In a captivating turn of events, this week has proven to be a roller coaster for gold investors, presenting a complex picture of highs and lows that demands a closer inspection.

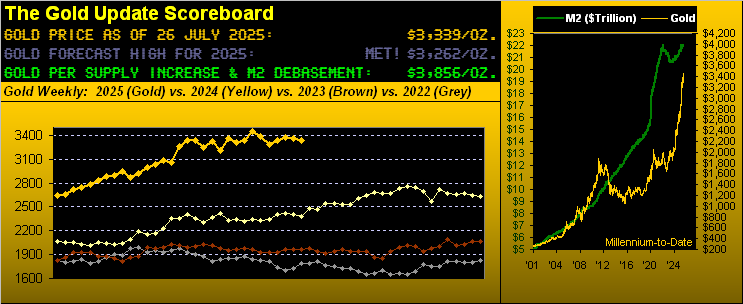

On the brighter side, this past Wednesday, precisely at 00:21 GMT, gold enthusiasts witnessed a sigh of relief as the precious metal seemingly put an end to a harrowing 10-week decline. The moment gold prices ascended above the 3449 mark, a provisional end to its prolonged short spell was signaled, with confirmation following suit at the settle of 3339 on Friday, albeit at a slightly diminished position.

However, the journey was anything but smooth. After briefly surpassing the 3449 threshold by a minimal margin, reaching 3452, gold prices took a dramatic tumble throughout the remainder of the week. This abrupt descent to as low as 3323 translates to a significant three-day plummet of -3.7% or a 129 point drop, concluding at the already mentioned 3339 settle. This movement marked gold’s sixth most substantial weekly “points given up” for the year, highlighting the volatile landscape of commodity investments.

This tumultuous period led gold into its new weekly parabolic long trend; however, the path it embarked on was less than ideal, raising eyebrows and concerns among investors and analysts alike. The intricate patterns of gold’s behaviour, adorned with the newest rightmost encircled parabolic long trend blue dot, offer a visual representation of its tumultuous journey. While aesthetically pleasing, this marker of a new long phase ironically kicks off with an adverse move, adding complexity to gold’s narrative.

On the analytical front, a revisit of gold’s performance over the past three years through the lens of weekly bars and the Moving Average Convergence Divergence (MACD) study provides compelling insights. Despite the recent adversity, the MACD framework still harbours reservations about the wisdom of short selling gold, fueled by the persistent and troubling negative MACD crossover.

In an era where predictions and market movements are closely scrutinized, the question of whether gold is poised for another historic high looms large. While history and trends provide an optimistic lens, suggesting an inevitable rise, immediate assumptions of a new record peak remain guarded. Analyzing gold’s last ten weekly parabolic long trends through a table of “Max Gain” statistics offers a moderate 60% likelihood of surpassing the 3511 all-time high, set back on 22 April. However, viewing these projections through a conservative lens, based on average and median gains of approximately +10% and considering seasonal duration, prospects of reaching or even surpassing the 3700 mark by November appear viable, albeit conditionally.

The imminent future holds substantial influence over gold’s trajectory, with key economic announcements and policy decisions on the horizon. Particularly, the eyes of the world are set on the forthcoming U.S. Q2 Gross Domestic Product announcement and the Federal Open Market Committee’s Policy Statement, followed by the introduction of additional tariffs. These events, along with the U.S. Treasury’s looming challenge of addressing a significant funding shortfall, could dramatically sway the market, potentially catalysing substantial shifts in gold prices.

Further complicating the landscape is the thinly veiled vulnerability of the stock market. Current evaluations and the atmosphere of a seemingly inflated S&P 500 hint at a market bracing for impact, with gold positioned as a haven or a benefactor in scenarios of economic downturns or stock market corrections.

In summary, gold stands at a pivotal juncture, laden with potential yet fraught with uncertainty. As investors navigate this complex terrain, marked by both promising signs and cautionary tales, the allure of gold remains undiminished, its ultimate direction influenced by a myriad of economic factors, market sentiments, and global events. Whether the coming days will cement gold’s status as a secure bastion for investors or unveil further challenges lies in the unfolding narrative of global economies and market dynamics.