In the intricate world of financial markets, those who have immersed themselves in the study of deMeadville’s frameworks might be familiar with the term “The Metals Triumvirate”. This term is an elegantly crafted nomenclature for the trio of metals—gold, silver, and copper—that often sway in unison, reflecting the undercurrents of the global economy and investor sentiment.

Recently, the trajectories of these metals have experienced remarkable volatility. Between the 23rd and 30th of July, the price of gold witnessed a decline of 5.4%. In a similar vein, silver prices took a significant hit, dropping by 9.1% from the 23rd of July to the 31st. Copper, however, faced an even steeper descent, with its value plummeting by 27.3% during the same period—a figure so astonishing it might be misconstrued for an error.

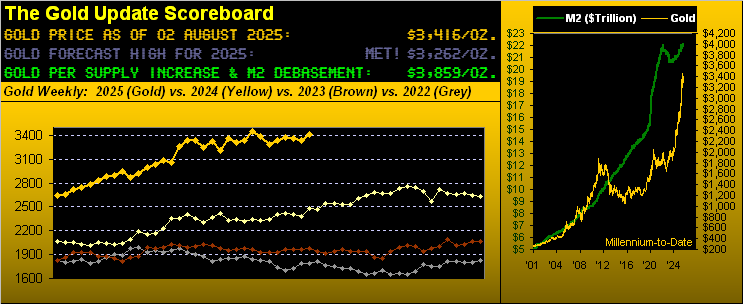

Moving into the subsequent week, silver’s price stabilised, showing no net weekly gain, while copper, already bruised by tariff impacts, found itself in a desolate state with no glimpse of recovery on the horizon. In contrast, gold painted a different picture. The December contract for gold closed on the concluding Friday at 3416, marking a net weekly advancement of 0.7% (an equivalent of +23 points). The so-called “continuous contract” of gold saw a more pronounced gain of 2.3% (+78 points), bolstered by a fresh price premium of +54 points as the August contract made way for December.

This edition is enriched with visual insights, especially as we delve into gold’s weekly bars by the continuous contract over the past year, highlighted by a newly instated parabolic Long trend for the second successive week. From this point, a journey to the all-time high of 3510 on 22 April represents an additional climb of 2.8% (+94 points). This trajectory aligns harmoniously with the historical patterns observed during similar parabolic Long trends in recent times.

Silver, often adorned in the guise of an industrial metal, was inevitably dragged down by copper’s dramatic downturn, with the Gold/Silver ratio expanding from 87.1x to an astonishing 92.1x within a mere week. Despite this, silver’s year-to-date performance remains impressive, second only to gold amidst the tumult of financial markets.

The narrative unfolding within the realm of precious metals signifies a broader theme of resilience amidst uncertainty. Over the past year, notable performers include Pan American Silver with a 22% increase, Franco-Nevada climbing by 27%, and Newmont surging by 32%, with gold itself outshining others by recording a 37% increment. The realm of exchange-traded funds (ETFs) witnessed remarkable gains as well, with entities such as the Global X Silver Miners ETF and the VanEck Gold Miners ETF both ascending by 42%, and Agnico Eagle Mines leading the way with a staggering 67% uptick.

Since the dawn of 2020, gold has emerged as the monumental victor with an increase of 124%, setting a remarkable precedent for other equities which have shown variable ranges of gains. The graphical representations of these shifts not only provide a visual summary but also underscore the turbulence that The Metals Triumvirate has recently navigated.

The turbulence isn’t confined to metals alone but extends across the broader spectrum of BEGOS Markets, where directional trends and consistency in performances are meticulously tracked through “Baby Blues”. This analysis reveals the resilience of gold amidst receding prices, contrasted starkly against silver and copper’s struggle for recovery.

Amid this backdrop, the market’s giants wrestle with their own set of challenges, reflected in the subtly dissenting whispers at the foot of the Open Market Committee’s Policy Statement. While the global stage beholds the developments in interest rates and economic indicators, the metals market, particularly gold, continues its ascent, undeterred by the broader market’s whispers of corrections or complacencies.

This narrative, enriched with an in-depth examination of recent market dynamics and historical context, paints a vivid picture of the current state and potential future of The Metals Triumvirate. As we navigate through these fluctuations, the insights gleaned provide not only a reflection of past occurrences but also a glimpse into the intricate interplay of factors shaping the market’s trajectory. Cheers to the relentless pursuit of understanding in the complex, ever-evolving world of financial markets.