Amid the whirlwind of global economic indicators, geopolitical unrest, and monetary policy adjustments, the sheen of gold has captured the market’s imagination, embarking on a remarkable journey. As we navigate through these tempestuous times, it becomes pertinent to delve into the factors that have been propelling the price of this lustrous metal to unprecedented heights.

### The Unprecedented Rise of Gold Prices

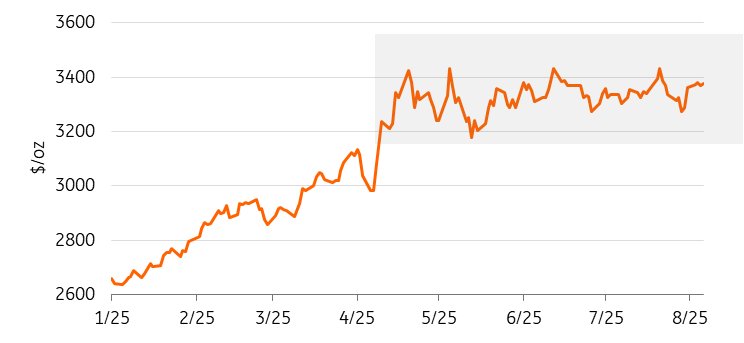

Earlier in the year, the price of gold catapulted to a historic peak, exceeding $3,500 per ounce, a milestone that underscored the metal’s reputation as a bastion of value amid global uncertainty. The price chart of gold has since been fluctuating within a relatively narrow band, yet the metal’s allure remains undiminished, bolstered by a confluence of factors that signal its potential ascent to even greater heights.

This remarkable performance can be attributed to a multitude of drivers: the United States’ aggressive trade stance under the administration of Donald Trump, escalating tensions in the Middle East and Ukraine, and robust purchasing activities by central banks worldwide.

Despite this, most of gold’s impressive gains were concentrated in the initial four months of the year, with the metal’s price hovering within a constrained range thereafter, unable to breach its April high. This dynamic, however, may soon shift, with speculation around US rate cuts gaining momentum and possibly setting the stage for gold to scale new records.

### Intensifying Speculation Around US Rate Cuts

A deteriorating economic landscape in the United States – marked by slackening growth and inflation rates – has steered market sentiment towards the anticipation of impending rate reductions by the US Federal Reserve. The odds are now heavily tilted in favour of a rate cut, especially in the wake of a disheartening job report that triggered market tremors and intensified calls for monetary easing.

It’s within this context that the prospect of further rate reductions looms large, with some economists projecting a more aggressive rate-cutting trajectory than what is currently anticipated by markets. The implications of this for gold, an asset that thrives in low-interest-rate environments due to its non-yielding nature, could be profound, potentially catalysing another upward surge in its price.

Further fuelling uncertainty around US monetary policy is the resignation of Federal Reserve Governor Adriana Kugler, which might provide an opening for a reshuffle more aligned with a dovish agenda. Such developments underscore concerns regarding the central bank’s autonomy and serve to enhance gold’s appeal as a safe haven.

### Central Banks and Their Insatiable Appetite for Gold

Another pivotal driver of gold’s ascent is the sustained appetite of central banks for gold acquisitions. Reports from the World Gold Council highlight a significant uptick in gold reserves globally, underscoring a strategic move by nations to diversify their holdings and mitigate exposure to the US dollar amidst an unpredictable economic climate.

In particular, the National Bank of Poland’s aggressive expansion of its gold reserves exemplifies this trend, contributing to a heightened global demand for the metal. While there was a moderation in purchasing volumes in recent quarters, the overarching direction reflects a steadfast commitment to bolstering gold reserves, indicative of central banks’ confidence in gold’s enduring value.

### China’s Persistent Pursuit of Gold

China’s central bank has been on a continuous gold-buying spree, amassing significant quantities of the metal and reinforcing its position in the country’s reserve strategy. This relentless accumulation points to a broader pattern of diversification and an endeavour to enhance financial security amidst global economic fluctuations.

### The Flow of Gold into ETFs

The influx of gold into Exchange-Traded Funds (ETFs) presents another dimension to the metal’s buoyant market dynamics. The first half of the year witnessed substantial growth in gold ETF holdings, driven by escalating prices, geopolitical anxieties, and inflationary concerns. This surge in demand highlights the widening appeal of gold as an investment vehicle, with the potential for further growth as global holdings approach record levels.

### Looking Ahead: A Gilded Future

As the confluence of central bank buying, enduring trade tensions, geopolitical risks, and expanding ETF holdings continues to underpin gold prices, the anticipation of US rate cuts emerges as the pivotal variable that could reignite the metal’s upward trajectory.

In light of these developments, a reassessment of gold price forecasts is warranted. We now envisage an elevation in the average price of gold, anticipating a continuation of this year’s robust performance into the coming quarters.

As we peer into gold’s gleaming future, it’s paramount to acknowledge the intricate web of factors at play, from geopolitical strife to monetary policy shifts, each weaving into the narrative of gold’s meteoric rise. In the face of uncertainty, gold remains a beacon of stability, its lustre undimmed by the vicissitudes of global affairs.