broader economic and geopolitical landscape.

As we move forward, let the unfolding price action and market sentiment guide our strategies, always mindful of the risks involved and the unpredictable nature of the financial markets. For those keenly observing and participating in the crude oil market, the journey ahead promises to be as informative as it is challenging.