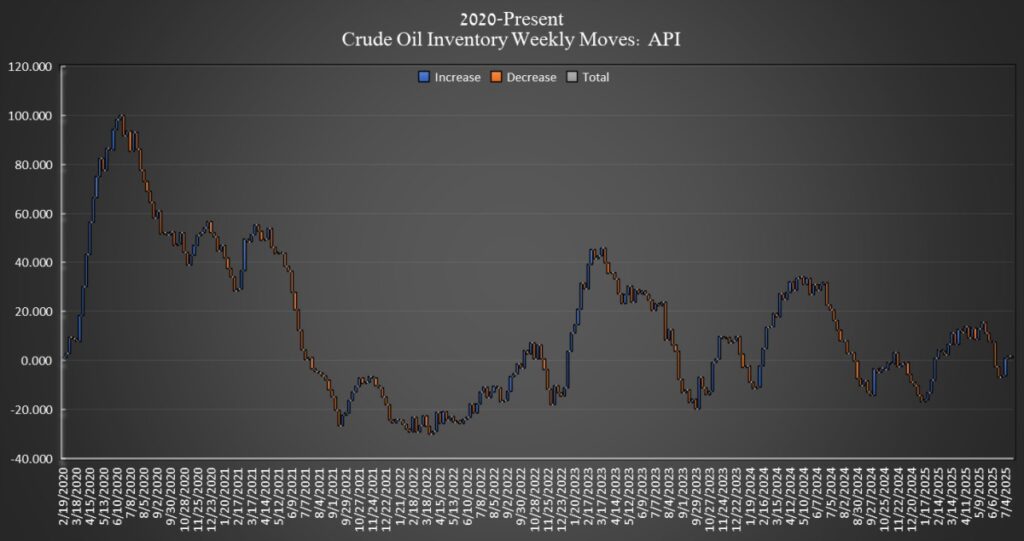

In recent news, there has been a notable development in the oil industry within the United States, shedding light on the dynamics of oil inventories and pricing that are critical to both the economy and the energy sector. Based on insights from the American Petroleum Institute (API), a significant event unfolded in the week concluding on July 18, where there was a decrease in crude oil inventories by approximately 577,000 barrels. This development is part of a broader narrative in 2023, a year where, up to this point, there has been an overall increase in crude oil inventories by 11 million barrels. This information has been meticulously compiled from API data, providing a snapshot of the current state of oil reserves in the country.

Exploring the backstory, crude oil inventory levels are a vital indicator of supply and demand dynamics in the energy market. A decline in inventories often suggests an uptick in demand or a drop in production, leading potentially to higher oil prices, whereas an increase can imply the opposite. Therefore, such weekly data is closely monitored by stakeholders across the globe.

Moreover, earlier in the same week, attention was drawn towards the Strategic Petroleum Reserve (SPR), where another discernible decrease was observed. This time, inventories contracted by 200,000 barrels, bringing the total down to 402.5 million barrels. This consecutive drop, particularly noteworthy for being part of a critical reserve meant for emergencies, reflects the United States’ efforts to navigate through a complex energy landscape. Notably, this depletion echoes the decision by the Department of Energy to authorize an emergency release of oil from the SPR to ExxonMobil, aimed at alleviating logistical bottlenecks encountered at its Baton Rouge refinery. These complications primarily affected the quality of the Mars grade oil. It is worth mentioning that this release was structured as a loan, with an agreement for ExxonMobil to replenish the reserve in future transactions, alongside additional barrels.

Comparatively, when assessing the inventory levels of the SPR now against those before significant withdrawals initiated under the administration of President Joe Biden, one can observe a substantial reduction. Such strategic decisions underline the governmental approach to managing national reserves amidst various challenges, including geopolitical tensions and logistical issues within the United States.

On the trading front, interesting movements were noted in the prices of crude oil. By 3:37 pm ET, there was a slight decrease observed, with a downward adjustment of $0.40 (0.58%), positioning the price at $68.81. This represented a near-stable pricing scenario compared to the figures recorded in the preceding week. Similarly, the West Texas Intermediate (WTI) experienced a downturn on the day by $0.84 (-1.25%) to $33.36, marking a decline of about $0.30 per barrel from the prices seen in the last week.

Shifting focus to gasoline, a noteworthy reduction in inventories was recorded for the week ending July 18, with a drop of 1.228 million barrels. This development took place in a context where, as of the week before, gasoline inventories were slightly above the five-year average typical for that time of year. This data was corroborated by the latest figures from the Energy Information Administration (EIA), thus giving a comprehensive view of the inventory levels with respect to historical standards.

Contrasting with gasoline, distillate inventories experienced a remarkable increase within the same timeframe, with a substantial hike of 3.480 million barrels. This significant build in distillate inventories reflects a situation where it was recorded to be 21% below the five-year average, as indicated by the most recent EIA data available up to the week ending July 11.

Focusing on Cushing, Oklahoma – a critical hub for the storage and trade of crude oil in the U.S., which also serves as a benchmark for U.S. futures contracts – inventories experienced an elevation by 314,000 barrels over the week. This aspect is of particular interest to market participants, as Cushing’s inventory levels often serve as a barometer for the overall health and direction of the U.S. oil market.

In summary, the developments in the U.S. oil inventories, pricing, and strategic reserve releases capture the complex interplay of market dynamics, government interventions, and logistical challenges that define the current energy landscape. These fluctuations in inventories, whether as a drawdown in crude oil, strategic reserves, or shifts in gasoline and distillate stocks, provide invaluable insights into the state of supply and demand, alongside the strategic considerations at play within the United States. As stakeholders continue to navigate this ever-evolving scenario, these weekly snapshots serve as a critical tool in understanding and forecasting the movements within the global energy markets.