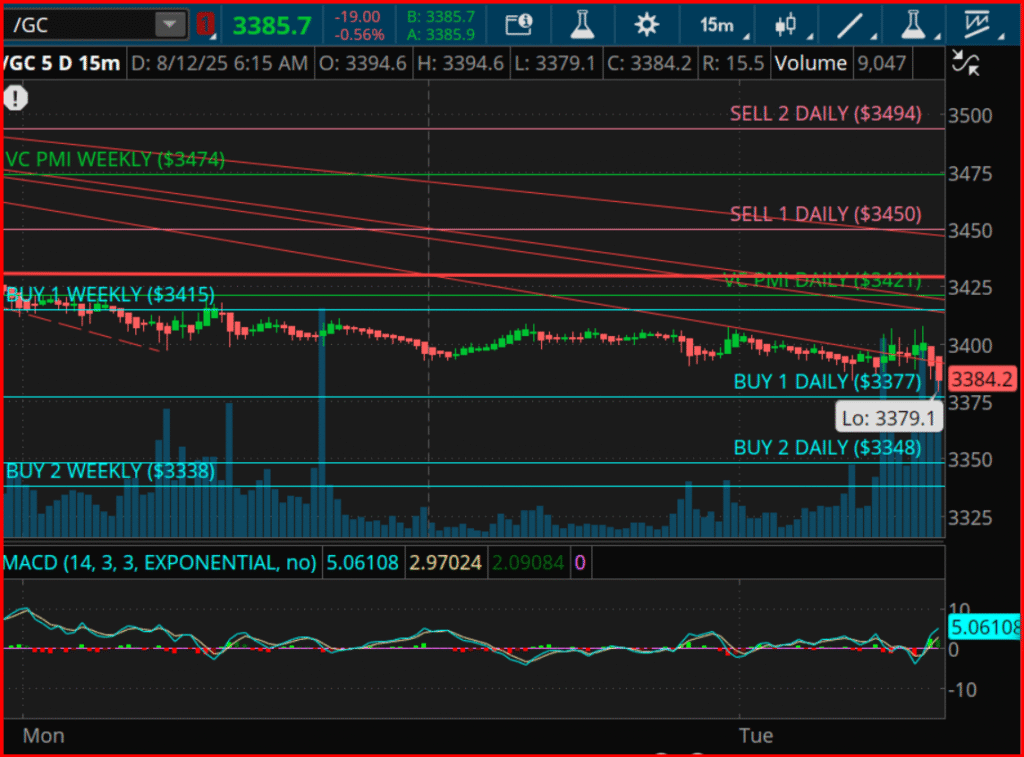

In the intricate world of commodity trading, gold is currently navigating a precarious path, with its price perched at $3,385.7, teetering marginally above the Daily Buy 1 level of $3,377. This scenario is reminiscent of a mountaineer gripping onto the edge of a precipice amidst a tempest, underscoring the precarious position of gold in the current market dynamics. The pressure from sellers has been unyielding, leading to a retreat from the lofty heights achieved in the previous week, and the current position is significantly lower than the Weekly VC PMI pivot of $3,474. This situation signals a dominant bearish bias in the short term.

Exploring the structure according to the VC PMI, we find ourselves in what is considered a classical mean-reversion zone. This scenario offers a strategic perspective on potential market movements. The Daily Buy 1 level at $3,377 serves as the first bastion of hope for the bulls in the market. Further support is observed at the Daily Buy 2 level of $3,348 and the Weekly Buy 2 level of $3,338, which together create a foundational support shelf. This structure suggests a higher likelihood of a market rebound from these levels. On the contrary, resistance is forthcoming, with the first significant barriers positioned at the Daily VC PMI pivot of $3,421 and the Sell 1 level of $3,450.

Adding a layer of technical analysis, the Moving Average Convergence Divergence (MACD) indicator presents a positive yet waning momentum. This suggests that the recent upward movement is losing strength, indicating that any attempts at rallying would require a substantial boost in conviction to surpass the resistance levels that loom overhead.

Diving deeper into the analysis, the Gann Time Cycles provide an intriguing perspective. The current week falls within a minor time cycle window, historically associated with brief yet potent market reversals. This timing indicates a potential for a swift rally if the market manages to hold above the Buy 1 level. However, failure to maintain this position might precipitate a steeper decline, aligning with the next projected cycle low set to occur within the ensuing 3–5 trading sessions.

In the realm of Gann’s Square of 9, a fascinating projection emerges from the recent cycle high of $3,534. The Square of 9 analysis reveals a natural harmonic support zone around $3,342–$3,348, coinciding perfectly with the Daily Buy 2 level. This confluence of price and time significantly enhances the likelihood of a technical rebound occurring within this zone.

Expanding our view to the 360-day cycle paints a picture of gold in an upwards trajectory from a major cycle low earlier in the year. However, the journey has encountered a short-term corrective phase within the overarching bullish structure, suggesting the current decline might be setting the stage for a robust rally between late August and September. Yet, this potential upturn hinges on the critical support levels in the mid-$3,300s holding firm.

In summary, the market is undergoing a tactical retreat, delving deep into its buy zone, which presents a significant psychological battlefield. The onus now lies on the buyers to demonstrate their ability to defend the critical levels of $3,377 and $3,348. Success in this endeavour would pave the way towards tackling higher resistance levels of $3,421 and $3,450. Conversely, failure to uphold these positions would see the market’s focus shift to the Weekly Buy 2 level at $3,338 as the final bastion before a potential steep decline. This juncture is where market discipline is paramount, with traders seeking confirmation before making any commitments, given that the forthcoming 48 hours could decisively shape the market’s trajectory for the remainder of the month.

It is imperative to acknowledge that trading in derivatives, financial instruments, and precious metals encompasses considerable risks of loss and is not a pursuit suited for everyone. Furthermore, it is worth noting that past performance does not necessarily predict future results, underscoring the inherent uncertainty and the need for caution in trading strategies.